Encouraging Signs, But No Full Recovery in Secondaries Yet

Has the drawdown in secondary market deal activity—which began in early 2022, after Russia’s invasion of Ukraine and when the Federal Reserve began raising interest rates—finally come to an end?

That’s the big question for investors now that we’re more than halfway through 2023, even as activity is really starting to spike. The good news is that pricing and deals are pointing in the right direction, and secondaries fundraising in the year’s early months replenished the demand side. With new capital comes new deployment pressure. A flurry of new deal launches over the past three weeks – nearly 25 LP-led transactions and nearly as many on the GP-led side – further evidence a buoyant mood among sellers. Fueling the seller confidence in finally unleashing their backlogged portfolio-churning initiatives is growing word-of-mouth that each LP-led deal that’s passed through the market in recent months has increasingly yielded price outcomes above expectations. Buyers, for their part, are driven by a high conviction that much of the negative news is behind us, GP valuations are more in line with their views, and diversified LP portfolios are a highly attractive opportunity right now, even as discounts continue to shrink.

Buyers are already starting to complain about their bids getting blown out of the water as the start-of-year mantra “80 is the new par” gives way to prices landing just shy of actual par for top-shelf holdings. But even if buyers have to stretch harder to take part in the slew of new deal flow, the more varied supply offers them the opportunity to pick their spots more strategically, focusing on deals for which they have the highest overlapping coverage and deepest conviction, in which they can be confident of hitting return targets even at higher prices.

Nevertheless, we’re still seeing something of a bifurcated market, one where pricing for high-quality, blue-chip assets is trending favorably. More volatile strategies, however, will continue to draw more limited interest. Signs of life in the M&A and IPO markets could bode well for venture pricing, but office- and retail-focused real estate funds have a long way to go before the market has comfort around valuations.

Another area of struggle is energy, which faces inherent volatility, a transition to renewable energy and regulatory pressures. Many energy assets are capital-intensive and carry heavy debt burdens—making them less attractive to investors seeking stability. That said, energy is a better market than it was two years ago, buoyed in part by ESG sellers looking to complete deals and non-traditional buyers recognizing opportunities with limited competition in a space that will likely recover.

This is prologue for where we find ourselves in summer 2023, and for what we’ll cover in the rest of this report. We’ll outline the status of GP-led secondaries, how creative structuring has become incredibly important and whether we can expect a return to normalcy in the fourth quarter.

Hopes for Q4

The Case for and Against a Fourth Quarter Bounce Back

There’s one question everyone in secondaries has seemingly been asking for the past year: When will the market improve enough to return a regular flow of activity?

That doesn’t necessarily mean the massive surge of 2021’s V-shaped COVID-19 rebound. It means steady dealmaking and a departure from the opportunistic moves on distressed assets that we’ve seen since early 2022.

There are strong indications that regular flow is already back, with a growing influx of LP deal launches and a recapitalized buyer set scrambling to keep up with price momentum. But there’s a good counter-argument for why a full recovery could take longer, with current activity resulting in cherry-picked deals much smaller than what’s hitting the market. Here’s a case for both perspectives.

The Case for a Rebound by Year’s End

Even in down years, secondaries usually sees a slight uptick in the fourth quarter as sellers are forced to move assets off their books for accounting purposes or last-minute allocation decisions. We saw that in 2022, even after a virtual standstill in the second and third quarters.

Against that baseline is the fact that a lot of money has been raised and needs to be deployed. In the first quarter of 2023, dedicated secondaries vehicles focused on private equity accounted for almost 20% of the $163.9 billion raised for private equity. At the same time, the amount of capital raised by secondaries funds jumped almost 1,000% year-on-year compared with the $2.8 billion raised in the first quarter of 2022.1

Meanwhile, pricing is moving to where sellers are becoming more comfortable making deals—and other levers are emerging to deploy creative structures and alternative solutions (as we noted elsewhere in this newsletter). Deals beget deals, so if activity begins picking up, a groundswell could follow. Even as buyers lament shrinking discounts, the growing supply will offer a wider variety of deals for buyers to pick their spots, focusing on portfolios where they have the most overlap—and highest conviction of hitting their return even at higher prices.

Also, the array of “mega-deals” with more than $2 billion NAV that have been absorbed at strong pricing over the past year has signaled that the market has plenty of room to absorb transactions of scale—leading to a steady flow of larger portfolios that will continue to drive volume higher.

The Case Against a Rebound in Q4

The simple truth of the matter is that “Wait until next quarter” has been said a lot over the past 12-18 months.

If buyers and sellers remain on different pages about valuations and exit prospects for underlying portfolio companies, we might see a repeat of the fourth quarter of 2022—i.e., an increase in activity but one that’s effectively driven by year-end pressures. That’s especially likely if the current crop of sizable deal launches gets whittled down to cream-of-the-crop subportfolios that actually trade.

Finally, the good signs that we’re seeing as far as pricing might be fleeting, driven by buyers willing to pull the trigger now for fear of missing out on a market that still offers some degree of discount. News this week that Moody’s downgraded 10 regional banks and that the sector is subject to ongoing scrutiny may re-trigger sentiments that macro risk is not entirely behind us.

But if sellers’ recent actions – launching 20+ deals in the last two weeks of July – are any indication, buyers and their dry powder won’t likely stay on the sidelines for long for fear of missing out.

1 Source: Secondaries Investor, “Secondaries skyrockets to second-most popular strategy in Q1,” May 4, 2023.

Creative Secondaries Structures

Creative Solutions Until the ‘In-Between’ Moment Ends

While the wide bid-ask spread of 2022 continued into the first half of 2023, buyers are replenishing reserves and sellers are growing more motivated. But even as we pass what has been a prolonged “in-between moment,” the prolonged challenges of finding liquidity solutions under rocky conditions have raised the profile of an array of alternative liquidity structures that are here to stay.

Indeed, these solutions will provide a heightened range of optionality for the foreseeable future. Here’s a sampling of some of those solutions being deployed:

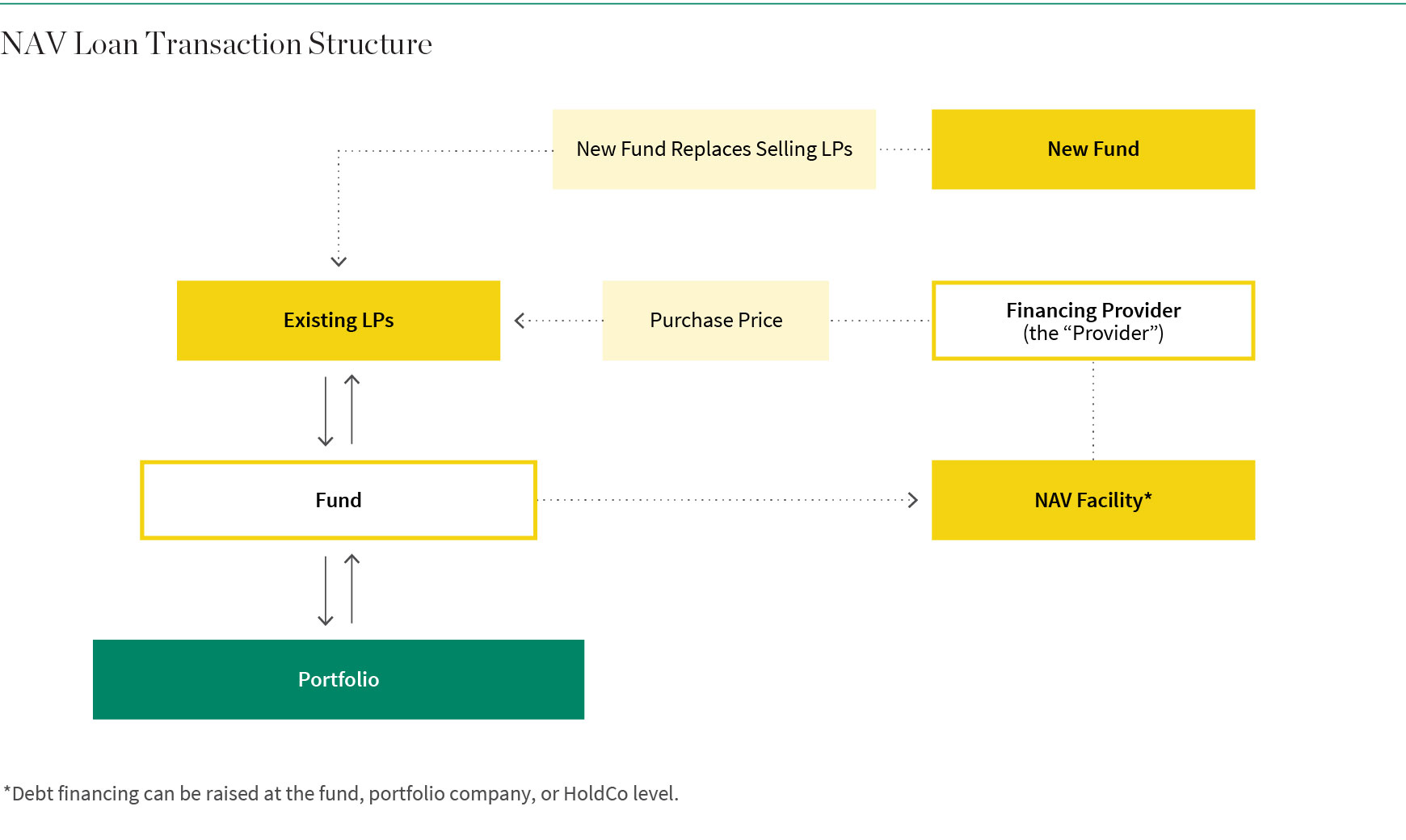

NAV Loan: A new senior security that borrows money against the net asset value (NAV) of the investment portfolio, a NAV loan represents the cheapest cost to generate liquidity. The cost of the facility is borne by the remaining LPs and considered when the new position is sold to the new fund.

Benefits:Generating liquidity without sacrificing potential upside, favorable pricing for longer-term facilities, flexible structuring with broader potential investor base.

Considerations: Uncertainty around timing and amount of distribution and capital calls, can require over-collateralization if portfolio value shifts, regulatory risk of reclassifying as an equity

Benefits: Capital flexibility, no fund or portfolio company governance changes, non-dilutive financing

Considerations: New covenants and governance to fund structure and possible duration mismatches

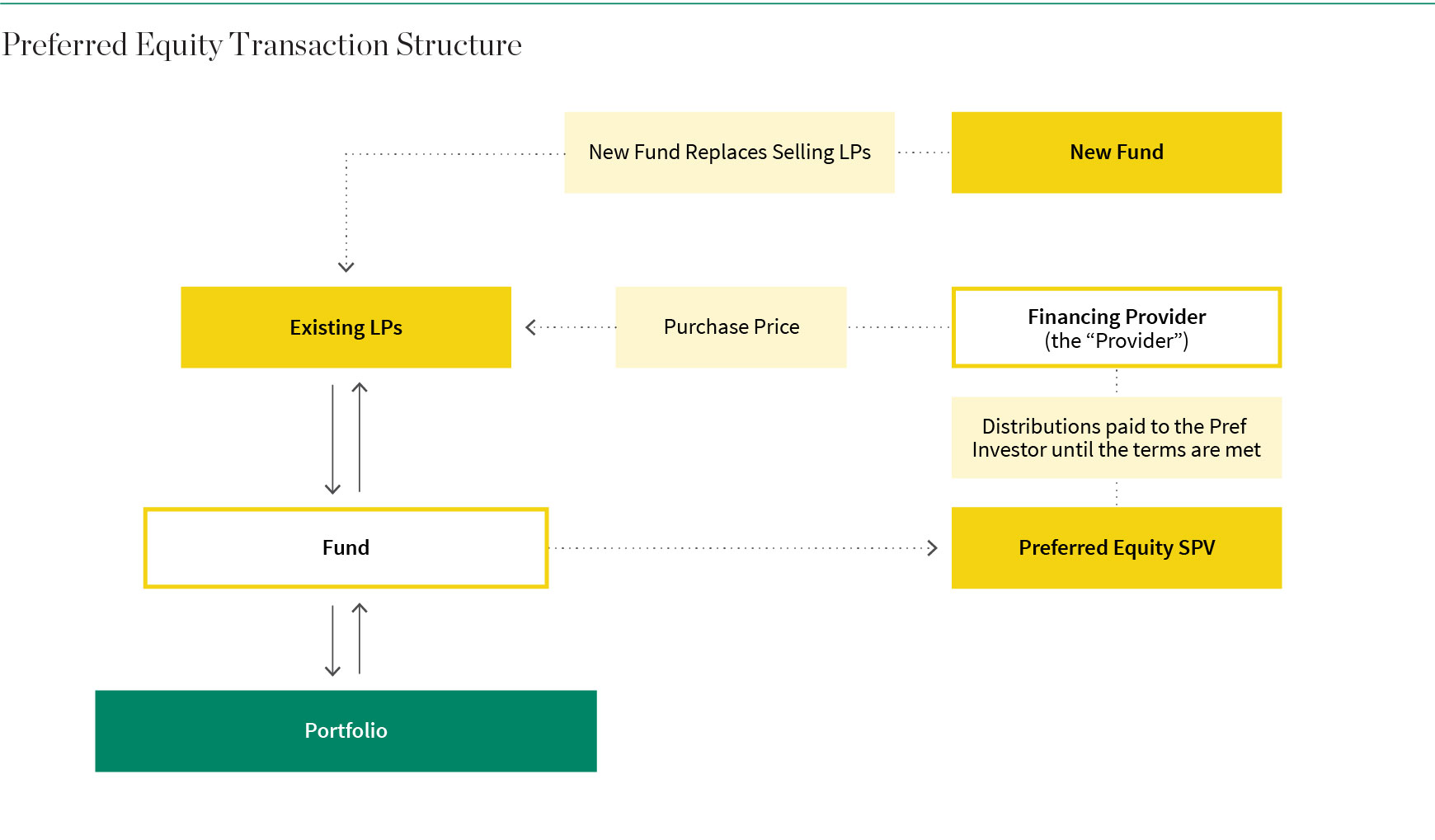

Preferred Equity Investment: Structured as an affiliate transfer, a portfolio is moved to a new special purpose vehicle with no consent required from the underlying investments. Approximately half of the selling fund’s NAV is realized and used to buy out the selling LPs with portfolio cash flows paid to the preferred equity investor until the minimum return has been achieved.

Benefits: Accelerates distributions, improves investment performance with minimal administrative burden, creates potential for further upside for LPs

Considerations: Complex structure, retention of residual downside risk with the prospect of no further distributions, upside sharing

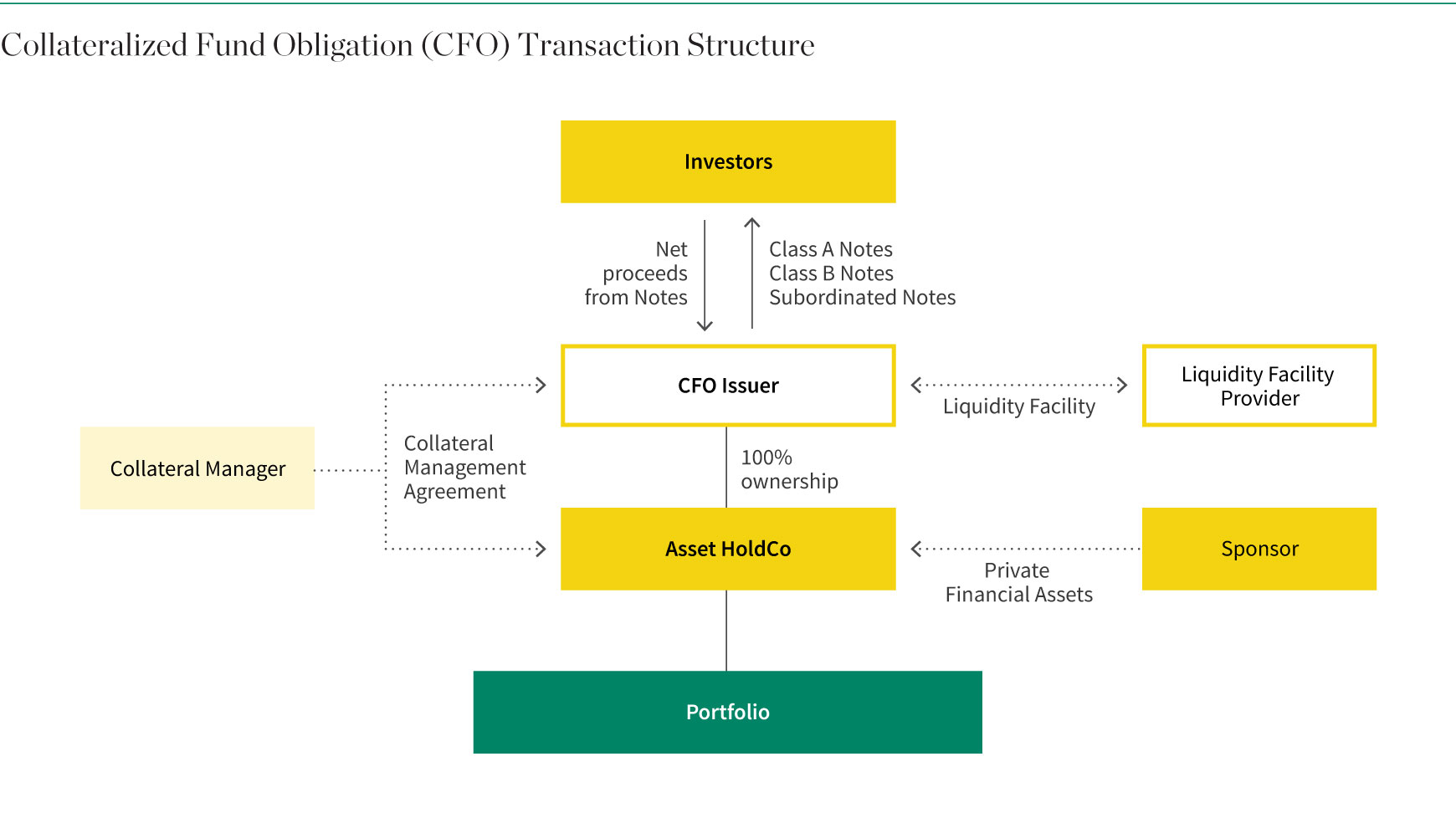

Collateralized Fund Obligation: A CLO-like structure securitizing private partnerships instead of loans. Tranches of securities are issued, and each tranche offers seniority or priority over others with “tighter” collateral quality tests.

Despite the positive signs of the past few months, it’s unclear when the current in-between phase will end. Until it does, examining creative solutions is critical.

GP-Led Update

What to Expect from GP-Led Secondaries

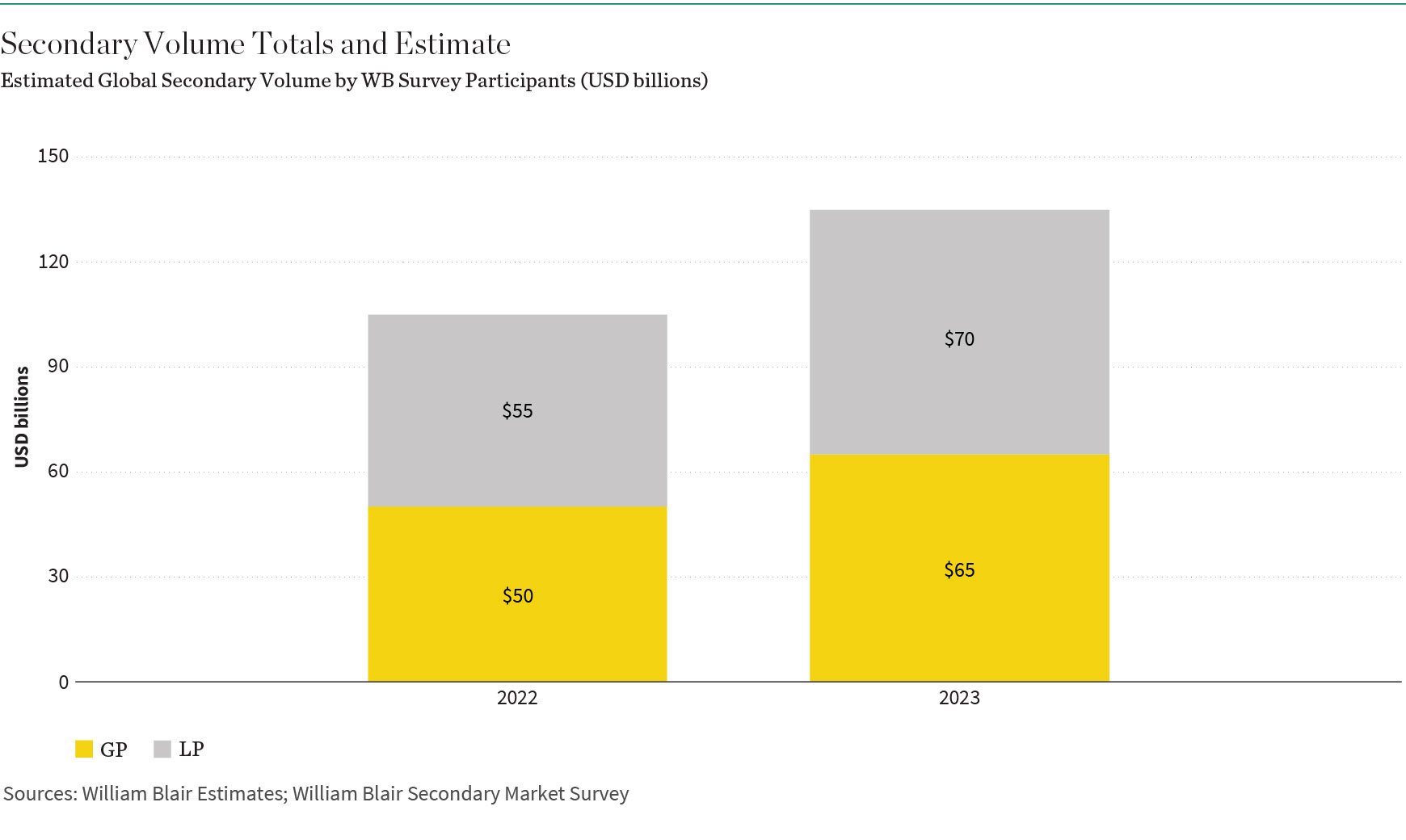

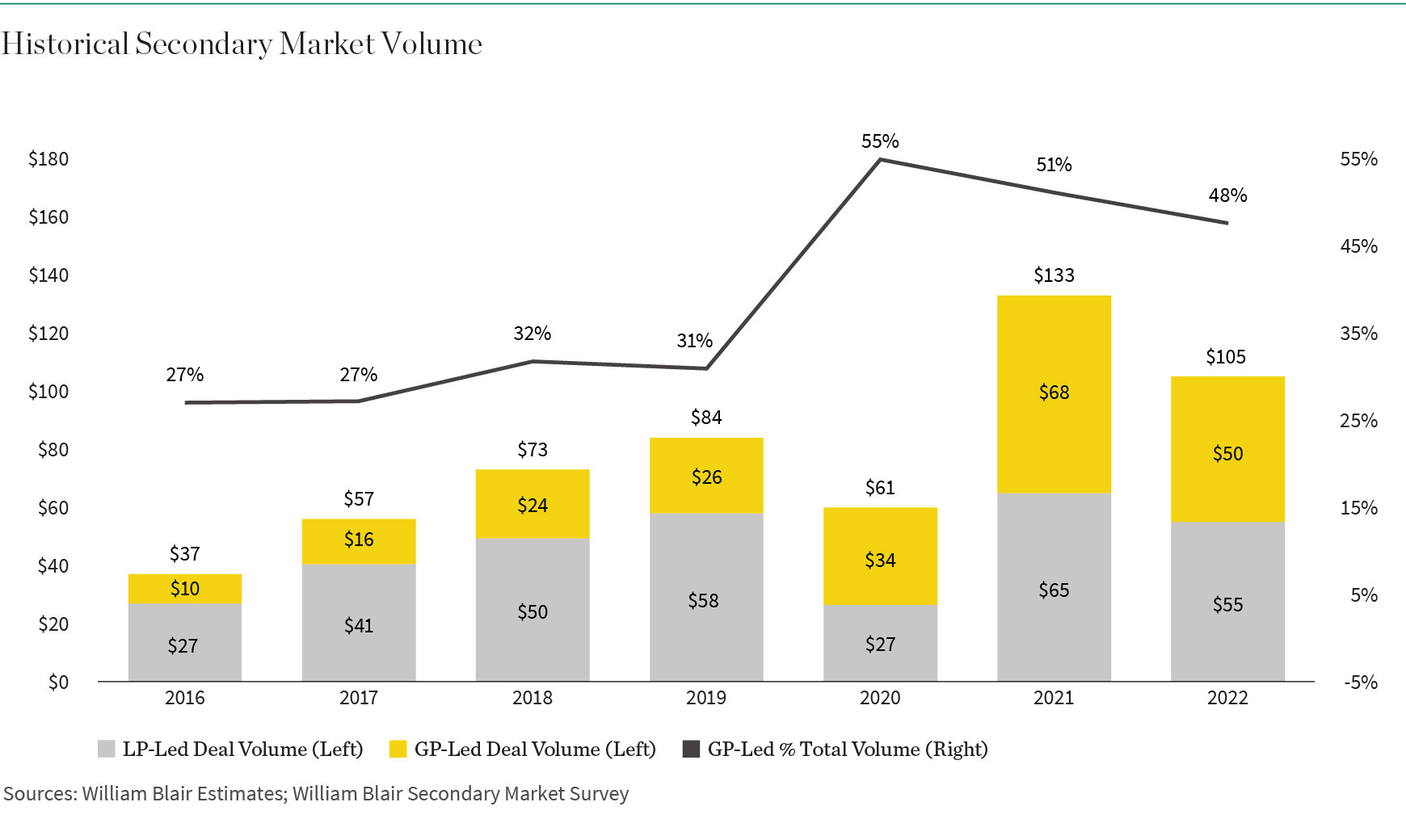

In 2020 and 2021, GP-led secondary transactions came into their own, with record volumes accounting for more than half of total secondary transactions by volume.

Both GP-led and LP transaction activity, of course, fell over the past 18 months. Now, secondary buyers are primed to take on more risk and deploy available capital—and given the apparent staying power of single-asset continuation funds that largely drove the GP-led pandemic surge—the category appears well positioned for what’s ahead.

Strong fundraising activity for GP-led secondaries, and a rise in pricing for LP-led secondaries, have created recent tailwinds for the GP-led market. Further, the challenging environment for control sales and IPOs has sponsors increasingly turning to creative capital solutions for funds and companies. As we wait for growth to resume, here are two creative solutions specific to the GP-led category that are worth watching:

Tail End Fund Wind-Ups: Secondary LPs price the remaining assets from a seasoned fund, providing existing LPs a full liquidity option at a market-driven price, with the option to roll over. The GP receives additional time, and sometimes capital, to increase the portfolio’s value. These transactions allow the GP to double-down, cash out inactive partners, and re-align the carry pool.

Annex Funds: A way to address portfolio company capital requirements for growth and liquidity, the GP raises a special purpose vehicle (from new or existing LPs) to provide new capital to support one or more existing portfolio company. This approach can avoid valuation bid-ask spreads as the annex fund investment is typically structured as a convertible preferred security with downside protection.

The past few years have shown that GP-led secondaries have staying power, particularly for strongly performing assets owned by quality managers. We’ll know for sure if GP-led activity sees significant growth—even if not immediately at 2021 levels—when the overall market and valuations stabilize in the months ahead.