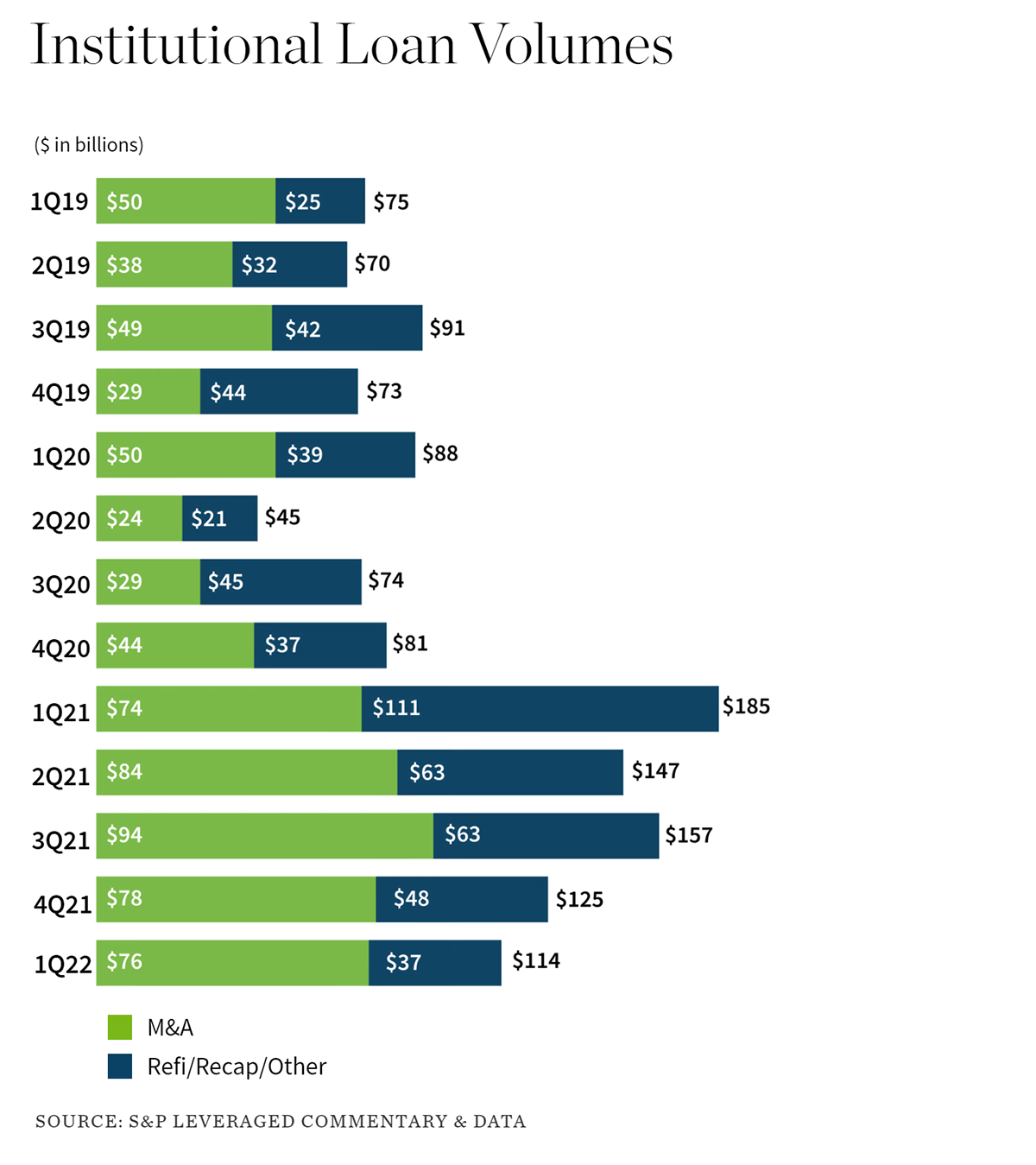

The broader leveraged finance market stumbled during the first quarter of 2022 as rising interest rates, inflation, and Russia’s invasion of Ukraine created significant headwinds.

According to William Blair’s Leveraged Finance Survey, lenders’ willingness to stretch in order to win new deals softened during the quarter, particularly within the syndicated loan market.

Look for the private debt markets to capitalize and continue to attract borrowers due to increasingly larger hold sizes, strong investment appetite and high certainty to close.