The leveraged finance market was resilient in 2025 amid fast-changing policy shifts and economic uncertainty. While optimism for a banner year did not materialize, volume across key areas was stable-to-up and expectations for 2026 remain high, particularly related to increased M&A-driven activity. Borrower-friendly conditions continue—and if market volatility can remain in check, 2026 is well-positioned to finish atop the podium. Learn more about fourth-quarter performance and trends shaping the leveraged finance market in our latest report.

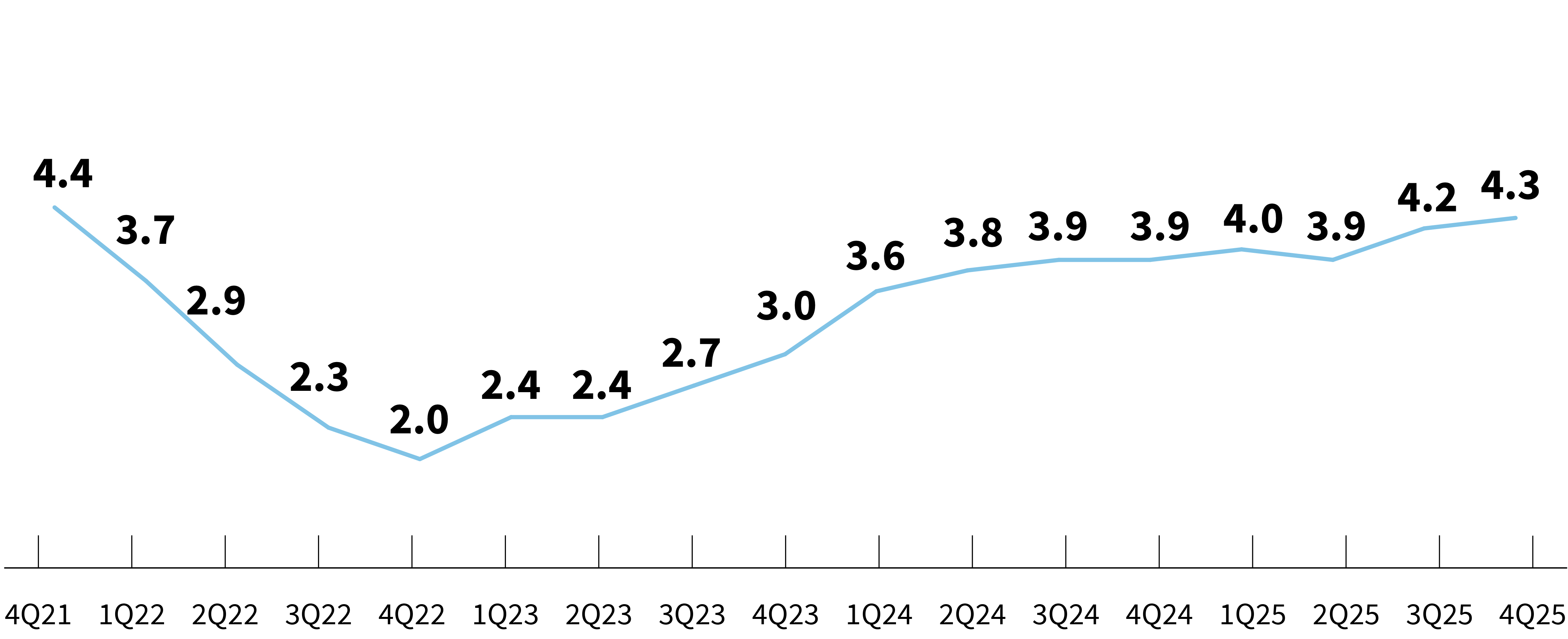

William Blair Leveraged Lending Index

Each quarter we ask middle-market lenders to rate overall conditions in the leveraged finance market on a scale of 1 to 5, with 5 being the most borrower-friendly conceivable.