Overview: This article highlights the key trends that are driving an expected increase in M&A activity for cloud services companies that serve the federal government, which is undergoing a massive IT modernization effort to close the gap with the private sector. Strategic acquirers are using M&A activity to build capabilities that align with the government's major IT spending priorities. In addition, COVID-19 is strengthening these trends, as the government seeks to quickly address increasing technology and security needs, while strategic acquirers are attracted to the reliable and stable income streams associated with federal contracts.

Key takeaways:

- Dealmaking in the federal IT services sector has been very active over the past five years. More than 60 transactions have been executed at a combined enterprise value of more than $34 billion and an average EV/EBITDA multiple of 11.6x. Given the defensive nature of government spending, we expect substantial M&A activity to continue as strategic acquirers look to acquire new service capabilities and contracts.

- The federal government must implement and maintain leading-edge IT systems and procedures to keep up with a fast-paced and ever-evolving technology and security landscape, but the government historically has struggled to develop and effectively manage IT investments. This area is ripe for investment regardless of which political party occupies the White House. Current priorities include investment in the areas of cloud adoption, cybersecurity, and artificial intelligence.

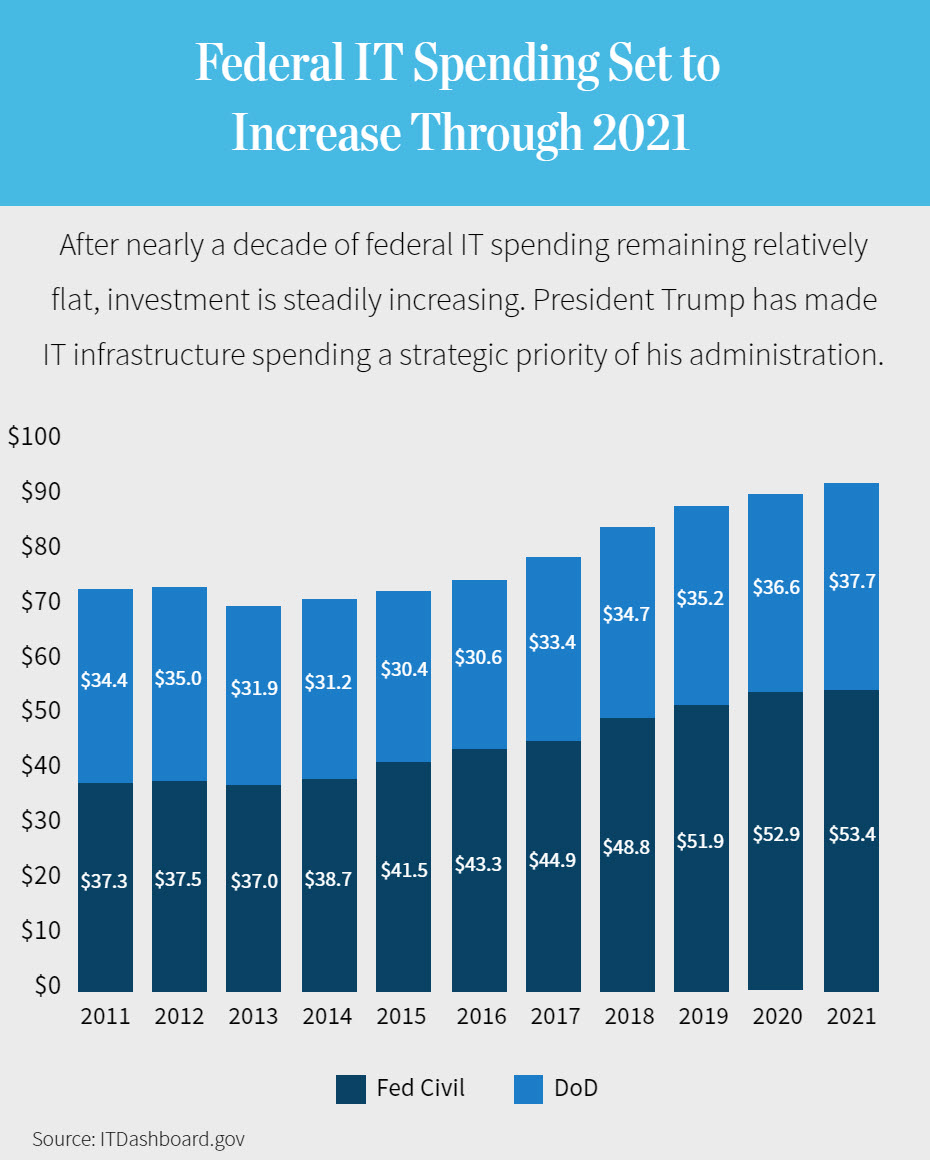

- The need for IT modernization is particularly acute for the Department of Defense (DoD). DoD IT spending decreased 11% from 2011 to 2016. The Trump administration has prioritized defense spending and has generated, funded, and awarded an increasing number of large defense cloud contracts in recent years. But hurdles remain, including nebulous selection criteria that have led to legal challenges over the awarding of new contracts.

- Numerous factors make government cloud services an area ripe for continued investment and consolidation. In addition to the projected increases in federal IT spending over the next decade, the sector is viewed as well insulated in a recessionary environment. The sector is dominated by a handful of large strategic acquirers, but beyond that, most providers that focus on the federal government are smaller than $50 million in revenue. Many sponsors are actively looking to build and scale government cloud platforms that will become attractive targets for the strategic acquirers in this fragmented space.