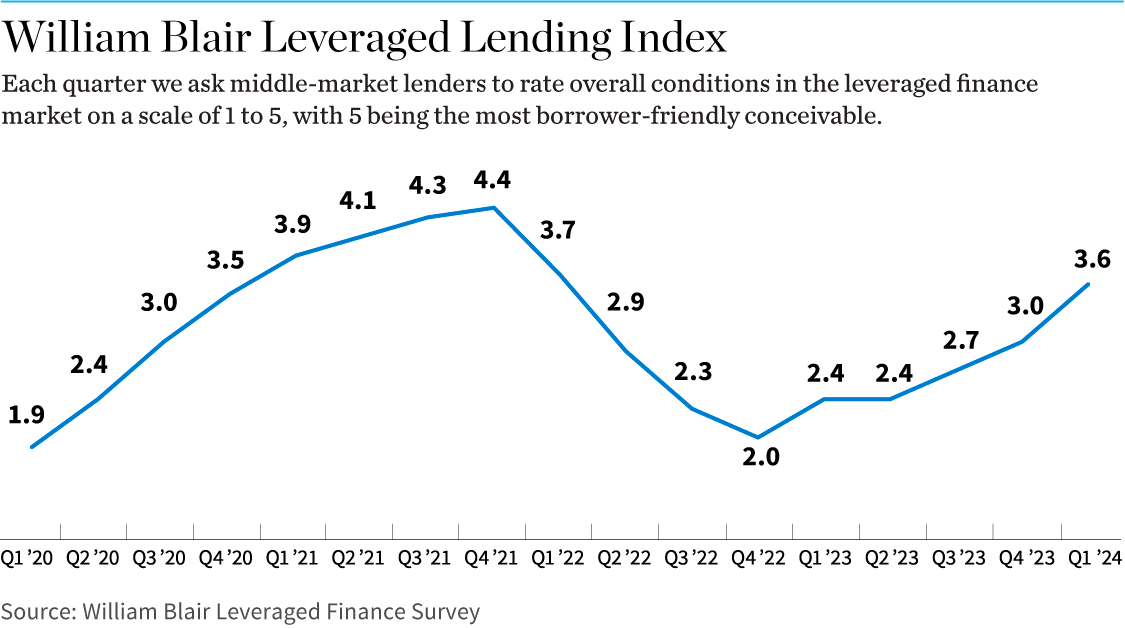

Q1 institutional loan volume hit its highest total since 2021, revitalizing leveraged finance markets after a humdrum 2023. Momentum toward more borrower-friendly pricing, leverage, and terms continues as the broadly syndicated markets reemerge and competition among lenders reaches new territory. With higher deal volume, anticipated rate cuts, and a more encouraging economic outlook, lenders are optimistic about the remainder of 2024.