William Blair acted as the exclusive financial advisor to Beaver-Visitec International Holdings, Inc. (BVI), a portfolio company of RoundTable Healthcare Partners, in connection with its sale to TPG Capital. The transaction was announced on July 18, 2016, and is expected to close in the third quarter of 2016. The sale of BVI represents William Blair's 34th medical technology transaction and 13th ophthalmology transaction since 2014.

Transaction Highlights

- Deep relationships and sector expertise: BVI and RoundTable were attracted to William Blair’s highly relevant transaction experience, deep sector knowledge, and ability to identify and effectively engage with strategic and financial acquirers globally. By drawing on its extensive knowledge of the medical technology and ophthalmology spaces, William Blair was able to successfully position the merits of this investment opportunity.

- Process and execution excellence: William Blair’s transaction team orchestrated a highly competitive marketing process, coordinated a robust due diligence process, and led a competitive negotiation of key transaction terms with multiple potential strategic and financial acquirers.

- Trusted guidance: William Blair’s senior deal team worked closely with management and RoundTable through each step of the transaction process. The hands-on involvement and effective communication from William Blair’s senior bankers ensured seamless execution and resulted in an outstanding outcome for BVI’s shareholders.

About the Companies

Based in Waltham, Massachusetts, Beaver-Visitec International is a global manufacturer, developer, and marketer of ophthalmic and other specialty microsurgical products. It offers products and services for all aspects of ophthalmic surgery, including cataract, refractive, oculoplastic, and vitreoretinal sub-specialties with highly trusted brands such as Beaver® knives, Visitec® cannula, CustomEyes® Kits, Merocel® and Weck-Cel® fluid control products, Wet-Field® Eraser® electrosurgery products, Parasol® punctal occluders, and the Endo Optiks® microendoscopy products. Beaver-Visitec products are distributed in more than 90 countries worldwide with a salesforce recognized throughout the industry for its clinical expertise and outstanding customer service. With manufacturing locations in different parts of the world, including the United States and United Kingdom, BVI maintains ISO-9001 and ISO-13485 certified quality standards for its FDA-registered manufacturing plant, with the U.K. facility acting as the authorized EU representative for CE mark purposes.

RoundTable Healthcare Partners, based in Lake Forest, Illinois, is an operating-oriented private equity firm focused exclusively on the healthcare industry. RoundTable partners with companies that can benefit from its extensive industry relationships and proven operating and transaction expertise. RoundTable has established a successful track record of working with owner/founders, family companies, management teams, entrepreneurs, and corporate partners who share a vision and believe in the value-creation potential of its partnership model.

TPG is a leading global private investment firm founded in 1992 with over $70 billion of assets under management and offices in San Francisco, Fort Worth, Austin, Dallas, Houston, New York, Beijing, Hong Kong, Istanbul, London, Luxembourg, Melbourne, Moscow, Mumbai, São Paulo, Singapore, and Tokyo. TPG’s investment platforms are across a wide range of asset classes including private equity, growth venture, real estate, credit, and public equity. TPG aims to build dynamic products and options for its investors while also instituting discipline and operational excellence across the investment strategy and performance of their portfolio.

More about our healthcare investment banking practice

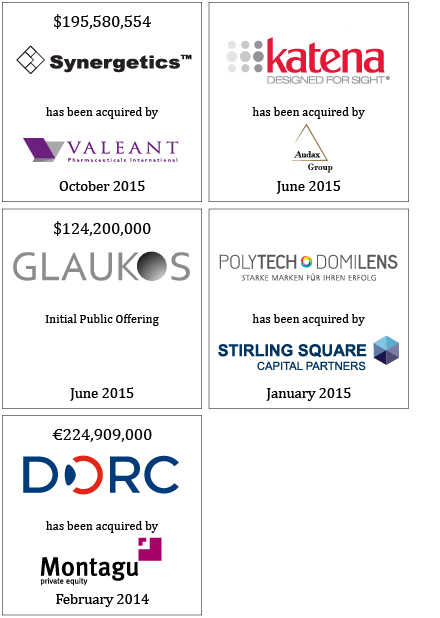

Selected William Blair Ophthalmology Transactions