The COVID-19 pandemic continues to drastically alter the food and beverage industry, presenting wide-ranging challenges and opportunities for company CEOs, employees, investors, and consumers. Retailers and food manufacturers continue to assess when pantry loading will begin to moderate. Companies across the supply chain are adapting to ensure the safety and continuity of their workforce; meanwhile, the CARES Act has added new complexity to these unprecedented times.

This report is the latest in our series of updates on the food and beverage industry (see previous report from March 26). In this issue, we focus on several emerging themes based on our real-time conversations with operators and investors from across the food and beverage industry in late March and early April.

-

Consumer demand for staples remains elevated, but moderation is in sight.

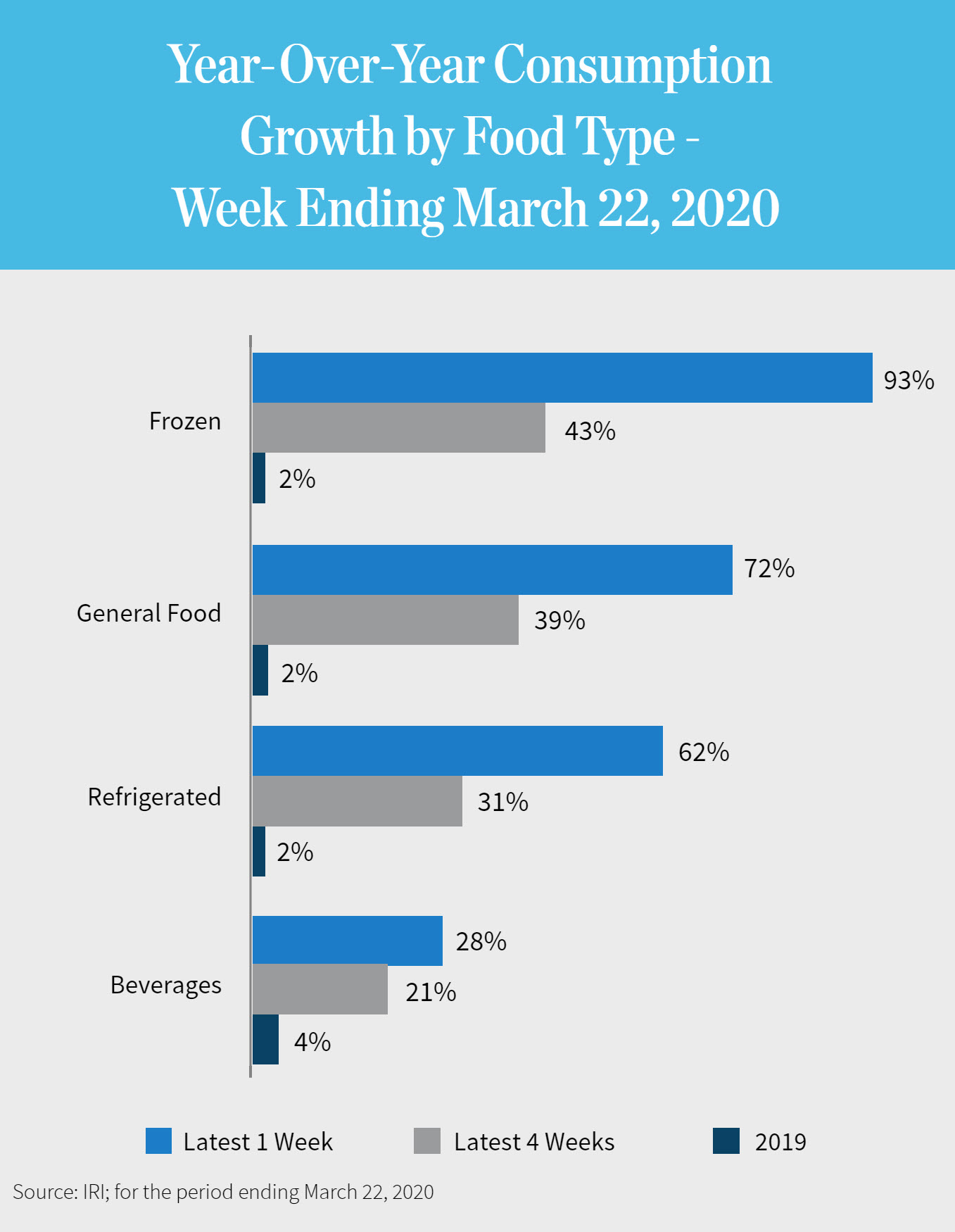

Reported food and beverage sales remained at extremely elevated levels headed into late March. For the week ended March 22 (the most recent data available from IRI), retail food and beverage sales were up 61% on a year-over-year basis. Demand growth has been strongest for frozen and shelf-stable foods as consumers look to load up on food that can last through a prolonged shutdown. Most frozen food categories saw year-over-year growth in excess of 100% for the week ended March 22, according to IRI.

Several observations suggest that consumer demand is beginning to moderate in early April. Many consumers have fully stocked pantries and are adjusting to shelter-in-place orders that could remain in effect for an extended period. Our conversations with manufacturers have indicated that the volume of new orders in the club and mass market channels are starting to return to more normalized levels.

In the early stages of the pandemic, the surge in consumer demand was most pronounced for club retailers, such as Costco and Sam’s, before expanding into traditional grocers. We believe this evolution was driven by club stock-outs as well as by broader consumer awareness and engagement in pantry loading. We consider the club channel a leading indicator for consumer moderation, because clubs have more efficient supply chains than traditional grocers. Club retailers manage less and faster-turning inventory in their supply chain, so will be an early indicator of a reduction in consumer purchases.

-

CPG supply chains are holding up; focus shifts to rebuilding channel inventory.

The food supply chain has operated well amid this extraordinary challenge. Overall orders remain at heightened levels, and production is still full steam ahead as distributors and many retailers focus on replenishing inventory levels and rebuilding safety stock. As a result, manufacturers will still need to maintain elevated production levels for some time following a decline in consumer purchases at retailers. In addition, manufacturers will also have to rebuild inventory across a wide number of SKUs after many purposefully narrowed production to a select set of the highest-velocity SKUs in order to lengthen runs and maximize production volume.

Cracks in the food supply chain are beginning to emerge, however, especially for perishable items. On April 3, Reuters reported that despite surging consumer demand, many U.S. dairy farmers are beginning to dump milk supplies—or even consider culling their herds—because production facilities and distribution networks have not been able to reallocate food inputs away from foodservice channels to retail channels quickly enough.

-

Multiple forces are likely to drive market share gains for value-oriented products, including private label.

While private label’s penetration in food and beverage has plateaued in recent years, the COVID-19 pandemic could trigger a new inflection point for store brands. Consumers will most assuredly become more value-conscious as they prepare for an extended period of economic uncertainty. As retailers prepare for these emerging consumer needs, we are hearing anecdotally that grocers are already revisiting planograms and beginning to allot more shelf space to private label and other value-oriented brands. It is worth noting that retailers have invested significantly in expanding and promoting their private-label programs in recent years.

In addition to macroeconomic factors, we expect products that deliver a strong value proposition—whether branded or private label—to gain share as a result of COVID-19. Consumers’ frantic pantry loading created widespread out-of-stocks, forcing consumers to try new brands or find substitutes for commonly consumed products. These trials, which often lead consumers to private label or lesser-known brands, could cause a significant realignment of consumer preferences toward newly discovered products that deliver the utility consumers require at an attractive price point. Utility in this case includes factors such as taste, ingredients, convenience, and packaging.

-

Private equity firms struggle to value portfolio companies.

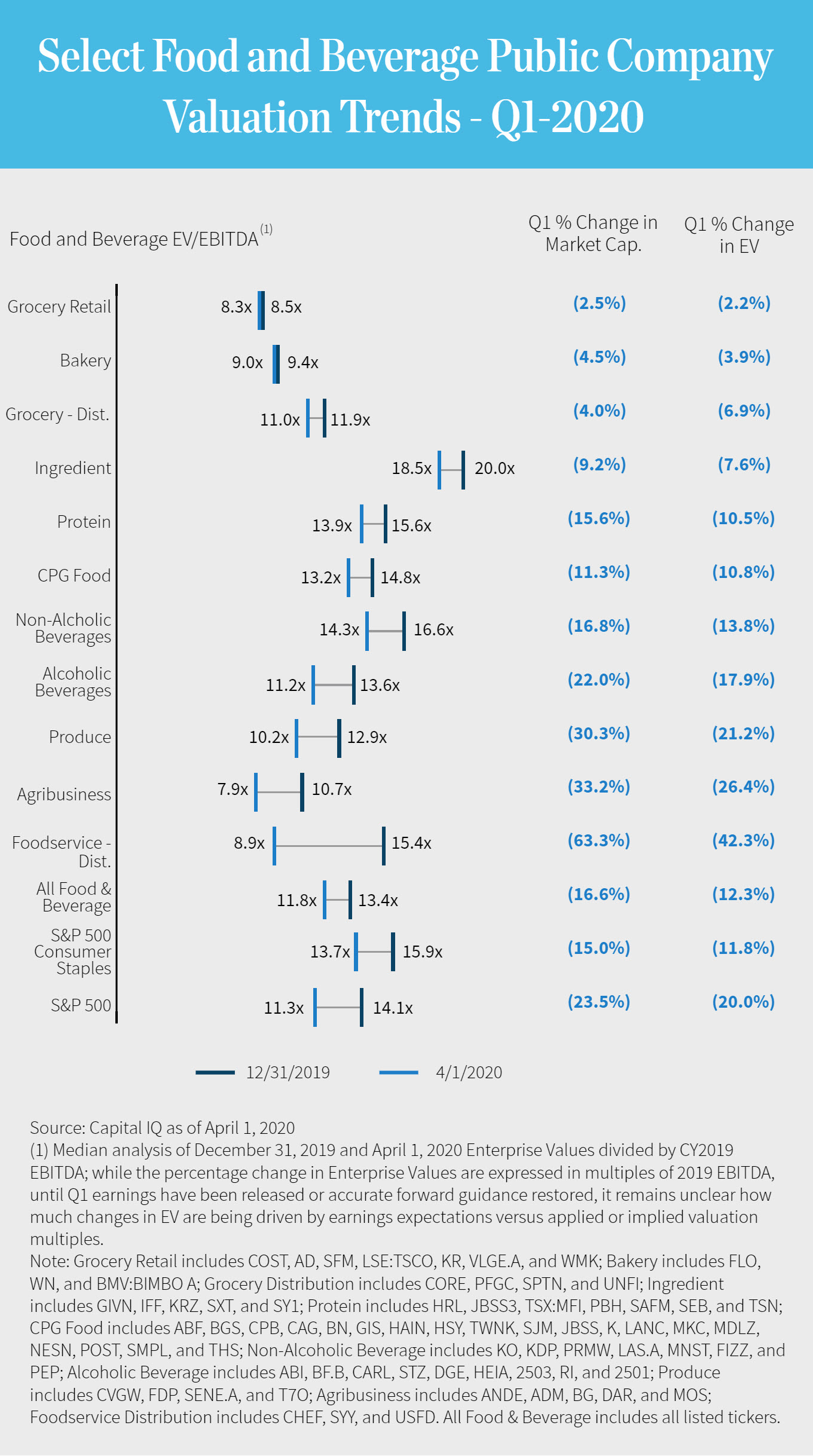

Private equity firms have faced increasing pressure from institutional investors, regulators, and auditors to develop processes and procedures to value their portfolio companies using more transparent market-based assumptions. In late 2019, the American Institute of Certified Public Accountants (AICPA) for the first time issued guidance regarding the valuation of portfolio companies held by private equity managers. Many financial sponsors began to institute new valuation processes in early 2020. Just as sponsors were formalizing new valuation processes, the coronavirus pandemic hit, hugely complicating the exercise.

To help sponsors gain insight into the valuation of current and prospective food and beverage portfolio companies, William Blair has analyzed the valuation trends of publicly traded companies as a group and across several sub-verticals. We believe this data will be informative to investors as they look to understand how valuations are evolving in real time.

It is important to note that until there is greater visibility into public company earnings, it will remain a challenge to disentangle earnings expectations from valuation multiple attribution. The potential for public market inefficiency—and irrational behavior by investors—to affect this analysis should also be considered.

-

Key Takeaways From Conversations With Food and Beverage CEOs.

Below are select takeaways relating to COVID-19 that have emerged through our regular conversations with CEOs across the food and beverage industry.

-

Managing the dynamics of the CARES and FFCR Acts: Following the passage of the CARES Act and the Families First Coronavirus Response Act, company leaders have shared significant concerns on how the new rules related to the Family and Medical Leave Act will affect the willingness of employees to continue working. There is a concern that employees may engage in the use of FMLA for the next several months due to a combination of:

- Need to care for children who are out of school and socially distanced from other substitute caregivers (e.g., grandparents)

- Fear of contracting the disease at work

- Financial incentives to receive paid leave at 67% of income

-

Communicating and providing leadership for employees: CEOs’ communication and employee engagement skills are being put to the test. Many companies have started holding daily or weekly conference calls and virtual town halls to stay visible to employees, as well as to provide transparency into business performance and COVID-19–related decision-making. Some CEOs have noted that in the absence of a strong, consistent narrative from the C-suite, well-meaning managers and supervisors will fill the void for their teams, often creating disjointed messaging.

-

Engaging employees to enhance workplace safety: As leaders of essential businesses whose facilities are to remain open throughout the pandemic, food and beverage CEOs must balance worker safety with fulfilling a critical societal need. In managing this challenge, many companies have learned that their employees can be a valuable source of ideas for optimizing safety. CEOs noted that employee panels and committees have helped develop and lead a number of creative safety protocols, such as taping out breakrooms to encourage social distancing and removing conference room doors to reduce physical touchpoints and increase air flow.

-

Balancing the need to make quick decisions while seeking legal counsel: The current crisis is forcing CEOs to make hugely important decisions related to safety, benefits, and staffing in a highly compressed timeline. But CEOs need to balance the need for decisive action with the risk that hasty (or improperly executed) decisions can lead to costly lawsuits in the future. In this environment, some very tenured CEOs are asking for multiple sets of counsel opinions relating to layoff and furlough decisions, as well as legal advice for how to communicate these decisions. Some observers predict a wave of future lawsuits surrounding decisions that, although well-intentioned, may run afoul of HR regulations once the pandemic has subsided.

-

Many additional themes that merit close attention will emerge as the COVID-19 response continues to develop. We will continue to monitor these developments closely through our ongoing conversations with the business leaders and teams at the front lines of the food and beverage industry, as well as with the investors and analysts who focus on this critical part of the global economy.

If you have any questions about these themes and what they mean for your business, please do not hesitate to contact us.