For a second consecutive quarter, U.S. institutional leveraged loan volume increased driven by refinancing activity. However, M&A-related volume continued its decline, reaching a quarterly low not seen since the Great Recession. As the financing markets work to conform to a challenging operating environment, additional risk emerged as Silicon Valley Bank collapsed, sparking the largest banking crisis in over a decade.

Highlights of this quarter's William Blair Leveraged Finance Report include:

- Analysis of Q1 U.S. institutional loan volume

- Impact of Silicon Valley Bank Collapse on the Leveraged Finance Market

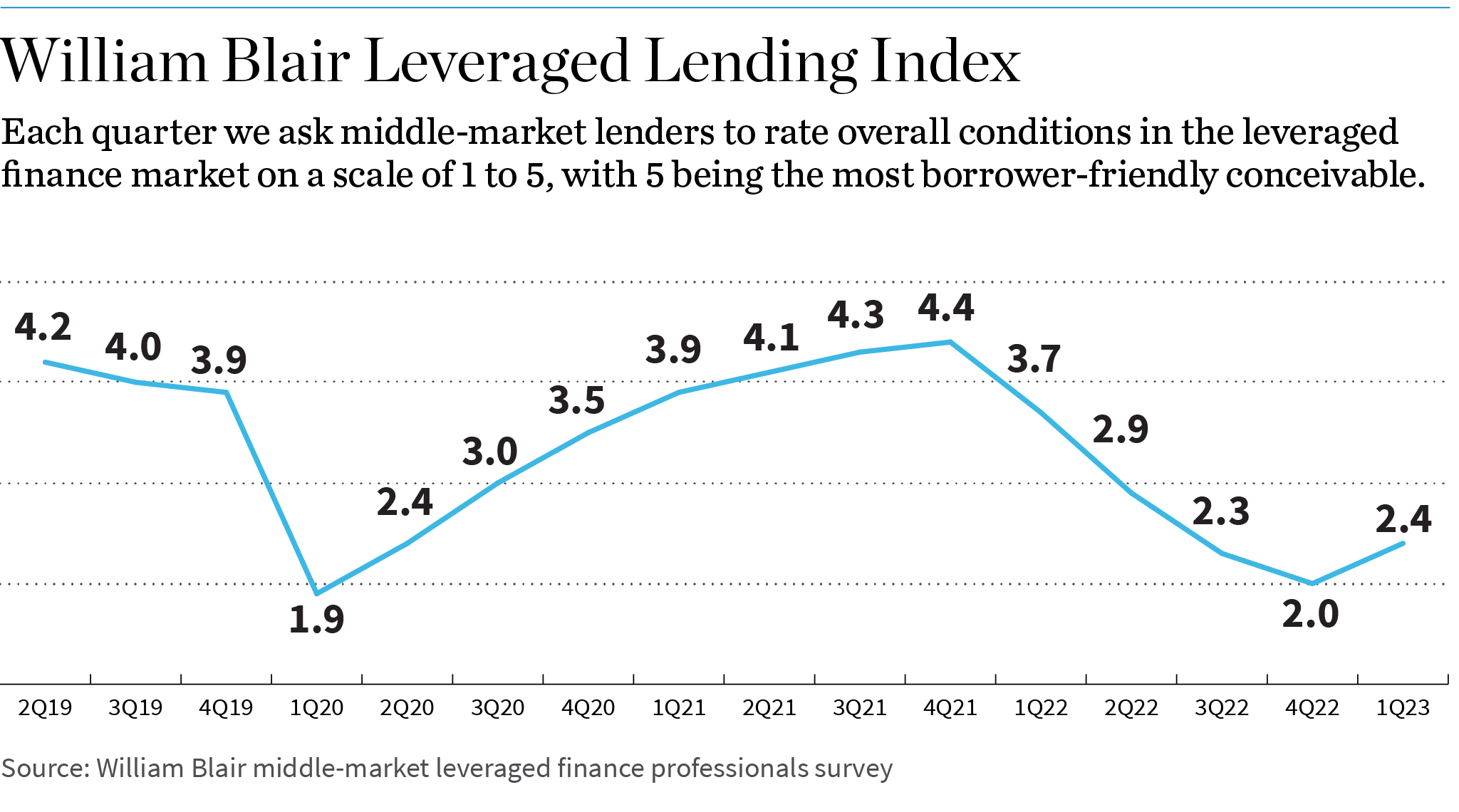

- Results from the William Blair Q1 2023 Lender Survey