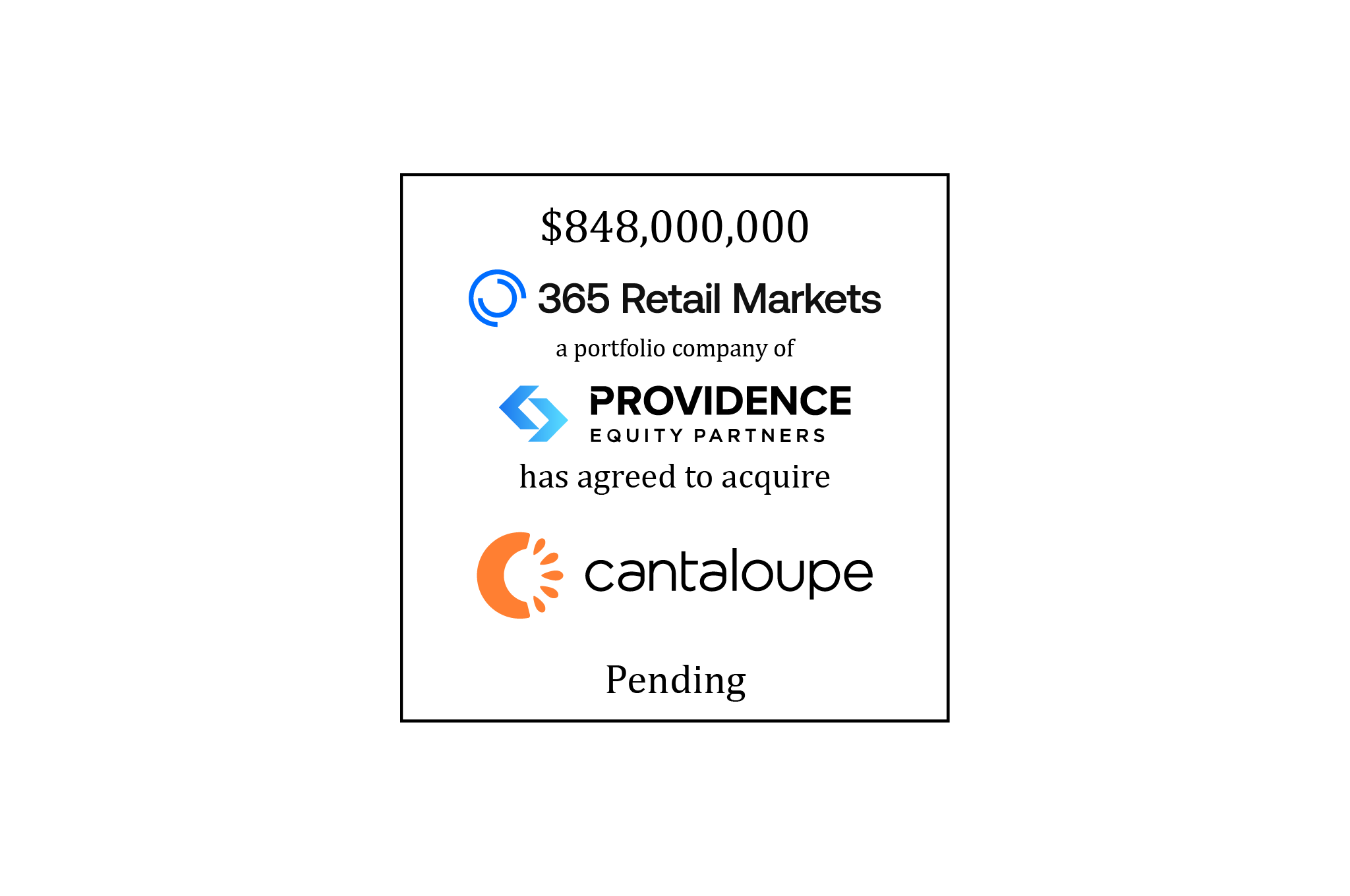

William Blair acted as financial advisor to 365 Retail Markets, LLC (365), a portfolio company of Providence Equity Partners L.L.C. (Providence), in connection with its pending acquisition of Cantaloupe, Inc. (NASDAQ: CTLP) (Cantaloupe). The transaction is expected to close in the second half of 2025.

About the Companies

Cantaloupe, Inc. (NASDAQ: CTLP) is a global technology leader powering unattended commerce. Cantaloupe offers a comprehensive suite of solutions including micro-payment processing, self-checkout kiosks, mobile ordering, connected point of sale systems, and enterprise cloud software. Handling more than a billion transactions annually, Cantaloupe’s solutions enhance operational efficiency and consumer engagement across sectors like food & beverage markets, smart automated retail, hospitality, entertainment venues and more. Committed to innovation, Cantaloupe drives advancements in digital payments and business optimization, serving over 30,000 customers.

365 Retail Markets is a leading innovator in unattended retail technology. Founded in 2008, 365 provides a full suite of best-in-class unattended technologies for food service operators including end-to-end integrated SaaS software, payment processing and point of-sale hardware. Today, 365’s technology solutions autonomously power food retail spaces at corporate offices, manufacturing and distribution facilities, hospitality settings, senior living facilities, universities and more in order to provide compelling foodservice options for consumers. 365's technology solutions include a growing suite of frictionless smart stores, micro markets, vending, catering, and dining point-of-sale options to meet the expanding needs of its customers. 365 continuously pioneers innovation in the industry with superior technology, strategic partnerships and ultimate flexibility in customization and branding.

Providence Equity Partners is a specialist private equity investment firm focused on growth-oriented media, communications, education and technology companies across North America and Europe. Providence combines its partnership approach to investing with deep industry expertise to help management teams build exceptional businesses and generate attractive returns. Since its founding in 1989, Providence has invested over $40 billion across more than 180 private equity portfolio companies. The firm has headquarters in Providence, RI, and has offices in New York, London, Boston, and Atlanta.

Learn more about our consumer products and services investment banking expertise.