The COVID-19 pandemic has changed our lives in ways many of us did not expect. For Ken McAtamney, a William Blair partner and portfolio manager who leads investment management's global equity research group, it was the speed of many of the shifts that was surprising—not necessarily the shifts themselves.

That's because McAtamney and his team see the crisis accelerating a number of structural trends that were already underway pre-pandemic. He and his team are analyzing these changes to better understand the investment opportunities and risks in a post-COVID world.

We like to talk about not just investing in the technology sector but in all sectors and industries that use technology to differentiate their business model…

Digital adoption

The most sweeping cultural change amid the pandemic, according to McAtamney: the forced acceleration to a digital society. What had been a gradual 20-year shift to online life changed overnight amid the realization that digital was no longer a choice. It was and is the key to our survival.

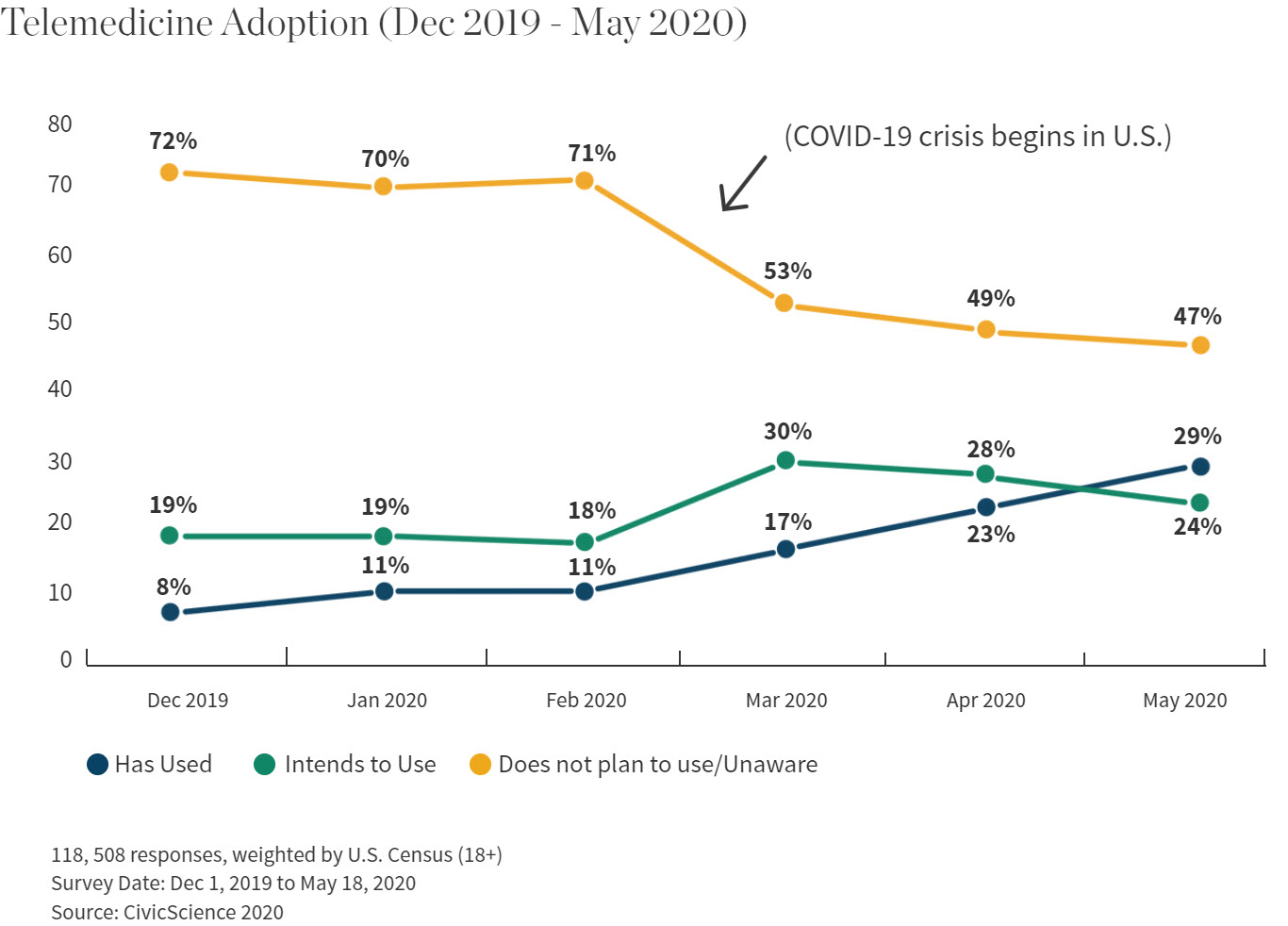

Nowhere is this forced acceleration more evident than in the healthcare system itself. Before COVID-19, technologies such as live videoconferencing and remote monitoring of patients by healthcare providers had not been widely accepted. But interest in and implementation of telemedicine grew rapidly during the crisis as policymakers, insurers, and health systems found ways to deliver care to patients in their homes to limit the spread of the virus and reduce the strain on hospitals.

Another area where digital adoption is playing out: e-commerce. For years, consumers have steadily shifted to online shopping as retailers embraced e-commerce to personally connect with customers. Technology also improved security around payment and delivery times. Even so, in-store shopping remained popular for many until COVID-19 changed everything.

More people are now shopping online, whether due to fears of contagion or closed stores. McAtamney and his team expect to see a permanent increase in adoption of e-commerce, as more consumers become comfortable shopping online and some traditional brick-and-mortar retailers go out of business.

"Online shopping went into overdrive," says McAtamney. "With that, we saw a number of retailers, which had large brick-and-mortar operations, file for bankruptcy this spring."

E-learning has seen a similar boost. As elementary schools to universities were shuttered, educators once resistant to using e-learning tools no longer had a choice. Additionally, they embraced digital meeting tools like Teams, Zoom, and Google+ to stay connected with their students. So did thousands of companies that sent their employees home to work. McAtamney and his team expect that e-learning, the corporate shift to the cloud and more remote work are likely here to stay in some form or another.

"What we're going to see is that most practices have to change in terms of how we interact with each other," McAtamney says.

Changing food preferences

The pandemic has also accelerated changes to the global food chain, which spans from farm to plate. The food chain has been undergoing change for years, as customer preferences for health and convenience spurred the spread of organically grown foods; online grocery shopping and deliveries; at-home meal-preparation kits; sustainable-sourced foods; and plant-based proteins.

During the COVID-19 crisis, these preferences have become more widespread, according to McAtamney. Consumers have sought more online shopping apps, curbside pickups, and at-home deliveries. COVID also exposed weak links in the mass food production system, when meat processing plants across the U.S. were forced to close as workers became sick. That fed the consumer movement for plant-based meat alternatives occurring long before the pandemic. Plant-based food makers like Impossible Foods, Beyond Meat, and Tofurky have ramped up to fill the gaps, McAtamney says.

Sustainable growth in China

The transformation of China's economy from infrastructure and manufacturing toward value-added services and consumer business models was clear before the pandemic, as China evolved into a global competitor of scale. The COVID-19 crisis has helped accelerate this shift in China away from investment- and export-led growth toward consumption-led growth.

The Chinese government's stimulus in reaction to the pandemic shock, for instance, has been mostly targeted at boosting domestic consumption. This follows the government's focus in recent years on stimulus efforts, such as tax cuts, aimed at putting money in consumers' pockets to drive domestic consumption.

McAtamney and his team see this structural shift persisting, leading to ongoing improvement in the quality and sustainability of Chinese economic growth, with the benefits particularly to be seen in sectors such as healthcare and information technology.

Slowing globalization

Globalization was already slowing heading into the COVID-19 crisis. This trend too has been accelerated by the pandemic, McAtamney says. Before COVID, for instance, some companies were already starting to rethink their supply chains and manufacturing sources as the U.S.-China trade war intensified, shifting their supply chains to rely on multiple countries or to bring production back home.

McAtamney sees this supply-chain shift accelerating in healthcare especially, as the current pandemic has made it clear that relying on a single country puts a supply chain at risk. He and his team expect to see more investments in the U.S. healthcare system to make it better prepared for another big crisis or pandemic shock like this one.

"The obvious ones are investments in vaccines and antivirals—which is already happening—but we are going to need more," he says. That includes being better equipped to accommodate mass cases that strain healthcare workers, intensive care units, hospital beds, and other support systems.

The slowing of globalization brings risks along with opportunities, however. McAtamney calls globalization arguably the largest single force fueling global economic growth for the last 40 years. But that trend was being challenged even prior to the pandemic, driven in part by a growing perception that globalization was a driving force between increasing income inequality. The current crisis is likely to further drive this wedge, potentially slowing globalization even further.

"The implications of that are not good: lower global growth, the potential for higher prices and higher inflation," says McAtamney. "Additionally, a lack of geopolitical leadership or alignment raises the volatility of global markets."

The investing implications

What's certain is that in the near term, the economic growth outlook is uncertain. Testing for the virus and contact tracing for potential exposure are seen as critical to restoring consumer confidence and resuming some level of recovery. But longer term, the structural changes set in motion by the pandemic will continue. And McAtamney says the changes all have a common theme: technology will lead.

"We like to talk about not just investing in the technology sector but in all sectors and industries that use technology to differentiate their business model and form stronger relationships with customers," he says.