Overview:

In the fourth Food For Thought report published by William Blair since the beginning of the COVID-19 crisis, we examine two areas where the pandemic has produced some particularly interesting dynamics: M&A activity and the industry's adoption of artificial intelligence (AI). M&A activity, which not surprisingly slowed in recent months, is expected to pick up markedly in late 2020. COVID-19 has accelerated the adoption of AI and advanced analytical tools up and down the food and beverage supply chain.

Key takeaways:

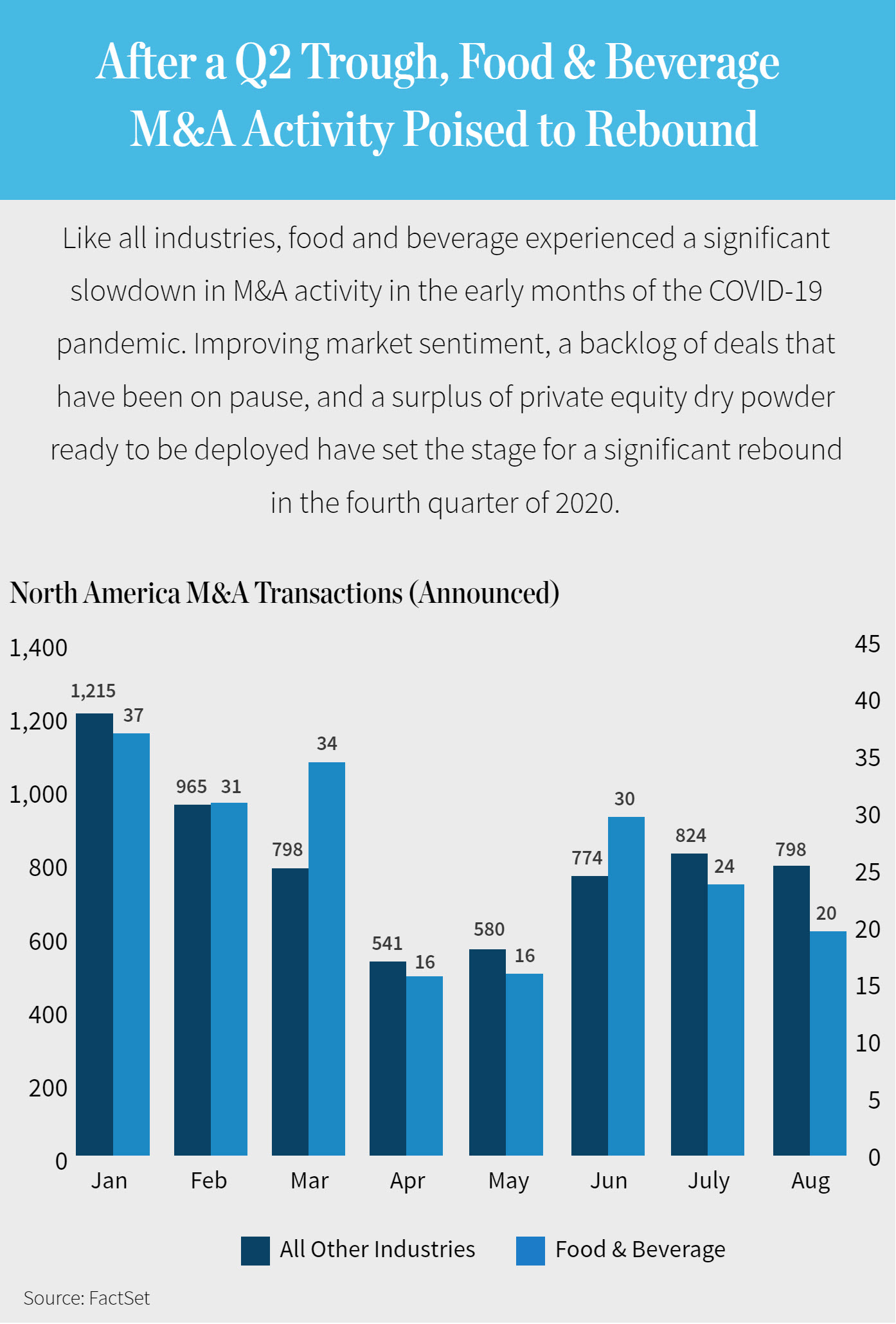

- Food and beverage M&A activity slowed down during the pandemic, reflecting trends seen across the broader market. But the late summer has seen a marked improvement in sentiment and numerous green shoots that point to a continued resurgence in M&A activity over the remainder of 2020 across sectors. There is a glut of deals that are poised to initiate and restart processes shortly after Labor Day, setting the stage for a strong rebound in M&A activity in the fourth quarter. At William Blair, our pipeline is approaching pre-COVID levels, and this is being driven by activity across sectors.

- In addition to sentiment and pipelines pointing to a coming increase in M&A activity, key trends defining the current state of dealmaking activity in the broader market include: 1) an abundance of capital tempering expectations for a "buyer's market" and 2) narrower, relationship-driven processes becoming more common.

- Compared with other industries, the application of AI and machine learning (ML) has been relatively nascent in the food and beverage industry. But the adoption of these tools has accelerated in the past several years, and the pandemic has highlighted new opportunities to use AI and ML across food and beverage supply chains.

- We have identified four primary ways that food and beverage companies are using AI, ML, and other advanced analytics tools to operate more efficiently and enhance profitability: 1) improving demand forecasting; 2) food safety from "farm to fork"; 3) virtualizing product innovation and improving product launch; and 4) "intelligent" production to optimize operations.

Chart to watch: