Insights

Statistical analysis and insight into activity and trends in M&A and capital markets.

Recent Investment Banking Insights

-

-

Going for Gold: After a Respectable 2025, Does a Resurgence Await?

The leveraged finance market proved resilient in 2025, with stable-to-rising activity despite policy swings and economic uncertainty. With borrower-friendly conditions and anticipated M&A momentum, 2026 is poised for a stronger finish if volatility stays contained.

-

Lawn Care’s Expansion Into Pest Control, Broader Outdoor Recurring Services

Lawn care companies are evolving into broader outdoor services platforms. Jack Williams from William Blair’s Investment Banking consumer products & services team delves into what’s behind this evolution and how it is stoking transaction activity.

-

-

-

-

-

-

-

-

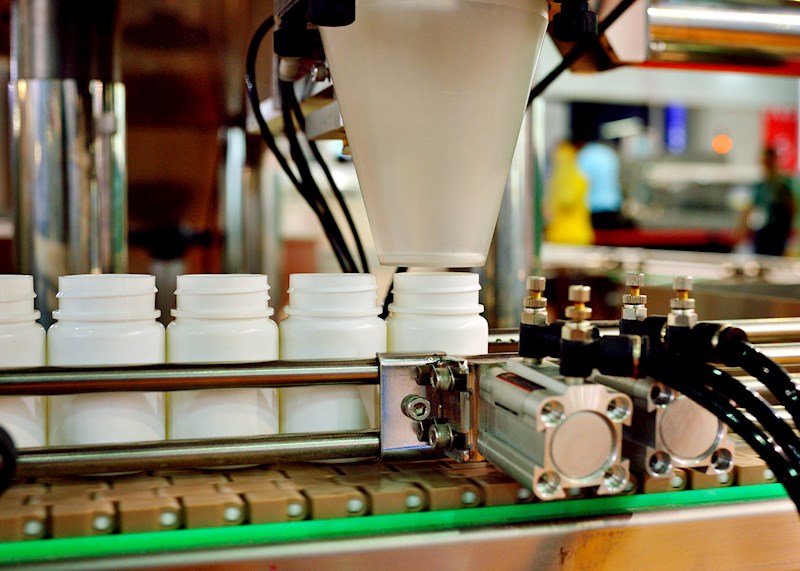

The Pet Supplements Industry Is Booming and Requires More Capacity and Capabilities

The pet supplements industry is on track for strong continued growth. Meeting future demand will require both additional capacity and enhanced capabilities to stay ahead of intensifying competition—creating opportunities for investors.