Certainly the recent market volatility is unsettling but a disciplined investment strategy that considers your time horizon, risk tolerance, return objectives, and liquidity needs is essential in times like these.

That’s why it’s important to keep an open and ongoing dialogue with your William Blair wealth advisor, who can help you manage through ever-changing conditions.

“You can’t control markets, market volatility, or what’s going to happen tomorrow,” said Tyler Glover, director of William Blair Consulting Services. “What you can control is your game plan—re-evaluating what you’ve put in place, your goals, and what makes sense in terms of a long-term investment strategy.”

Steps You Can Take

It begins with having a mutual understanding with your advisor, sharing your questions and concerns about the current environment, Glover said. Tax-efficient strategies, portfolio rebalancing, and other ways to optimize your portfolio can be a part of the dialogue as well.

“If something has changed or will change in your life, that should be discussed,” Glover added. “That said, it’s also important to not overreact and veer off of a course that’s appropriate for you.”

What makes 2022 more challenging than previous cycles is that stocks and bonds are seeing significant volatility and downward pressure simultaneously, he said. That’s in contrast to historical relationships in which stocks and bonds typically have not moved so sharply in the same direction—a potential benefit of a diversified portfolio. While rising interest rates have had a substantial influence on bond markets lately, the appropriate balance of stocks and bonds as well as complementary investments such as alternative assets remains a key asset allocation decision for long-term investors.

Additionally, some sectors have seen more compression than others, particularly technology and growth-oriented businesses, even though their core business model may be the same as it was 8-10 months ago. While U.S. stock markets are down overall, the energy sector is up year-to-date.

Driving Market Volatility

As the global economy faces soaring inflation fueled by the Russia-Ukraine war and rising commodity prices, supply-chain disruptions that began with the pandemic, continuing public health concerns, and more, the Federal Reserve and other central banks are doing whatever they can to fight it. That includes raising interest rates.

Equities have reacted to this uncertainty with turbulent swings and prices reflecting bear market conditions—defined by at least a 20% drop from recent highs.

Fed interest rate hikes are meant to cool inflation by slowing economic growth. Recent market volatility has been attributed to not only slowing growth forecasts, but also the worry that the Federal Reserve will not act quickly enough, resulting in stubborn inflation accompanied by lower growth (stagflation). Or, that it will overshoot its intended target, resulting in a recession.

While market volatility is concerning, historically it is not unusual. There have been 26 bear markets in the S&P 500 Index since 1928. The last bear market occurred in 2020 as COVID took hold and led to global shutdowns. It was also the shortest on record. However, there also have been 27 bull markets and stocks have risen over the long term.

“We’ve been through all kinds of challenging periods—most recently COVID and before that the global financial crisis that began in 2008,” Glover said. “For the long-term investor, it’s about understanding history, the cycles, and the ability to work through dynamic environments. Having a financial plan that fits your personal situation is critical.

“William Blair has a long history of navigating challenging markets and remains focused on meeting clients’ needs and goals.”

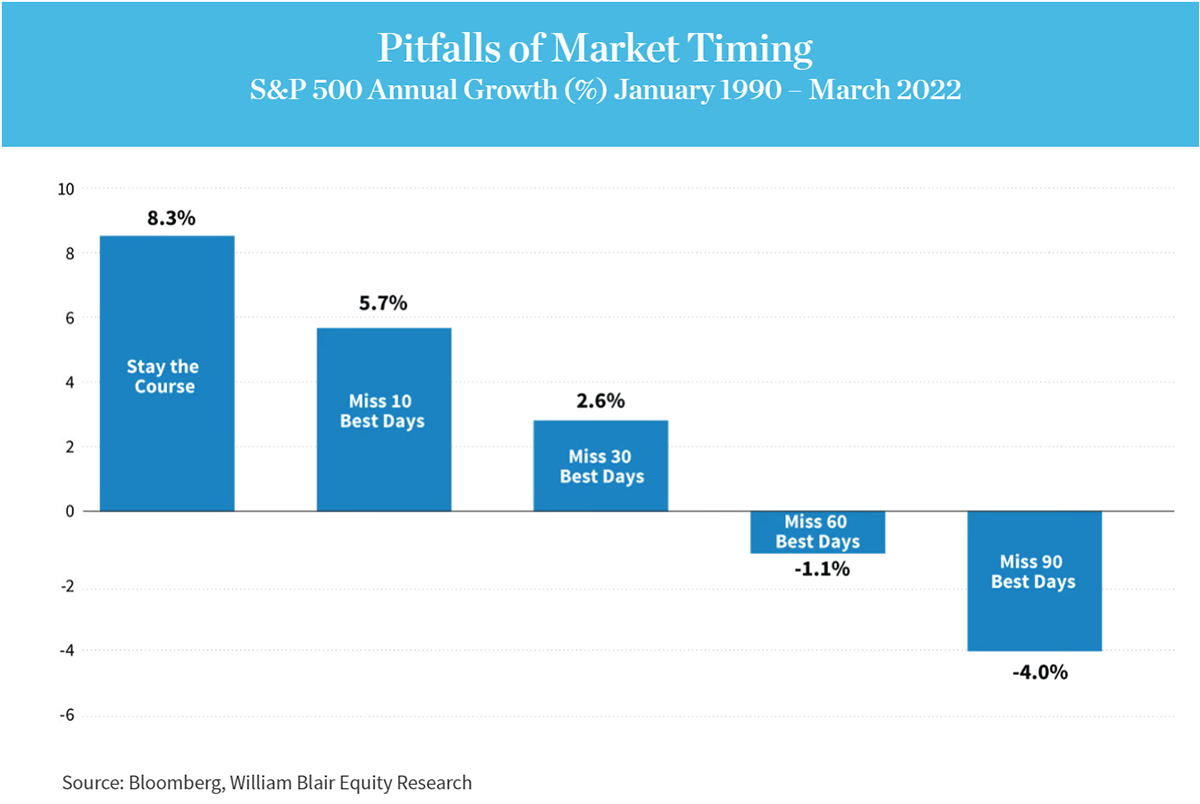

The chart shows annualized S&P 500 returns for an invested equity portfolio under five scenarios: investor stays course and misses the 10, 30, 60, 90 best performing days from 1990 to 2022. Using historical performance as a gauge, the chart illustrates the difficulty in predicting short-term market dynamics and the pitfalls of attempting to time the markets. One could argue that missing the worst performing days would have also had a meaningful impact. But the likelihood of successfully timing short-term market entry and exit over a long period of time is low and may come with tax and other implications.

For more information, contact your William Blair advisor or email PWM.

This information has been prepared for informational purposes and is not intended to provide, nor should it be relied on for, accounting, legal, tax, or investment advice. Please consult with your tax and/or legal advisor regarding your individual circumstances. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. The factual statements herein have been taken from sources we believe to be reliable, but such statements are made without any representation as to accuracy or completeness or otherwise. Opinions expressed are our own unless otherwise stated and are subject to change without notice.