John Kreger, director of equity research for William Blair, discusses the firm’s approach to identifying high-quality companies with attractive growth prospects. While 2022 was a challenging year given current market conditions, Kreger discusses William Blair’s long track record of identifying emerging growth companies. Kreger has been a partner of the firm since 2003 and was named director of research in 2022, bringing over 30 years of equity research to the position.

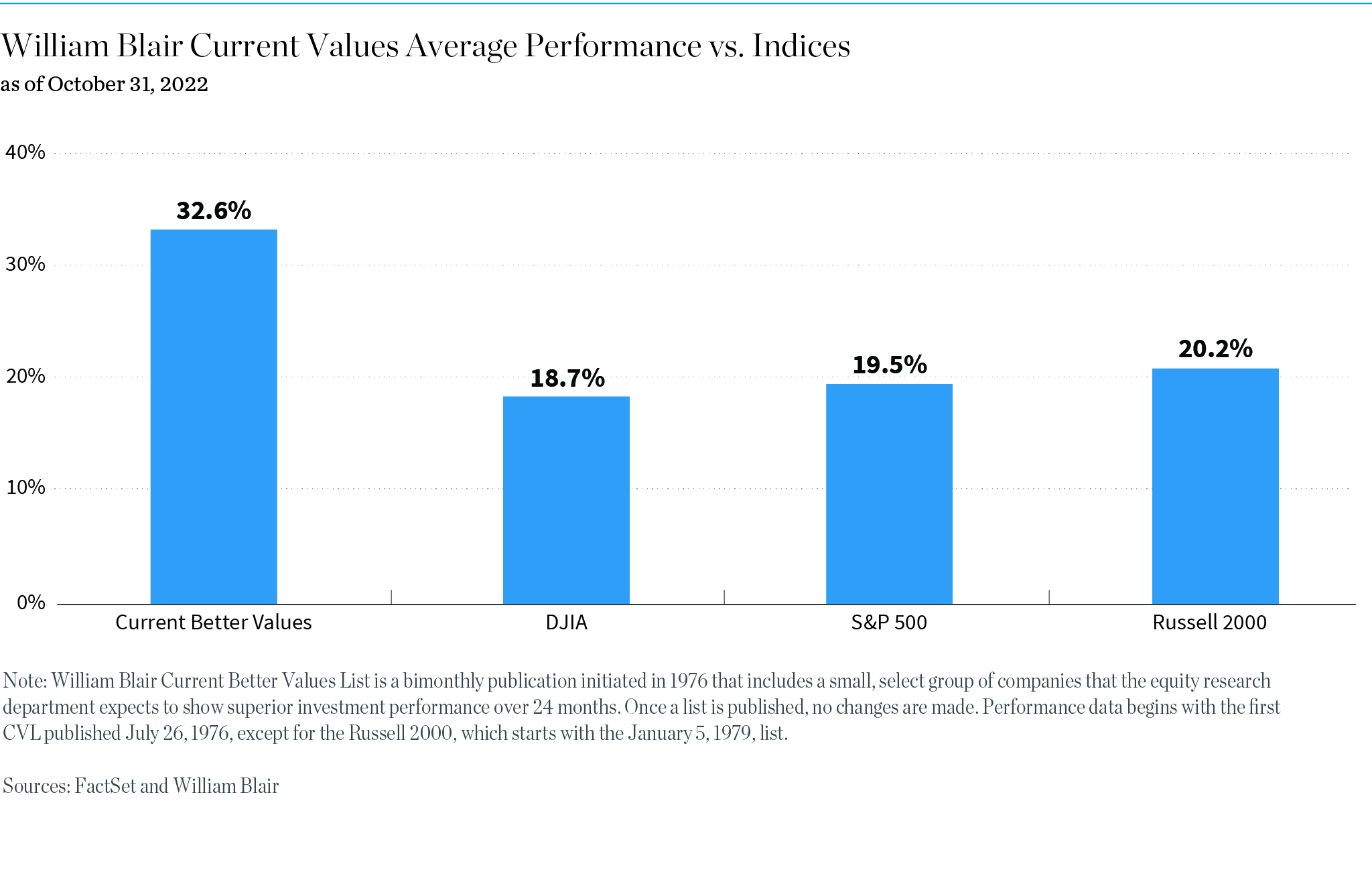

At William Blair, our investment objective is to find the best, highest-quality growth companies out there. Undoubtedly that can be more challenging during years like 2022 when the market was in a more risk-off cycle. But we take a long view to uncover what we think will be great long-term value-creation stories and focus on identifying big-picture trends that matter. Ultimately, we believe those companies will be the ones that excel over the long run.

That analysis involves employing multiple factors to identify emerging growth companies while keeping grounded in independence and maintaining a rigorous pursuit of clients’ success.

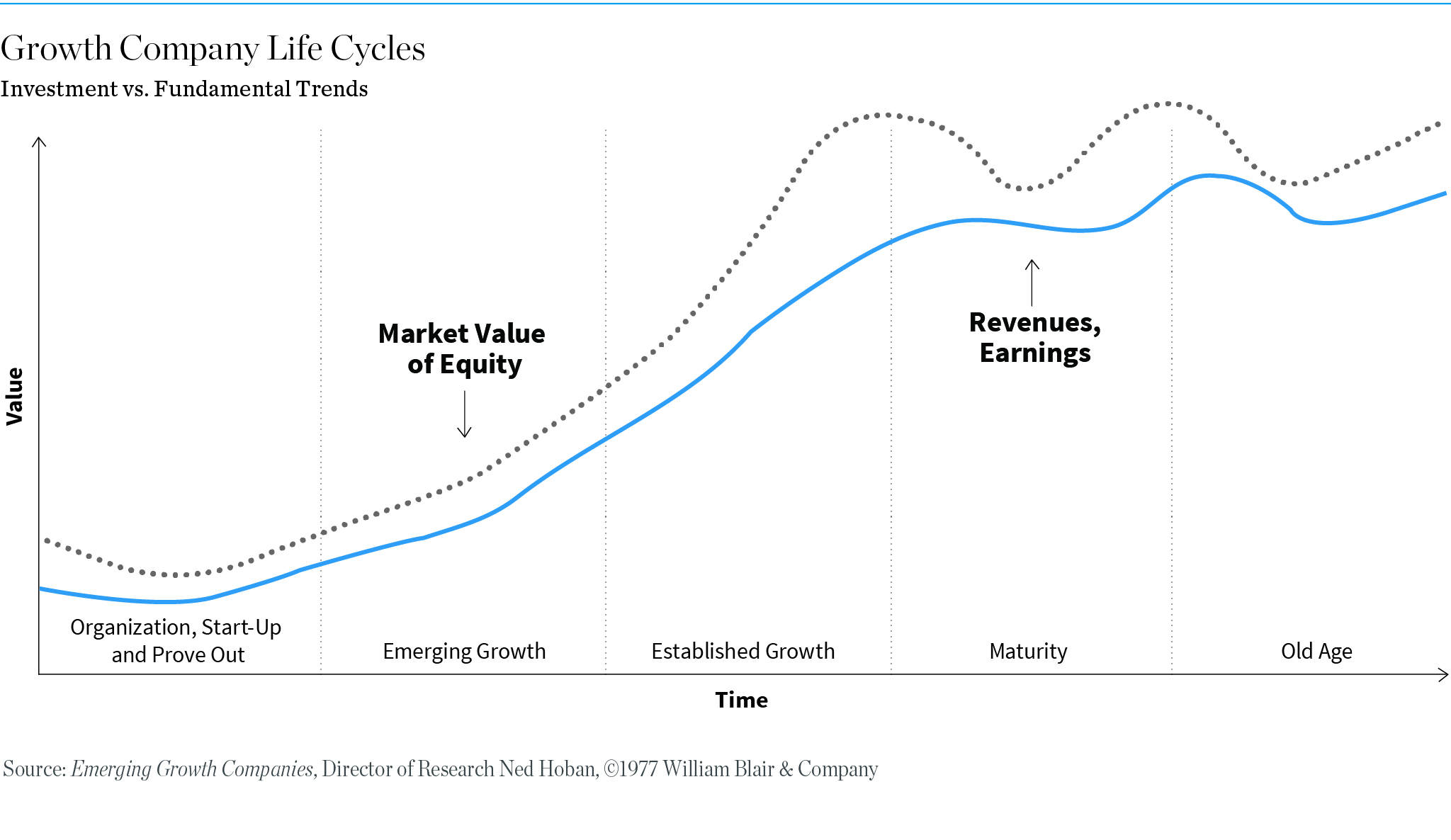

Our basic philosophy is that the best opportunities to invest occur in the emerging part of a company’s growth curve. We try to catch companies early in their lifecycle, when growth rates tend to be best, which is also when the valuation trends tend to expand.

That’s why William Blair’s research coverage universe average market capitalization looks very different from the broader market. Depending on the year, 80% to 90% of the companies our analysts cover are small- to mid-cap companies with a market value below $30 billion. We have 43 analysts covering a little more than 700 companies today. We don’t cover every industry but instead focus on those we believe have long-term, superior growth potential relative to the broader market and broader economy. In the last 12 months we have added about 70 companies, so we are constantly refreshing that list in an effort to find great investment opportunities.

William Blair analysts cover seven growth-oriented sectors: consumer; energy and sustainability; financial services and technology; global industrial infrastructure; global services; healthcare; and technology, media, and communications. About half of our universe falls in the tech and healthcare sectors. Most recently, we launched sector coverage in the energy and sustainability space—a big, expanding sector with increasing relevance across the globe as we collectively struggle to match energy demand and combat climate change.

Picking Companies

We continually try to find companies that grow a lot faster than the broader market. On average, our covered companies are growing faster and have higher valuations than the S&P 500. Ultimately, the driver of value is growth in sales, earnings, and cash flow. From there, we peel back a layer to determine the potential success of a company over the long haul—does it have a durable business model; what is the potential growth in the years ahead; is it a leader among industry peers? We don’t want to follow a company that is going to be great for a quarter. Our mission is to identify a company that is going to work for five years, 10 years, or more.

That said, the three basic questions our analysts try to answer: Is this a great market? Is it a great business? And is this a great management team? If we find a company that checks all three boxes, the success rate goes way up.

The other important component is determining whether it can also be a great stock. Not all great companies make great stocks. So we apply a valuation framework to our analysis to help determine whether a company is already highly valued or perhaps overvalued by the market.

Some of the big names the firm has covered over the 1980s, 1990s, and 2000s have been Fastenal, ResMed, Starbucks, Salesforce, and Netflix, which from the time William Blair initiated coverage significantly outpaced the S&P 500. We don’t always get it right, but when we do, we ride these stocks as long as possible until we start to perceive that they are crossing into a mature phase. Then we take a step back and try to find another.

A Disruptive Model

Before becoming director of research, I was a healthcare analyst at William Blair for over 20 years, spending much of my time observing the biopharma industry. Biotech came of age in the 1980s. It struggled during the early years to bring new therapies and drugs to market as biotechs were burdened with high investment requirements to build plants, hire sales staff, put a regulatory structure in place—long before they ever knew whether a drug or therapy worked.

Seeing the need for change, pharmaceutical outsourcing and contract research organizations (CROs) were launched. We identified the theme early on and initiated research on one of the pioneers in the space, ICON. The stock was up more than 2,000% since we initiated coverage in September 1998 during a period when the S&P 500 was up about 260%, citing performance data from FactSet and S&P 500 as of September 30, 2022.

But the other thing that’s wonderful, we all like to think we are a making a difference. This industry has really enabled biotech, allowing thousands of biotech companies to become what are known as virtual pharma companies. As such, they can focus on the science without having to raise a couple hundred million dollars to build plants that may or may not have any use. That was the old model.

Keeping the List Fresh

We are always looking to find the next great company to follow, freshening our list of companies. With 43 analyst teams, each works to add at least one or two names a year. William Blair analysts are also respected thought leaders within their sectors and release in-depth reports on cutting-edge themes—such as synthetic biology, consumer-driven healthcare, fragmentation of the software market, quantum computing, and the list goes on.

Occasionally, we will add a whole new area to our coverage list, which we did in 2022 with the addition of the energy and sustainability sector. Clearly, there are long-term structural changes happening in the energy market and our goal is to cover 50 to 60 names in the sector over the next few years.

In recent years, we also have expanded our research to take a deeper dive into alternative investment classes. This area is increasingly relevant given the hundreds of billions of dollars moving into the private sector annually. Clean technology, financial services, and education software, for example, are among the industries attracting the biggest investments. We are asking each analyst team to be much more cognizant of the private companies being formed, and which ones are attracting additional capital. That also helps our analysts know these companies years before they would be in the public landscape.

But following privately held companies is harder. There are no SEC filings to dig into revenues, earnings, and margins. So it is important to take a holistic view of the industry and get to know the companies and management teams through interviews, industry research, and so on.

At the end of the day, our analysts take a deep dive on companies to identify emerging quality companies early in their life cycle, a philosophy William Blair research has been built upon for decades. But that growth comes with a cost. Companies early in their life cycle by definition are riskier and volatility tends to be higher. Emerging growth companies also tend to trade at a higher valuation than the broader market. The higher risk and higher valuation can lead to greater periods of volatility and underperformance in the short term—as we have experienced during 2022. But as long-term investors our view is that a superior model will win out over time.

That’s why we spend so much time analyzing themes, taking a big picture view, asking ourselves are the macros going in the company’s favor. This approach helps to shift the odds in our favor.

Visit williamblair.com/ResearchCoverage for disclosure information. The performance referenced is past performance and offers no guarantee of future results. Performance does not account for fees and expenses.