Executive Summary

Despite an unusually dense mix of political, monetary, and geopolitical developments, the U.S. economy closed 2025 with remarkable resilience. Economic growth remained steady, financial conditions eased modestly, and equity markets delivered strong, but uneven, returns. While market leadership stayed concentrated, important signs of broadening emerged late in the year. International markets benefited meaningfully from U.S. dollar weakness, and fixed income began to reassert its role as both an income generator and portfolio stabilizer.

As we enter 2026, the investment environment remains constructive but more complex. Valuations are elevated, policy uncertainty is high, and market returns are increasingly likely to be driven by fundamentals rather than expanding multiples. This backdrop reinforces the importance of diversification, quality bias, and disciplined portfolio construction.

U.S. Economic Performance: Resilient Amid Policy Change

U.S. economic performance in 2025 remained notably resilient in the face of sweeping policy changes under President Trump’s administration, particularly those aimed at rebalancing global trade and financial relationships. While consumer sentiment declined meaningfully during the year, actual economic behavior, especially spending, proved far more durable.

Real GDP growth for 2025 is currently estimated at approximately 2.0%, a level consistent with trend growth and achieved despite heightened uncertainty surrounding tariffs, immigration policy, and geopolitical tensions. Importantly, this growth occurred alongside a strong labor market and rising household net worth, supported by higher equity prices and continued appreciation in residential real estate.

Equity markets reflected this resilience. The S&P 500 Market Cap Weighted Index rose approximately 17.9% for the year, underscoring investors’ willingness to look through near-term uncertainty and focus on earnings growth and long-term structural themes. Projections suggest economic momentum may persist into 2026, particularly if business investment remains strong.

Drivers of Economic Growth in 2025 and 2026

Business investment was a central pillar of economic expansion in 2025, driven largely by artificial intelligence-related spending. Capital flowed aggressively into data centers, advanced semiconductors, cloud infrastructure, and the energy generation capacity required to support these investments. This spending cycle increasingly resembles a multi-year industrial buildout rather than a short-lived technology upgrade.

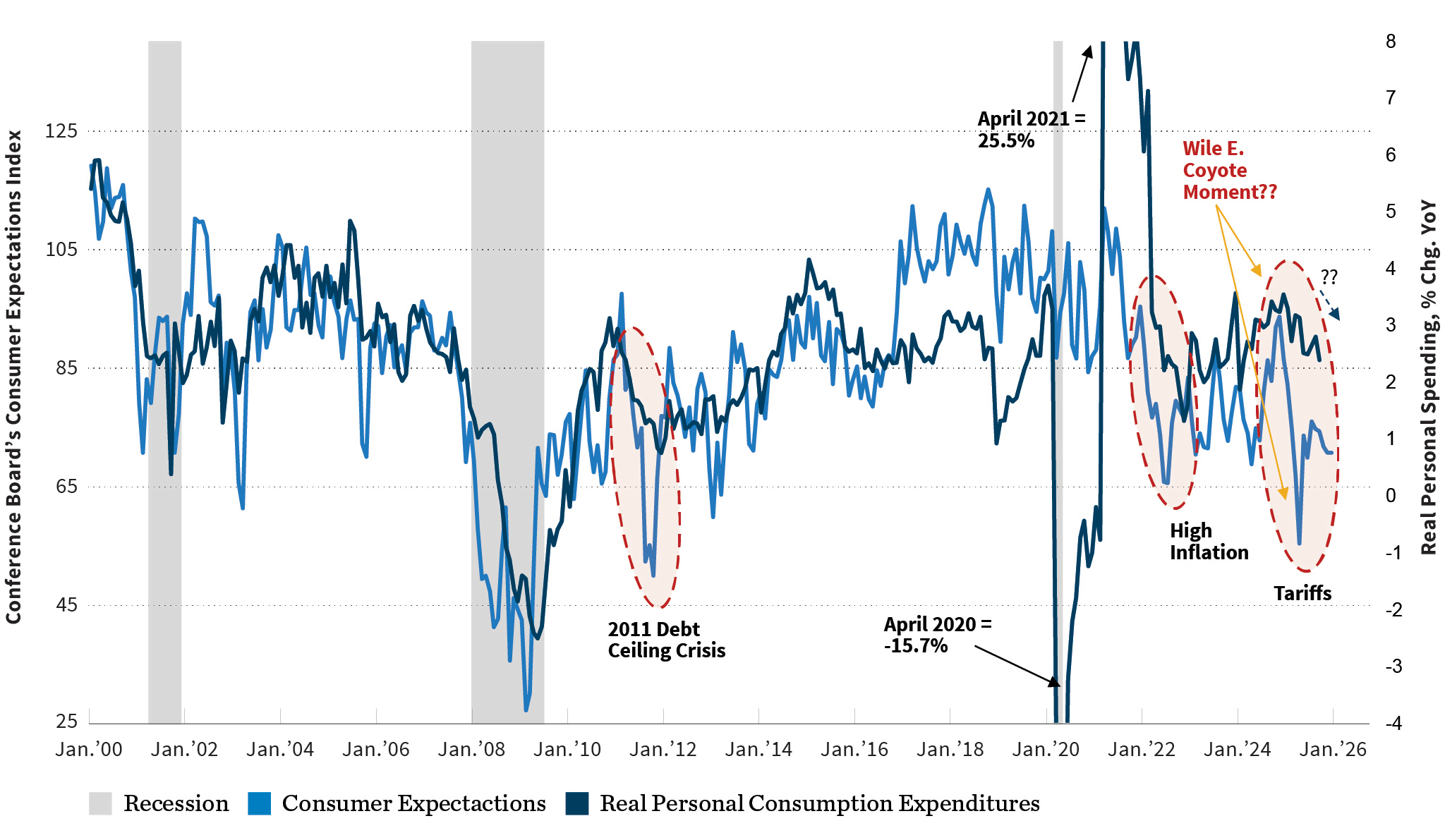

Consumer spending also surprised to the upside, rising an estimated 3.5% over the year. This strength persisted despite weak consumer sentiment, which remained weighed down by inflation concerns, fears of AI-driven job displacement, and the rapid pace of policy change. The divergence between sentiment and spending (exhibit 1) highlights the importance of balance sheet strength: households entered this period with historically high levels of net worth and manageable debt service burdens.

Consumer Expectations Index vs Annual Growth in Real Personal Consumption Expenditures

Labor market dynamics shifted subtly but meaningfully. Employment growth slowed, not due to rising layoffs, but because of reduced immigration, demographic retirements among baby boomers, and improving productivity. Corporate profit margins remained healthy, reinforcing the view that economic deceleration has been orderly rather than recessionary.

Real wage growth remained positive overall, though the benefits were unevenly distributed. Lower-income households experienced a deceleration in real wage gains following exceptional post-pandemic growth. Looking ahead to 2026, encouragingly, this cohort may benefit disproportionately from proposed fiscal initiatives, including tax relief measures and targeted credits, which could provide incremental support to consumption.

Equity Market Performance: 7 Stocks + Momentum in Few More

Equity market performance in 2025 remained heavily concentrated among a small group of mega-cap technology and growth companies. The continued dominance of the so-called “Magnificent 7” fueled ongoing debate about market sustainability and comparisons to prior speculative episodes. Importantly, the prevalence of this debate itself reflects a market environment that remains cautious rather than complacent, a characteristic often associated with durable bull markets.

Encouragingly, leadership began to broaden late in the year. A growing number of large-cap and select mid-cap companies contributed positively to aggregate returns, particularly in sectors tied to industrial investment, energy infrastructure, and defense spending.

Looking into 2026, consensus analyst estimates call for earnings growth of approximately 15.6%. Historically, realized earnings growth tends to fall below early-year forecasts, suggesting a more reasonable expectation closer to 11–12%. With valuation multiples already elevated, approximately 25x trailing earnings and 22x forward earnings, future equity returns are likely to be driven more by earnings growth, dividends, share repurchases, and inflation rather than further multiple expansion.

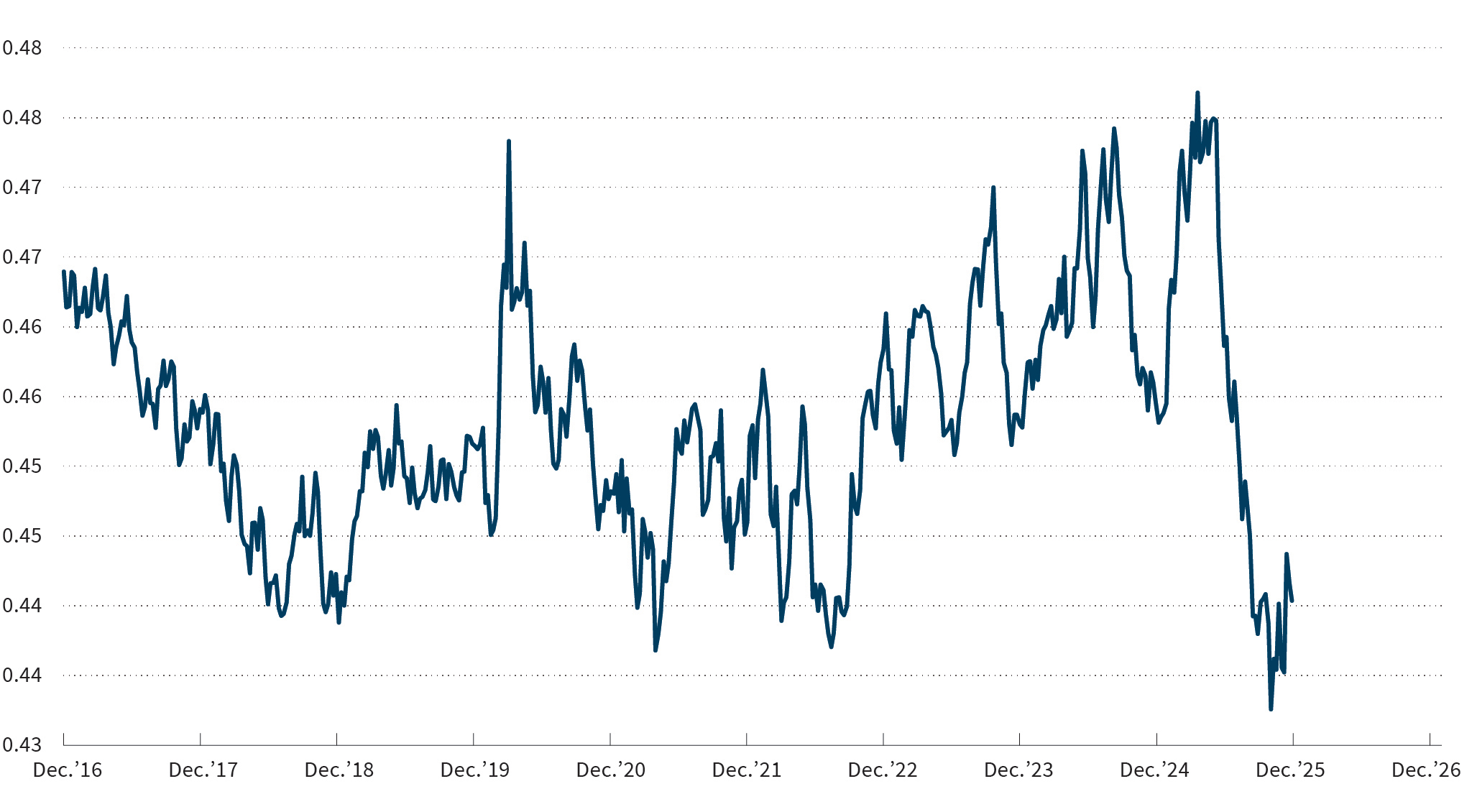

Quality-oriented stocks underperformed in 2025, marking their weakest relative showing since the late 1990s. This was largely a function of easing financial conditions favoring lower-quality balance sheets. As monetary policy normalization progresses and investors seek diversification, we expect quality characteristics, strong cash flows, durable margins, and disciplined capital allocation, to regain leadership.

2025 Was a Tough Year for Quality Stocks!

Relative Performance of S&P 500 Quality Stock Index to S&P 500

International equities were among the standout performers in 2025, particularly for U.S.-based investors. A nearly 10% decline in the U.S. dollar provided a substantial tailwind to foreign returns. In addition, geopolitical pressures prompted a sharp increase in defense spending across Europe, driving fiscal expansion after years of restraint.

Notably, defense-related expenditures have broadened well beyond traditional military categories, effectively acting as a wider fiscal stimulus. At the same time, global trade realignments have redirected a greater share of Chinese exports toward Europe and other regions, altering growth dynamics.

While international markets carry their own risks, including political fragmentation and slower structural growth, the combination of more attractive valuations, fiscal support, and currency diversification reinforces their role within globally diversified portfolios.

Interest Rate Environment

The Federal Reserve resumed interest rate cuts during the second half of 2025, lowering the policy rate from approximately 4.5% at the start of the year to 3.75% by year-end. Inflation, however, remained sticky near 3%, complicating the policy outlook.

The Fed now appears to be approaching its estimated neutral rate, and internal disagreements have become more visible, as evidenced by an elevated level of dissent at recent policy meetings. These divisions may intensify in 2026, particularly as a new Fed Chair is appointed in May. While the administration has openly advocated for further rate cuts, markets remain sensitive to the risk that overly accommodative short-term policy could place upward pressure on long-term interest rates.

Indeed, the long end of the yield curve represents a key risk factor. Persistent fiscal deficits, increased Treasury issuance, and rising corporate borrowing, particularly among large technology firms, could push long-term yields higher even if short-term rates fall. Credit spreads remain historically tight, leaving little margin for error should growth expectations weaken or financial conditions tighten unexpectedly.

| Index | YTD | 4Q | |

|---|---|---|---|

| S&P 500 | U.S. Large Cap | 17.88% | 2.66% |

| DJIA | U.S. Large Cap | 14.92 | 4.03 |

| Russell 3000 | U.S. All Cap | 17.15 | 2.40 |

| Russell 2000 | U.S. Small Cap | 12.81 | 2.19 |

| MSCI EAFE | Developed International | 31.22 | 4.86 |

| MSCI EM | Emerging Markets | 33.57 | 4.73 |

| Bloomberg U.S. HY | U.S. High Yield | 8.62 | 1.31 |

| Bloomberg U.S. Agg | U.S. Core Bond | 7.30 | 1.10 |

| Bloomberg Muni | U.S. Muni Bond | 4.25 | 1.56 |

| MSCI U.S. REIT GR | U.S. Real Estate | 2.95 | -1.69 |

Total Returns

Source: William Blair, FactSet