Insurance services is broadly defined as the vast ecosystem of companies providing services to insurance carriers or business services related to insurance. These non-risk-bearing companies often interact directly with insurance carriers' clients, highlighting the importance of insurance services within the value chain. Insurance services includes distribution and brokerage companies, such as BenefitMall, Goosehead Insurance, Pronto Insurance, Risk Transfer Group, and U.S. Retirement & Benefits Partners (USRBP); specialized claims consultants and outsourcing providers, such as J.S. Held, McLarens, and Worley Claims Services; and insurance technology companies ("InsurTech"), such as Businessolver, Corestream, Eagle View Technologies, GoHealth, and Hodges-Mace.

William Blair has been a prominent advisor and thought leader in insurance services throughout the surge in M&A activity. We have completed notable transactions across the insurance services continuum, led by the May 2019 sale of the specialized, global insurance claims consulting firm J.S. Held to Kelso Private Equity; we also held advisory roles for every company mentioned above. Earlier this year, we held the Second Annual William Blair Insurance Technology conference and Third Annual Benefit Technology Conference.

Drawing on this experience, we examine the trends that are shaping the dealmaking landscape in insurance services and identify how companies can position themselves for strong valuations in what has become a seller-friendly environment.

P&C Carriers Focus on Expense Savings

Property and casualty (P&C) carriers have continued to find ways to reduce costs by outsourcing work to specialized third-party insurance service companies. The types of outsourced work vary from handling core loss adjusting and processing, billing, and other administrative tasks, to more specialized services such as complex claims management and adjusting. In many cases, the third-party insurance service companies interact directly with the policyholders, making them an integral part of the customer relationship. We have seen carriers frequently using specialized outsourcing firms to control costs and drive efficiencies.

To drive efficiencies and gain more control over the customer experience, P&C carriers are consolidating their vendor panels and creating more stringent requirements, or "guidelines," for third-party partners. Consolidating their vendor panels protects P&C carriers' brands and creates a more consistent experience for policyholders. Working with fewer providers also allows carriers to gain further pricing power and operate more efficiently. Therefore, vendors with national or strong regional coverage have meaningful competitive advantages over smaller players.

This shift has driven increased volume to primary vendors that maintain long-standing relationships with the claims staff of different major P&C carriers. When evaluating potential partners, carriers want providers with a broad array of service expertise (one-stop shopping), specialized service offerings, unique technology, strong customer service, and extensive geographic coverage. Other factors that carriers prioritize include the partner's reputation in the industry and the partner's ability to track metrics that align with how the carrier evaluates its brand and customer service.

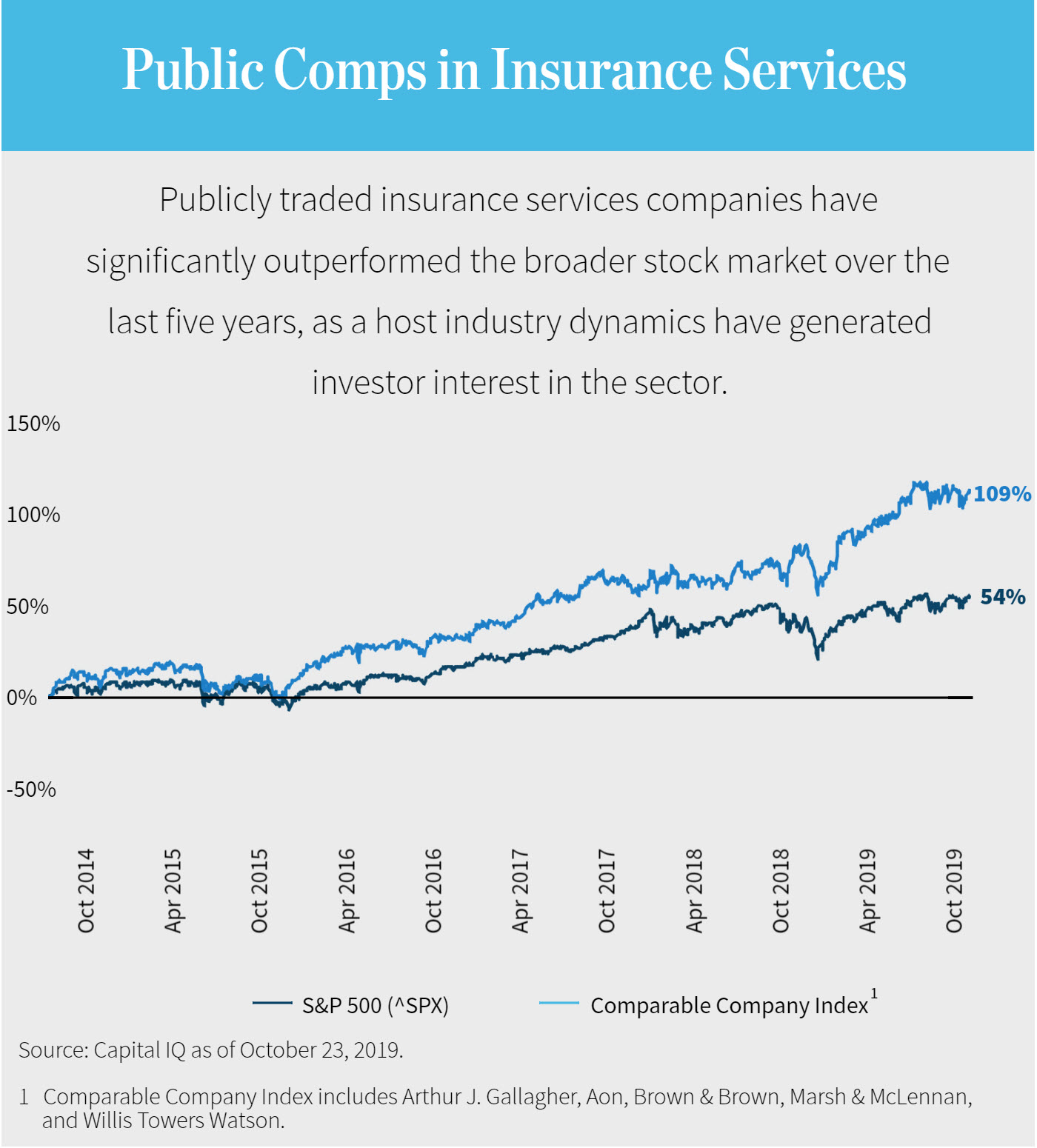

Cyclical Concerns Drive Interest in Defensive Insurance Assets

Insurance is generally a nondiscretionary spend for commercial and personal matters. Also, insurance claim volumes broadly are not tied to economic events, so insurance services companies have a low correlation to broader economic activity. Therefore, these companies are generally seen as an attractive asset to own near the end of an economic expansion. Their fee-based business models provide consistent earnings with less beta risk, and the industry boasts high client retention rates and cash generation.

As a result, financial sponsors—most of which are modeling for an economic downturn during their upcoming hold periods—have become increasingly aggressive in their pursuit of insurance services companies over the past number of years. Specifically, financial sponsors have focused on platform acquisitions to initiate or accelerate a consolidation strategy. Meanwhile, strategic buyers have been aggressively acquiring smaller businesses to augment services and build scale. In many cases, strategic buyers' attempts to acquire targets have been stymied by financial sponsors that are able to make preemptive bids and transact in highly accelerated deal processes.

The Rise of InsurTech

The insurance industry is often viewed as the final frontier within the broader financial services universe to adopt technology. Much of the industry still uses antiquated, inefficient paper-based systems that require significant human involvement, which can negatively impact the customer experience and increase costs. But, similar to how the lines between technology and banking or payments have blurred, the insurance industry is rapidly embracing technology. This backdrop is creating substantial opportunities for new businesses to introduce greater innovation and efficiency to the industry, driving robust valuations for insurance service providers that have successfully incorporated technology-enabled solutions that have broad applications.

The InsurTech movement is being driven by legacy companies that are creatively evolving to operate more efficiently, as well as by disruptive start-ups introducing new products aimed at unseating incumbents. The core legacy systems that still dominate the industry can be enhanced by incorporating improved technology stacks and deploying data analytics. Technology can also streamline distribution to more efficiently acquire end-customers and make the overall consumer experience with insurance more user-friendly.

Leading technology executives who participated in William Blair's Second Annual Insurance Technology Conference highlighted that the proliferation of emerging models is accelerating and legacy insurers/brokers are ratcheting up technology integration efforts. The dealmaking environment reflects these efforts as 2018 was a record year for global InsurTech transactions, with more than $4.1 billion of deals announced, up 87% from 2017, according to William Blair equity research analyst Adam Klauber. We continue to see interest in companies with new technology-enabled business models, such as Root, a mobile-first underwriter for auto insurance; Lemonade, a mobile-first underwriter for homeowners and renters insurance; and Shapsheet, a virtual claims technology provider for personal and commercial auto carriers. Additionally, carriers—including Aflac, Allianz, MassMutual, and State Farm—have started internal InsurTech venture funds to incubate ideas internally and better position themselves.

Klauber estimates that $60 billion of value has already been transferred from legacy insurance models to new technology-enabled businesses. Several factors point to this trend accelerating, including a surge in new technology-led company formations, the creation of dedicated pools of capital for technology investing, and consistent M&A dynamics that point to technology commanding premium value. Much of the activity is occurring in industry segments where new InsurTech companies are focused on customer acquisition and distribution efficiency, sometimes via exciting digital API integrations.

Strong Economy Creates Prime Conditions for M&A Activity

Multiple factors are contributing to this being an especially attractive time for owners of insurance services companies to consider selling their business and capitalize on the high valuations currently being paid by financial sponsors and strategic buyers:

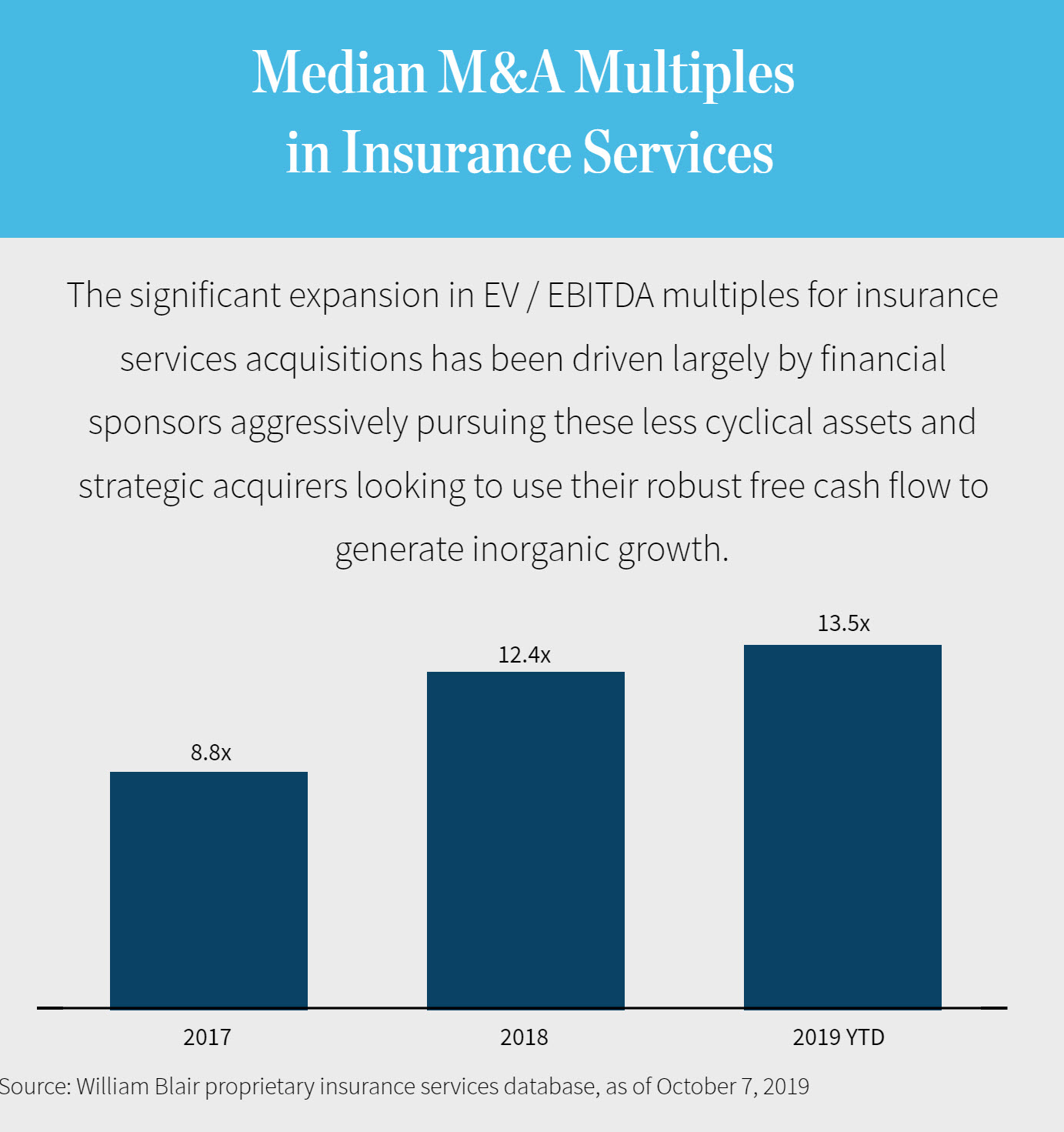

- Attractive valuations: M&A valuations for insurance services platform investments have historically been in the 10.0–12.0x EBITDA range. More recently, buyers are paying premiums for quality platform assets, which are becoming increasingly scarce; highly focused providers that play key roles in the risk distribution spectrum, specifically specialized MGAs and wholesale distributors; and businesses that have a proven acquisition track record in a sector with significant identified opportunities. InsurTech companies often trade on a multiple of revenue.

- Private equity industry making deals and raising capital at a historic pace: Easy access to financing and dry powder reserves have driven private equity dealmaking to historic highs, particularly within insurance services. Private equity firms have the ability to move quickly in M&A processes and often are willing to pay robust valuations as they look to deploy capital. Since 2017, William Blair's proprietary M&A tracking shows consistent increases in year-to-date insurance services deal counts.

- Brokers looking to acquire: Given the strong economic conditions, public insurance brokers are closing in on 10% top-line growth for the first time in recent memory, and they are using this increased free cash flow to go on the offensive, often via acquisitions. We have observed many instances in which brokers are exploring—and aggressively pursuing—larger acquisitions and services that may have been noncore two years ago.

- Buyers targeting family-owned businesses: A large percentage of insurance service companies, specifically agencies and brokerages, are owned by baby boomers nearing retirement age. Compared with previous eras, owners today are less likely to keep their business in the family and are more open to selling. As a result, strategic buyers and portfolio companies of financial sponsors have stepped up their pursuit of these assets.

Maximizing Value in Today's Environment

In this environment, there are several strategies that owners of insurance services companies considering a sale can adopt to strengthen the position of their companies:

- Diversification: Though not black and white, diversification typically drives value when analyzing a company's customer base, carrier partners, geographic footprint, and product/service mix. Still, specialization can be beneficial for businesses looking to dominate specific product/service lines. Owners must evaluate whether their company should focus on becoming a premier player in a specific niche or if pure diversification is more beneficial. In the ideal scenario, companies can leverage specialization to become dominant across a diverse set of products and services.

- Deepen relationships with customers and carriers: Insurance services companies with diverse, long-standing relationships with customers and carriers are typically viewed as having a competitive advantage. Companies should identify ways to strengthen these relationships and deepen wallet share by expanding their service offerings or leveraging highly specialized services to increase penetration.

- Operationalize a formal growth strategy: In an active, fast-moving dealmaking environment, speed and precision can be what separate great M&A process outcomes from average ones. Companies that have a formal, nuanced growth strategy and financial data that supports their ability to accomplish various initiatives show well to private equity investors, who underwrite growth, and strategic buyers. This is particularly true when the goal of an acquisition is to broaden a service offering or improve the acquirer's technology stack.

- Document long-term financial performance and develop KPIs: Given timing considerations related to the current economic expansion—especially in terms of weather-driven business models—buyers will want to see how a company's financial profile held up in the last recession and what percentage of volume is tied to weather-driven events.

- Institutionalize financial and operational reporting to highlight technology: Every services business wants to position itself as a technology-enabled provider. But to effectively do so during an M&A diligence process, business owners must prepare the metrics that validate those stories. From a technology perspective, buyers will want to see evidence that technology has had an impact on the company's top line and operational efficiency.

- Drive and improve business through technology: A host of technology-led trends will reshape the value-creation opportunities for insurance services companies over the next decade. Barriers to entry for new companies will erode and new sources of capital will emerge. Businesses that are able to use technology in creative ways and adapt to upcoming industry changes will quickly differentiate themselves from those that do not.

To learn more about these and other trends that are shaping investment and dealmaking activity in the insurance services industry, please do not hesitate to contact us.