Investment Management

William Blair Investment Management employs disciplined, analytical research processes across a wide range of strategies, including U.S. equity, non-U.S. equity, and emerging markets debt. To learn more, please visit us at im.williamblair.com.

Recent Insights

-

-

-

Setting the Stage for a 2026 Value Revival

Members of our U.S. value equity team explain why 2026 could mark a turning point for small- and SMID-cap value, citing improving fundamentals, historically wide valuation gaps, easing monetary policy, and the potential for a broader, more balanced market recovery.

-

Meet the Portfolio Managers: Matt Fleming and Mark Goodman

Matt Fleming and Mark Goodman share the experiences and principles that shaped their approach to value investing, the lessons that guide their decision-making, and why William Blair’s investment-led, partnership-driven culture supports long-term success for clients.

-

-

About Us

At William Blair, we are passionate about the profession of investment management. We are an independent, 100% active employee-owned firm with no distractions from our sole priority: creating strong, risk-adjusted returns for our clients.

William Blair is committed to building enduring relationships with our clients. We work closely with private and public pension funds, insurance companies, endowments, foundations, and sovereign wealth funds, as well as financial advisors. We are 100% active-employee-owned with broad-based ownership. Our investment teams are solely focused on active management and employ disciplined, analytical research processes across a wide range of strategies, including U.S. equity, non-U.S. equity, and emerging markets debt. William Blair is based in Chicago with global resources providing expertise and solutions to meet our clients’ evolving needs.

We provide investment solutions to corporations, pension funds, governments and public agencies, endowments, foundations, Taft-Hartley plans, and other leading institutional investors across the globe.

-

Consultants

Our senior relationship managers, who average more than 26 years* of industry experience, understand the complex needs of our clients and their investment consultants.

-

Foundations and Endowments

With a long tradition of serving not-for-profit organizations and their boards, we provide a range of investment strategies to 128 endowments and foundations*.

-

Public Funds

With deep experience serving government-sponsored plans and their consultants, our firm oversees more than $22.4 billion* in assets for public pension plans.

-

Corporations

Through customized investment strategies for corporations and their defined-contribution and defined-benefit plans, we oversee more than $14.1 billion* in assets for corporations across industries.

-

Taft-Hartley

We oversee more than $2.6 billion* of Taft-Hartley assets via separate accounts and commingled funds.

-

Financial Institutions

Based on a philosophy of building enduring partnerships, we have a long history of working with financial institutions.

-

Financial Advisors

We offer 18 actively managed mutual funds in a wide range of strategies, including U.S. equity, non-U.S. equity, and emerging markets debt.

*As of December 31, 2025

-

-

Collective Investment Trusts

CITs are pooled investing vehicles through which assets of qualified clients (which include only employee benefit plans governed by ERISA and certain government-sponsored entities) are commingled for investment purposes. CITs offer qualified retirement plan sponsors help controlling costs due to increased regulatory scrutiny of fees and costs.

-

-

See how our deep-conviction strategies can help you meet your investment needs.

The integration of financially material environmental, social, and corporate governance (ESG) factors in our fundamental research enhances our understanding of investment risks and opportunities. Learn more about our approach to sustainable investing.

Why We Invest Shapes How We Invest

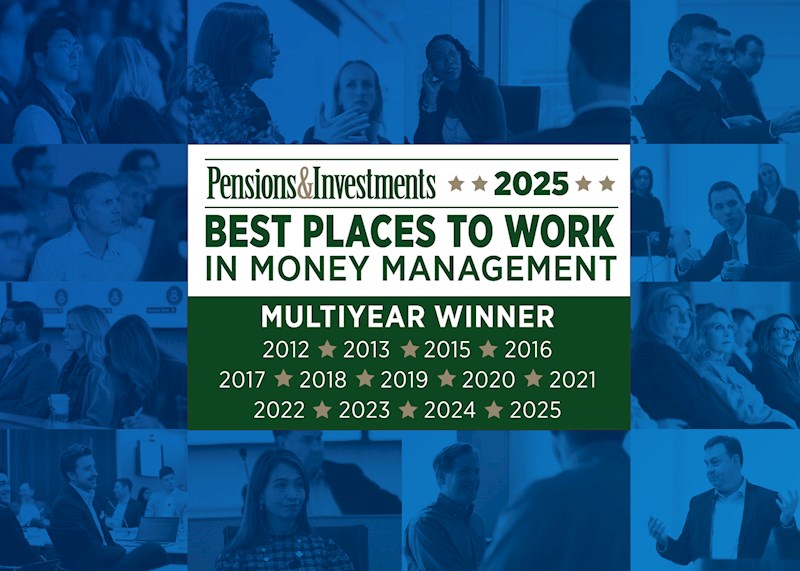

Culture is more than the ethos that characterizes our organization; it’s the engine that guides our practices. Our people are defined by their shared values and curiosity. Our approach is defined by teamwork; a disciplined, proven methodology; and technology-enhanced collaboration. Our purpose is defined by a focus on our clients and communities. But don’t take our word for it. See what culture means to our colleagues.

Read more about our culture-

$72.3

billion in client assets*

-

335

Investment Management employees

-

26

average years of experience for portfolio managers

As of December 31, 2025

Client asset disclosures

* Client assets are inclusive of discretionary assets under management (AUM) of approximately $65.5 billion as well as non-discretionary assets under advisement (AUA) of approximately 6.8 billion. AUA generally consists of non-discretionary advisory assets managed by third parties in accordance with investment model portfolios provided by William Blair Investment Management, LLC (William Blair). William Blair receives an asset-based fee on AUA but does not exercise investment discretion or trading authority over such assets. All AUA data is reported on a one-month lag. William Blair’s measure of AUM/AUA for these purposes may differ from the calculations employed by other investment managers and, as a result, may not be directly comparable. This measure also differs from the manner in which William Blair is required to report assets under management in certain regulatory filings.