What began as a year full of optimism with a record-setting January for the leveraged loan market gave way to an April shock shaped by tariff uncertainty. Despite a cloudy first half of the quarter, light began to shine through in June as market sentiment recovered and new issue volume strengthened. Now with summer in full swing, will a forecast of increased M&A and stable economic conditions hold true?

Learn more about Q2 performance and trends shaping the leveraged finance market in our latest report.

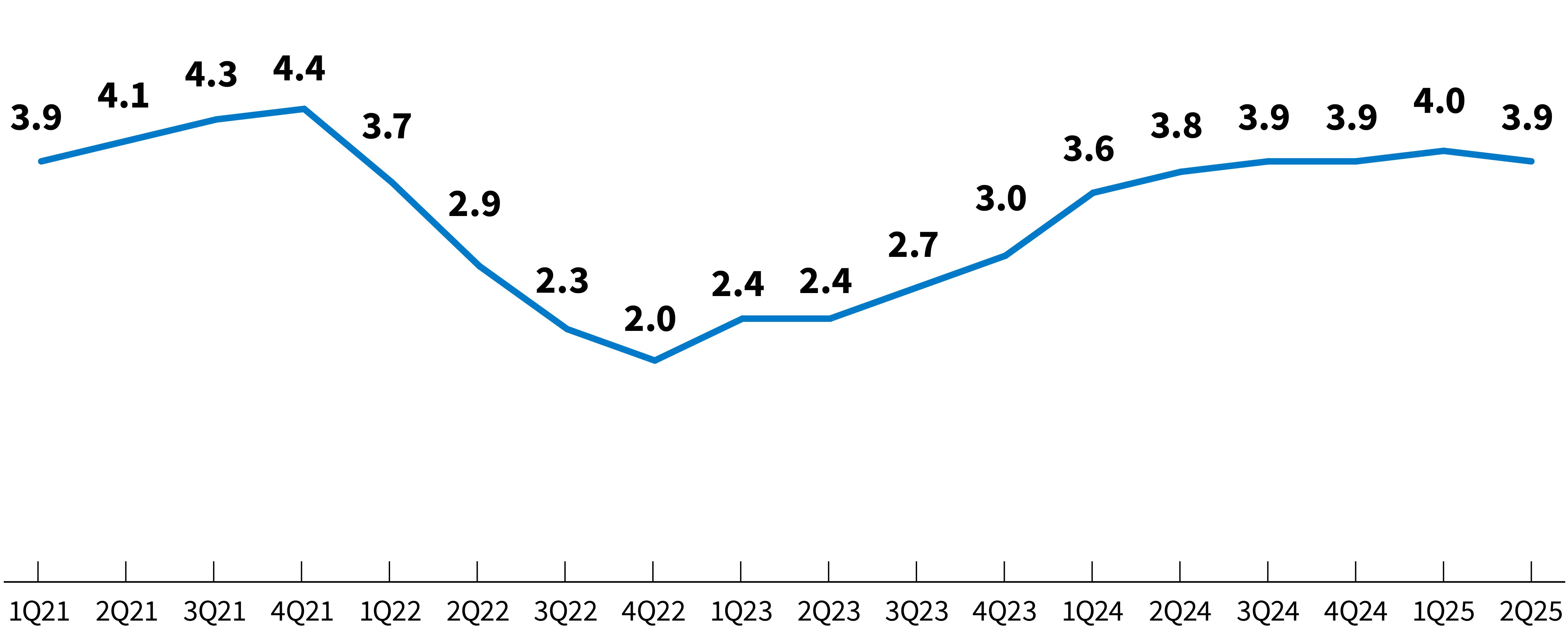

William Blair Leveraged Lending Index

Each quarter we ask middle-market lenders to rate overall conditions in the leveraged finance market on a scale of 1 to 5, with 5 being the most borrower-friendly conceivable.