Despite a surge of refinancing activity, the overall leveraged loan market remained depressed in Q4 as macroeconomic challenges and rising interest rates persisted. Notably, as the syndicated debt market remained closed, the private credit market provided much needed solutions for leveraged buyouts, displacing their syndicated counterpart.

Highlights of this quarter’s William Blair Leveraged Finance Report include:

- Direct lenders supplant syndicated counterparts and cautiously remain open for business

- Analysis of Q4 U.S. institutional loan volume

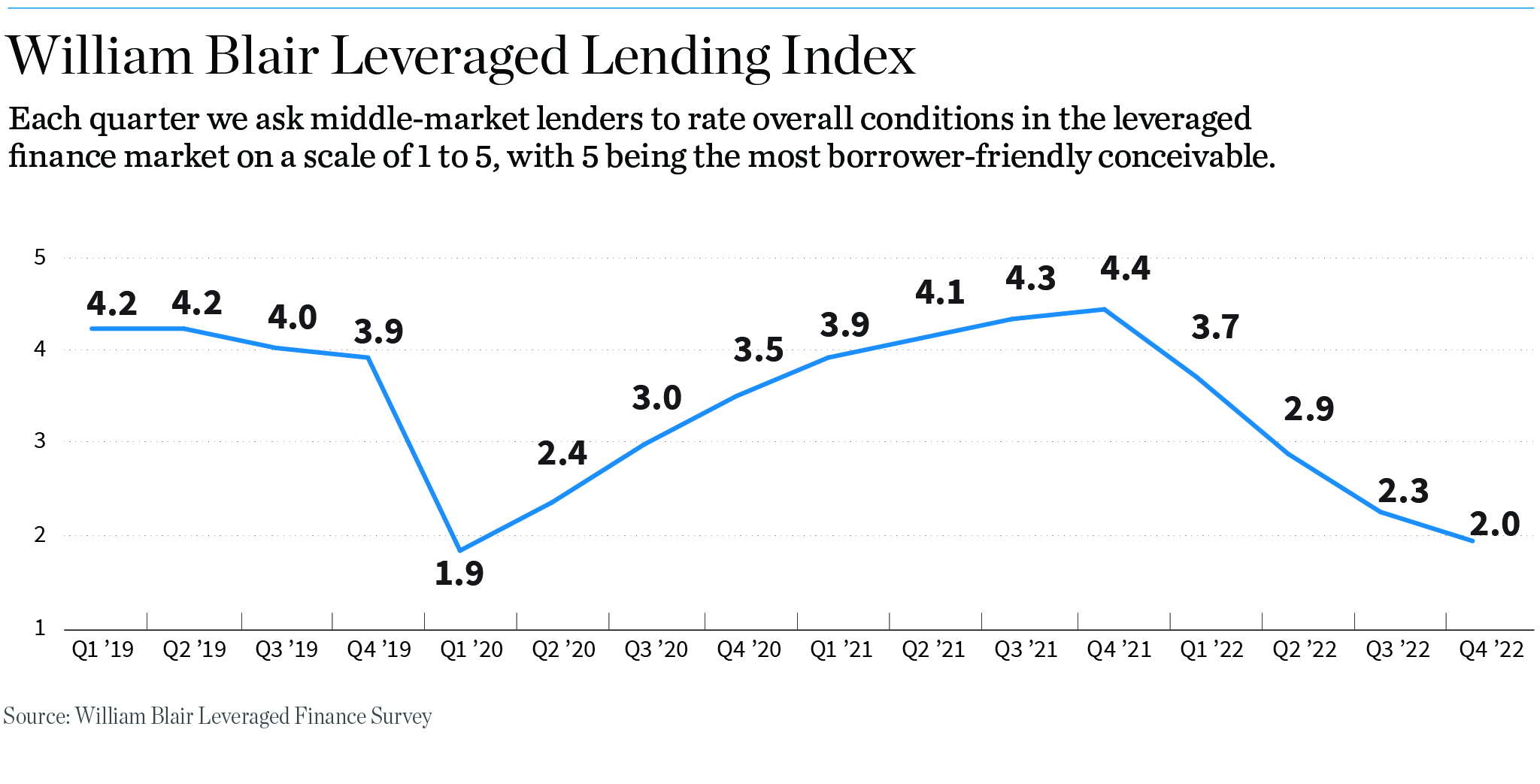

- Results from the William Blair Q4 2022 Lender Survey