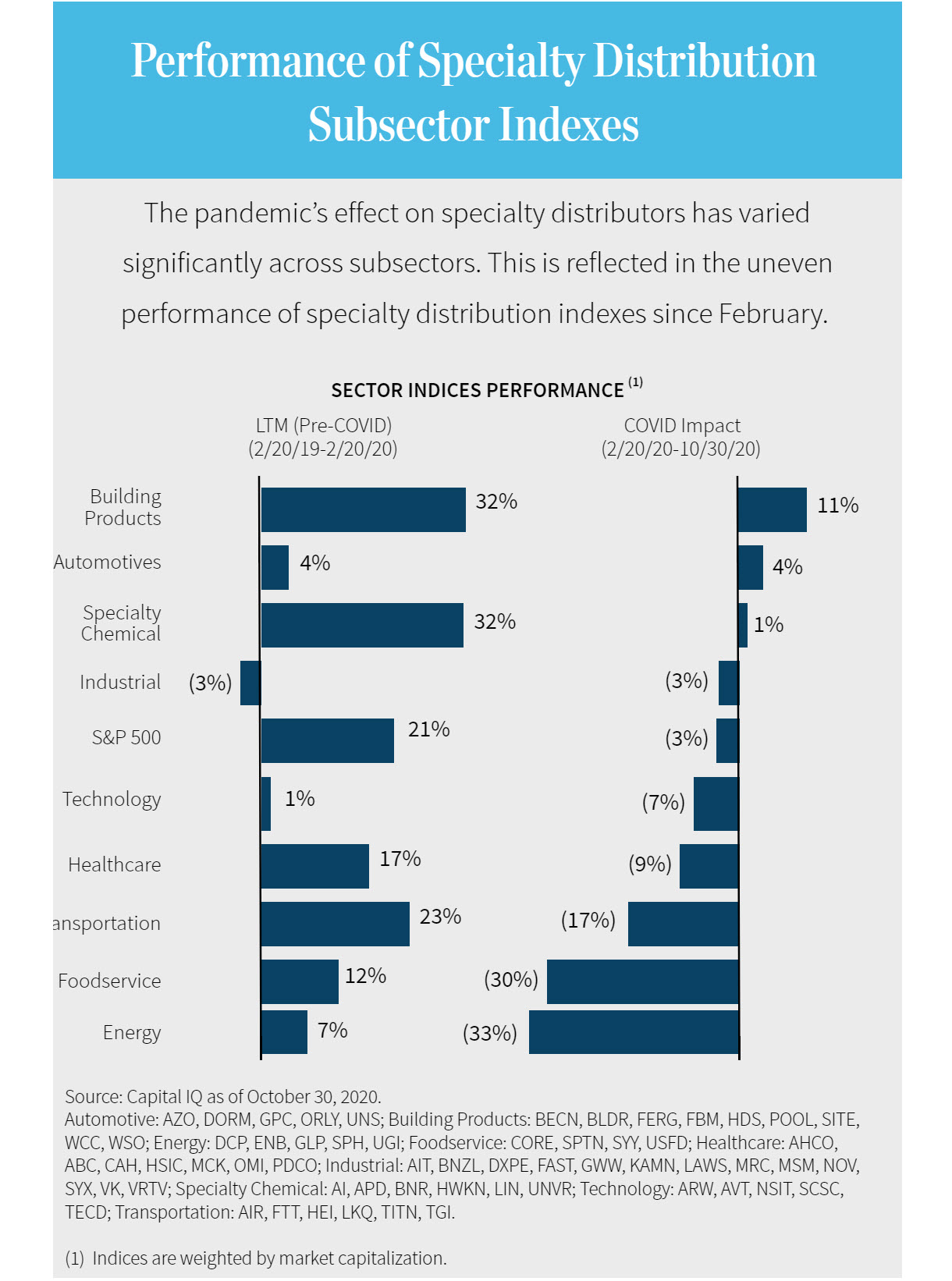

Overview: The COVID-19 pandemic has pressured supply chains across industries, but the net impact has varied significantly by end-market. We examine these dynamics in several key subsectors of specialty distribution. We also discuss the trends of e-commerce, onshoring, and surging M&A activity following a slowdown in the spring.

Key takeaways:

- For most end-markets, the net impact of COVID-19 has been negative. But surging demand for safety products and other idiosyncratic knock-on effects of social distancing and work-from-home have provided a buffer, and demand trends and overall market sentiment have been improving.

- The shift toward e-commerce in B2B markets had been much slower than what has occurred in B2C markets over the past decade. The COVID-19 pandemic, however, has been an inflection point in digital penetration for business buyers.

- The U.S.-China trade wars since 2018 have spurred momentum for localization of supply chains and onshoring of manufacturing and distribution capabilities. The COVID-19 pandemic added fuel to the fire by exposing how China’s role as the “world’s factory” could lead to disruptions that ripple across global supply chains.

- From an M&A perspective, specialty distributors are seen as a relatively low-volatility way for investors and financial sponsors to gain access to the highly cyclical industrials sector. Many distributors showed relatively impressive resilience during the pandemic by being able to quickly shift to certain surging categories. The increased need for scale and leading digital capabilities are also driving dealmaking in the sector.