With heightened scrutiny following the recent SVB turmoil, investors are starting to look for other potential areas where credit stress may emerge. One such area is the CRE market. Although, currently there are several mitigating circumstances which suggest we may not be re-entering a 2008 environment just yet.

The Fed last week effectively acknowledged that a recession is now much more likely, that the recent turmoil in the banking system was acting to further tighten financial conditions, and that rates were now at or very close to their peak. Yet, as economic growth slows, inevitably more cracks will start to show. One area that we continue to focus on revolves around any potential issues related to commercial real estate (CRE).

CRE on Bank Balance Sheets

One key aspect of the recent turmoil at Silicon Valley Bank (SVB) is the fact that the problems arose from extremely poor and/or a negligent lack of duration liability hedging. Furthermore, the assets in question—while they had performed quite poorly, thereby increasing liquidity and solvency risk—were high-quality assets (Treasurys, agency debt, and highly rated corporate debt) with little credit risk and plenty of price transparency, and whose nominal values will be paid off in the future as expected. This lack of major credit risk then gives the Fed plenty of leeway in using these securities as collateral for short-term liquidity and solvency enabling loans.

Importantly, and in comparison, this was very much not the case in 2008-2009, when seemingly AAA-rated asset-backed securities that were thought to be safe with limited credit risk were in fact completely worthless. The fact that they were hard to value also helped to rapidly erode any trust among the banks, resulting in the huge blowout in the TED spread—which is the difference between the three-month Treasury bill and the three-month LIBOR based in U.S. dollars, and the best gauge of interbank trust at the time.

However, what the SVB, First Republic Bank, and Credit Suisse episodes have also brought with them is a desire for much greater scrutiny of bank balance sheets. One area that investors are clearly starting to be much more concerned about as they scroll down bank balance sheets is CRE loans, which really do carry credit risk.

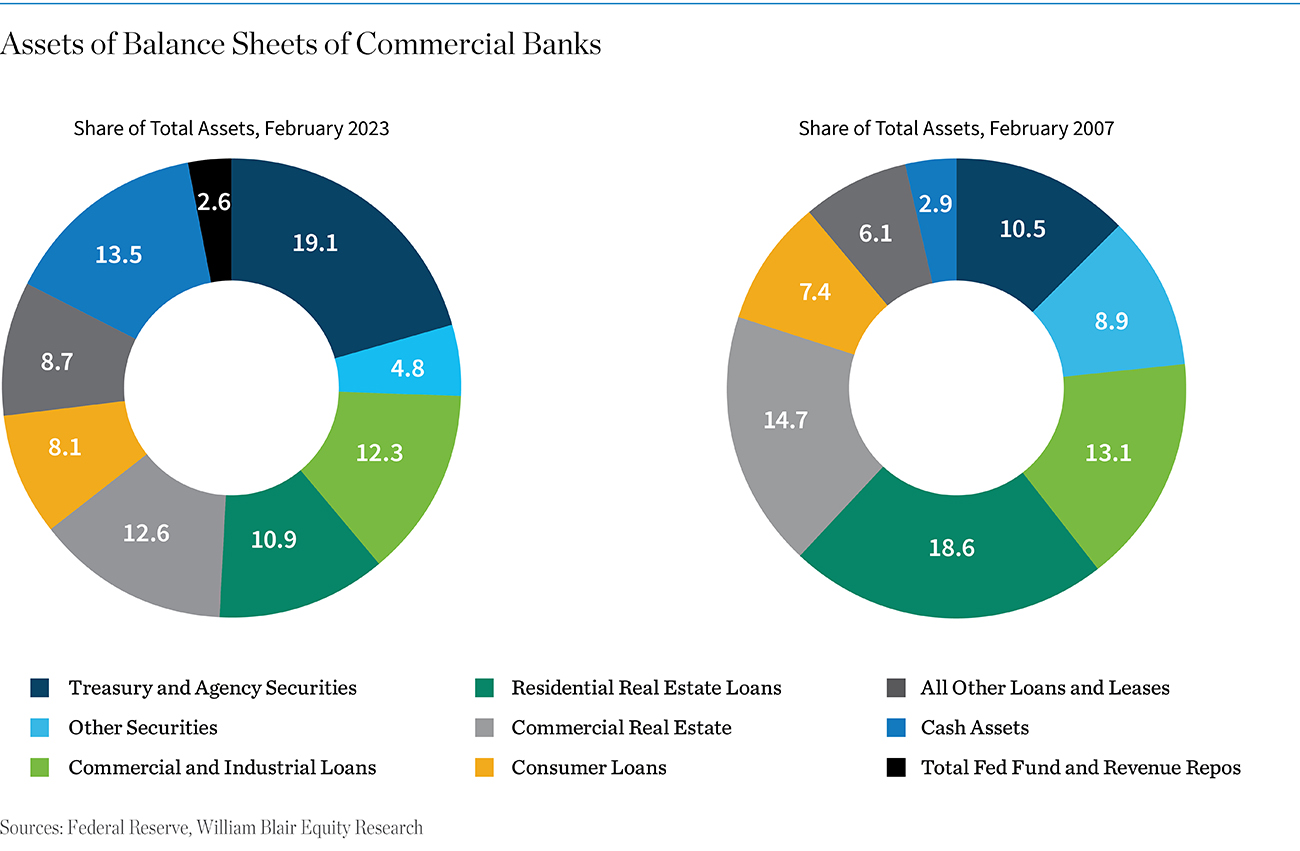

The two pie charts above show a breakdown of all the assets on banks’ balance sheets in February 2023, against a similar breakdown in December 2007. The charts highlight the far greater share of safer assets and cash today than was the case back then. They also show that the share of residential and commercial real estate is also smaller than it was ahead of the GFC (23.5% compared to 33.3% in 2007).

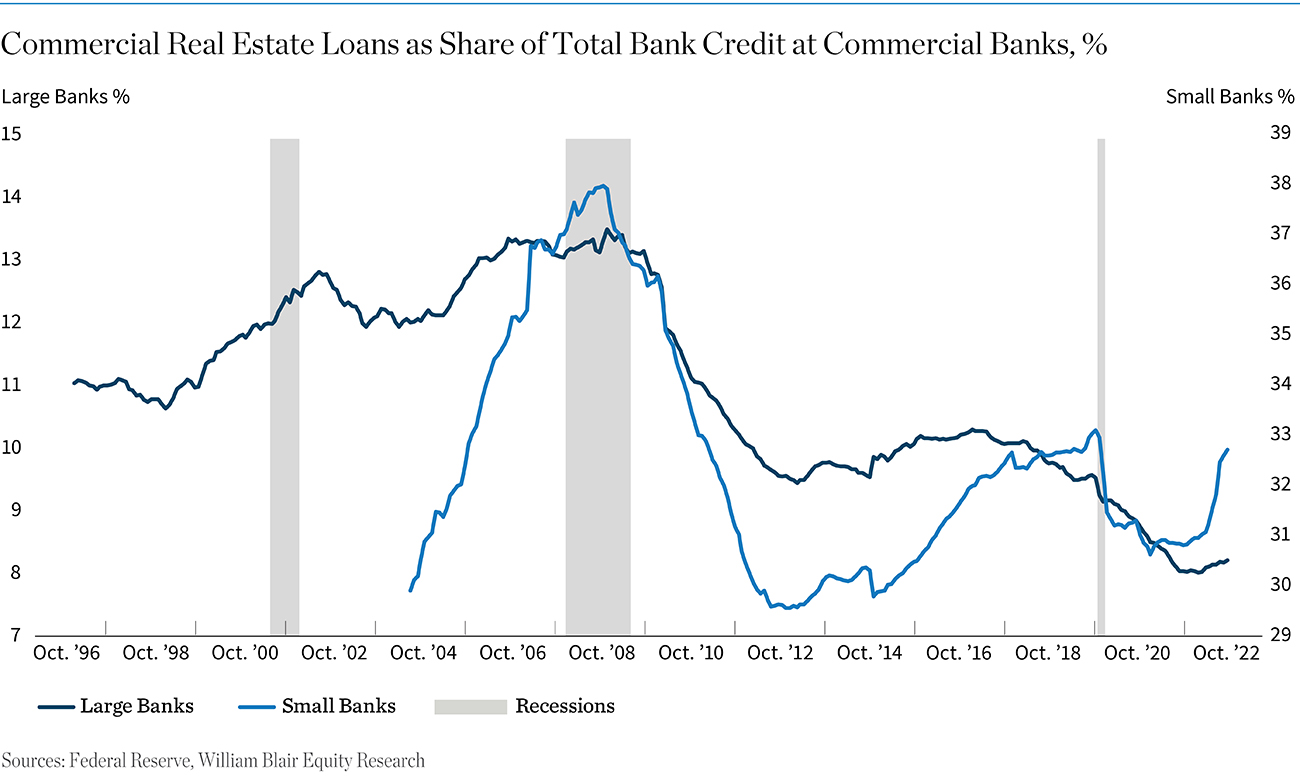

Meanwhile, the following line graph depicts the share of CRE loans over time among both small and large banks. Again, it shows that the relative shares are much smaller than at the start of the GFC, though the level is still very high in absolute terms for the smaller banks. That is, the share for smaller banks is 4 times larger than that for the larger banks—33% compared to 8.2%. The total amount of CRE loans listed at all commercial banks is $2.9 trillion.

The CRE Concerns

Investors’ concerns seemingly stem from five areas related to CRE. The first is the still-high exposure to this sector by the smaller banks as opposed to their larger counterparts, even though it is still much lower than in the early 2000s.

Second is the sharp increase in mortgage rates over the last year, which is already starting to slow activity. CRE is a highly leveraged industry and rates matter a lot. However, given that commercial mortgage loans are typically for a duration of between 5 and 20 years, the impact here in terms of immediately higher refinancing costs is likely to help to limit some of the pain, but will become more of a problem over time if rates actually stay high.

Third is the fact that office occupancy rates are now much lower than before the pandemic, resulting from the change to work from home. According to the Kastle back-to-work barometer, office occupancy is still only 47% of what it was pre-pandemic. Actual office vacancy rates from NAR show that vacancies rose from around 9.6% pre-COVID to a still rising 12.5% as of fourth quarter 2022. Meanwhile, this is being exacerbated by the existing trend in the retail space for stores with smaller footprints or away from bricks and mortar altogether, including, for example, many mall closures.

A fourth area investors are worried about relates to the fact that prices for all major sectors, with the exception of industrials (likely benefiting from reshoring and government investment), are now in outright decline on an annual rate-of-change basis. The impact of which is to increase the loan-to-value ratios on balance sheets.

Lastly, banks have been significantly tightening their lending standards, even before the recent SVB fiasco, and these will likely tighten further as a result.

Evidence of Stress in the System?

In terms of areas of stress, there is not a lot of evidence outside of the financial markets indicating that commercial real estate is particularly strained at the moment. For example, delinquency rates through to the fourth quarter of 2022 remain exceptionally low, according to data from the Federal Reserve. and bank coverage ratios are high across the banking system, based on FDIC data. If the banks are seeing distress, they are loath to foreclose on those assets, lest it mean they then have to own, operate, and then sell those properties. In the past, banks have put this off for as long as they can before regulators forced them to take action.

One factor that has particularly shocked investors was the gating of one of Blackstone’s flagship funds in early December following a spate of withdrawals. The withdrawals are reported to have mainly been from more highly leveraged Asian investors spooked by the sharp declines in their own commercial real estate values, though the departures also went beyond Asia as the year progressed. Brookfield’s default last month on two properties in LA has also raised some eyebrows, as did Columbia Property Trust/PIMCO’s default on $1.7 billion of seven office properties.

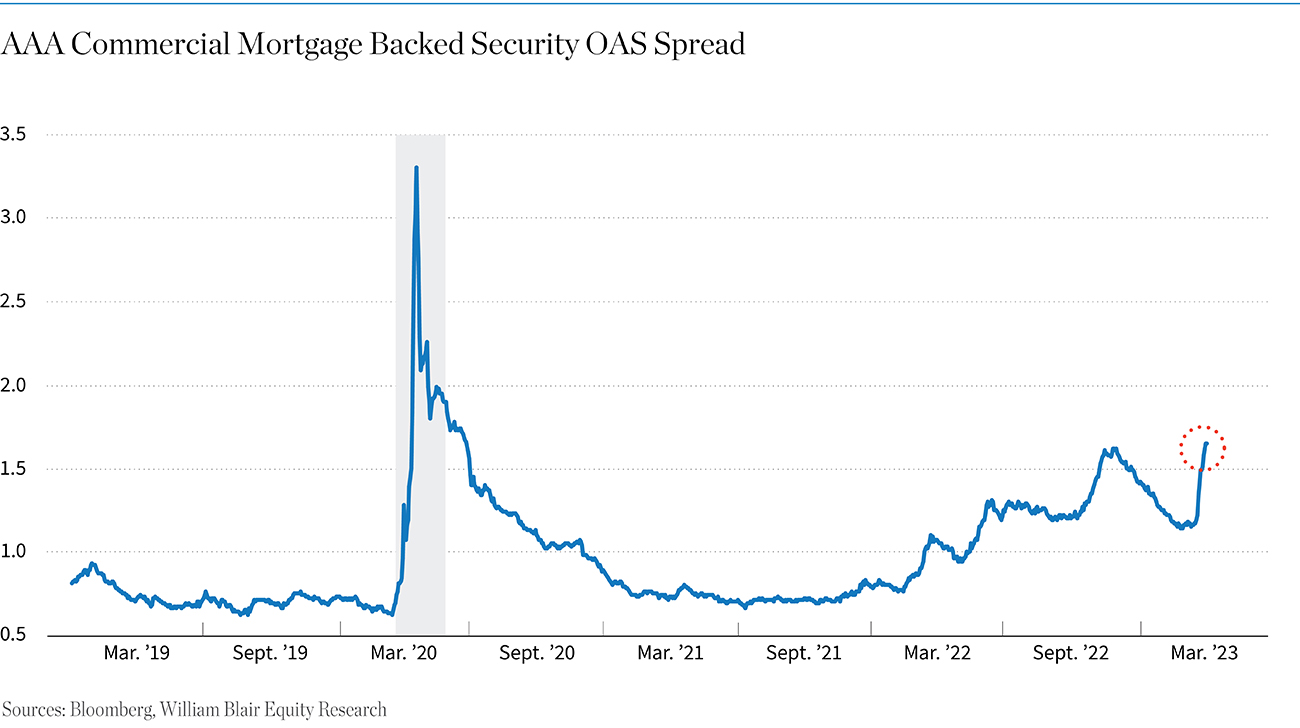

Lastly, we are seeing a significant widening of credit spreads for commercial mortgage-backed securities—not anywhere near the levels witnessed in 2008-2009 nor 2020, but high enough to suggest that investor caution is rising, and they are starting to demand a higher return on their investment.

Any Mitigating Factors?

While the CRE industry is clearly in a state of flux, there are perhaps some mitigating circumstances to be taken into account. Perhaps the first is that the largest two owners of commercial real estate are REITS and private equity, with the latter being the larger of the two.

The fact that private equity funds are reasonably opaque certainly works in their favor at times of stress in the market. Not only do these funds not have to market-to-market the value of those assets frequently, but it is extremely difficult for investors to force them into taking actions that they may not want to take, particularly when their funds are locked away for a number of years.

Estimates on the amount of total dry powder for private equity globally varies, but it is currently believed to be as high as $3.7 trillion at the end of 2022, with a smaller share of that available for commercial real estate. Furthermore, investors in these funds are highly diverse globally, just as the assets they invest in are.

CRE itself is similarly highly diverse across different areas. While offices in central business districts in, for example, New York City and Chicago, might be under pressure, this may not be the case in say, Miami and Austin. Similarly, it is also diverse across sectors, divided up into multifamily dwellings (the largest share), as well as office, retail, healthcare, industrials, data centers, towers, sports and entertainment facilities, and others.

Conclusion

With heightened scrutiny around bank balance sheets following the recent SVB turmoil, investors are starting to look for other potential areas where credit stress may emerge. One area where vulnerabilities are starting to show themselves is the CRE market. Strains were already starting to appear even before the SVB crisis, with several high-profile funds experiencing problems and defaults.

We have also been watching CMBS spreads widen to levels that would be consistent with growing investor concern, though not to the extent we saw in 2020, or anywhere close to what we saw in 2008-2009. The fact that much of this sector is owned by private equity, which has a significant amount of dry powder, does not have to regularly mark its assets to market, and is very dispersed geographically should help to provide some cushion.

Much less comforting is the exposure of the smaller banks, which hold a much larger share of their assets in CRE than the larger banks, and this will undoubtedly be an area of increasing pressure as the cumulative lagged impact of 20-fold rate increases continues to filter through the economy.