In July 2017, in response to the so-called LIBOR scandal of 2012, the UK’s Financial Conduct Authority (FCA) announced that financial market participants should not expect the London Interbank Offered Rate (LIBOR) to be available after 2021. While many market participants welcomed the FCA’s announcement, it nevertheless created a degree of uncertainty around which lending rate(s) would fill LIBOR’s void. Stepping into the fray, the U.S. Federal Reserve and other financial institutions recommended that the Secured Overnight Financing Rate (SOFR) replace LIBOR and began publishing SOFR rates in April 2018. Although the administrator of LIBOR confirmed its intention to cease publication of most LIBOR tenors after December 31, 2021, questions remained about the execution and how the market would respond.

William Blair’s Leveraged Finance group shares insight on the transition from LIBOR to SOFR, how the rates compare to each other, and where the leveraged finance market stands today.

We provide insight on:

- Key differences of LIBOR vs. SOFR

- Credit agreements and LIBOR phase-out

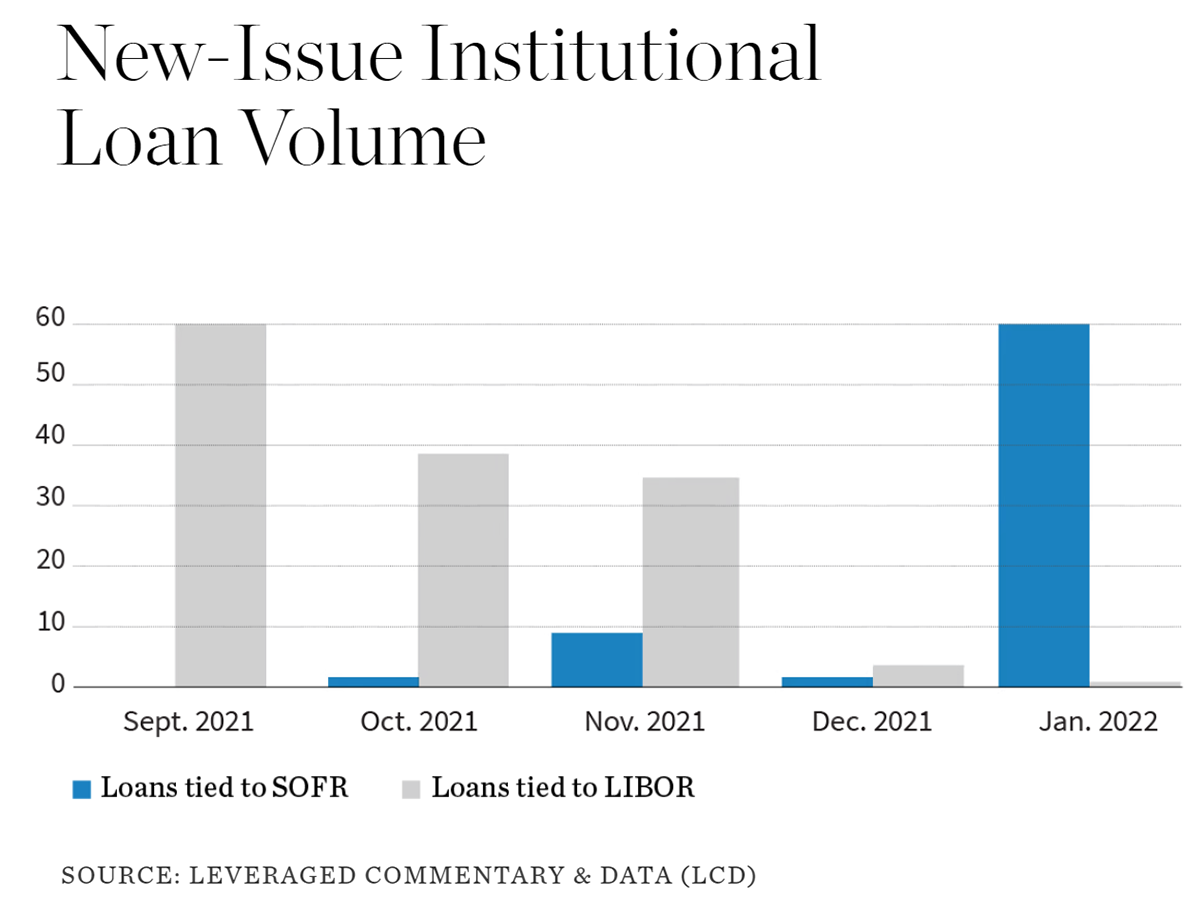

- Comparison of new-issue institutional loan volume by benchmark used