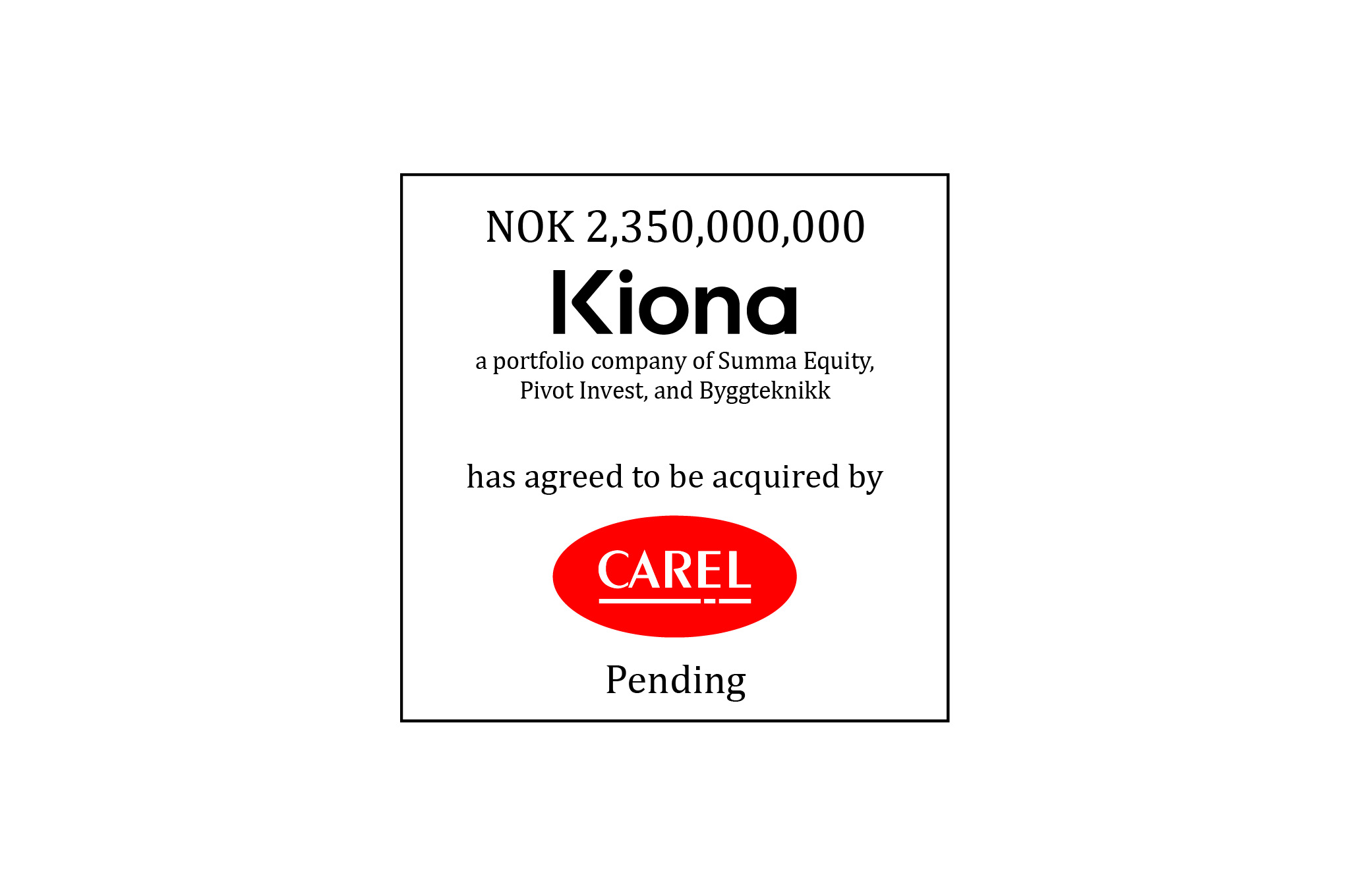

William Blair acted as the exclusive financial advisor to Kiona, a portfolio company of Summa Equity (Summa), in connection with its pending sale to CAREL (BIT:CRL). The transaction was signed on July 24, 2023.

About the Companies

Kiona is a leading SaaS company with the vision to significantly impact the fight against climate change by offering the most innovative and cost-efficient PropTech platform on the market. With well-proven solutions for integration and connectivity, Kiona helps customers achieve their financial and sustainability objectives by digitising new and old buildings and their heating, cooling, ventilation, and refrigeration systems.

Summa invests in companies that are solving global challenges and creating positive Environmental, Social, and Governance (ESG) outcomes for society. Summa’s purpose is to co-create win-win for investors, portfolio companies, and society through aligning its vision and investing in line with the UN SDGs. Summa invests across the themes of Resource Efficiency, Changing Demographics, and Tech-Enabled Transformation, and has c. EUR 4bn assets under management.

CAREL is a global leader, based in Padova (Italy), in the design, production and marketing of technologically advanced components and solutions for excellent energy efficiency in the control of heating, ventilation, and air conditioning (HVAC) and refrigeration equipment and systems. CAREL is focused on several vertical niche markets with extremely specific needs, catered for with dedicated solutions developed comprehensively for these requirements, as opposed to mass markets. The group designs, produces and markets hardware, software and algorithm solutions aimed at both improving the performance of the units and systems they are intended for and for energy saving, with a globally recognized brand in the HVAC and refrigeration markets (collectively, HVAC-R) in which it operates and, in the opinion of the group’s management, with a distinctive position in the relevant niches in those markets.

Learn more about our technology investment banking expertise.