Institutional loan volume declined significantly in the third quarter, reaching its lowest quarterly total in over 10 years, as broadly syndicated debt and M&A markets were challenged by rising interest rates and macroeconomic challenges. In addition, maximum leverage levels on new transactions tightened as lenders placed heightened scrutiny on cash flow coverage metrics.

Highlights of this quarter’s William Blair Leveraged Finance Report include:

- Analysis of Q3 U.S. institutional loan volume

- Impact of rising interest rates and widening pricing spreads on leveragability

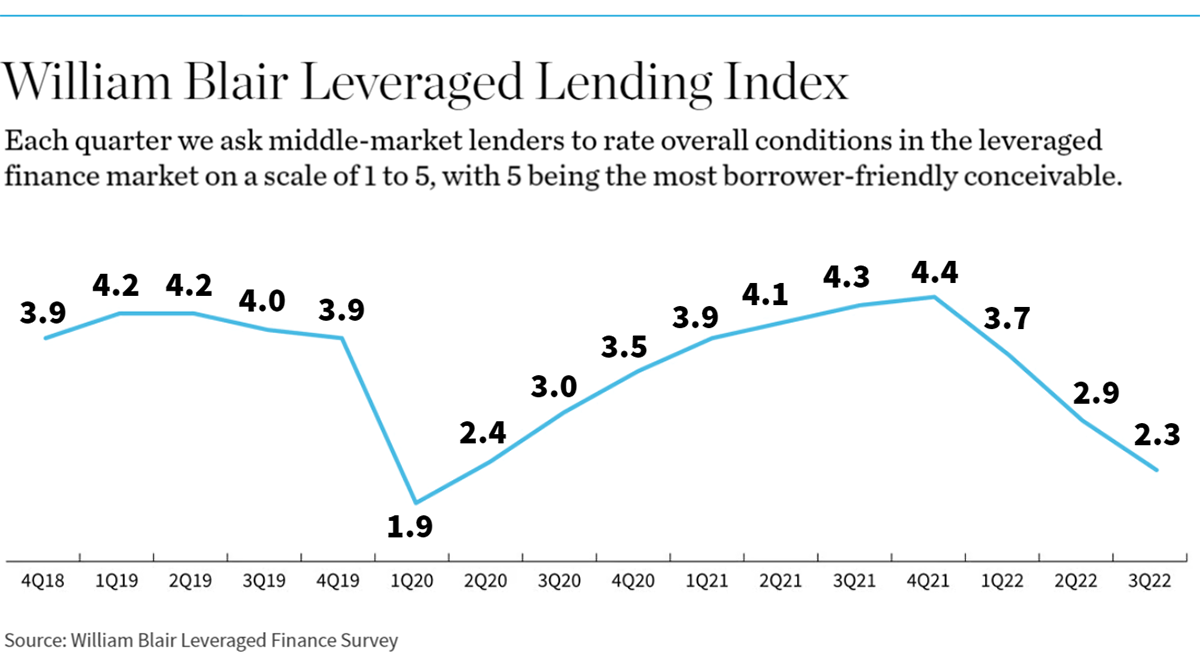

- Results from the William Blair Q3 2022 Lender Survey