Get ready, the debate on raising the U.S. debt ceiling is set to ramp up over the coming weeks.

And as the nation faces differences over raising the limit that Congress imposes on the Treasury’s total borrowing, it could be a bumpy journey ahead for financial markets.

Debt ceiling battles are not new. Congress has raised the limit more than 78 times since 1959. But what was once a routine vote has become more politically charged in recent decades, raising the possibility—while very unlikely—of the government defaulting on its debt obligations. Raising the debt ceiling is about paying for previous choices lawmakers approved; it is not about new spending.

“Politicians will typically have to have their feet held to the fire before they actually sign off on anything,” says William Blair macro economist Richard de Chazal. “They also need to be seen to not be caving in without a fight, so unfortunately there will be a whole pantomime before they do agree on something.

“But what typically might hold their feet to the fire is volatility in financial markets. That volatility will increase the closer we get to midnight on the X-date.”

Because the federal government runs a fiscal deficit, the U.S. Treasury borrows money from the public, both domestic and foreign investors, by issuing Treasury securities in a wide range of maturities. The debt ceiling restricts its ability to do so. On January 19, the debt ceiling was reached.

Since then, the Treasury has engaged in “extraordinary measures” to use its existing funds to pay interest and principal on its outstanding Treasury securities. The point at which extraordinary measures run out is referred to as the X-date, marking that point in time for a potential default.

What to Watch

Jeannette Lowe, a director of Washington policy research with consultancy Strategas, says the timeline of the debt ceiling could be as early as June, up from earlier projections of late July, reflecting tax revenues coming in below a year ago, increased government spending, and higher interest rates.

Both the Congressional Budget Office and the Treasury will release in mid-May their latest projections of when the Treasury will no longer be able to fully pay its obligations. Treasury Secretary Janet Yellen said on May 1 the U.S. government could become unable to pay its bills as soon as June 1 if Congress does not raise the debt limit.

Strategas’s view is the debt ceiling will be lifted, likely going down to the wire: 75% odds we will not solve this until the two weeks before the X-date—whenever that is—and 65% odds that it will not get done until one week before the X-date, says Lowe.

“But this is more of a debate about how do we raise the debt ceiling,” Lowe adds. “How many spending cuts do we put in? How much austerity? What other changes are we putting forth? That’s where the debate really comes in and that’s what’s important for investors.”

The House passed a debt ceiling bill on April 26 to raise the ceiling for about a year in exchange for $1.5 trillion in spending cuts, including many of the landmark renewable energy tax breaks in President Biden’s Inflation Reduction Act. The bill is now with the Senate with expectations that the Democrats will reach a deal on a less austere package. That will trigger more debates and eventually a bill lawmakers agree on that President Biden signs.

The Markets

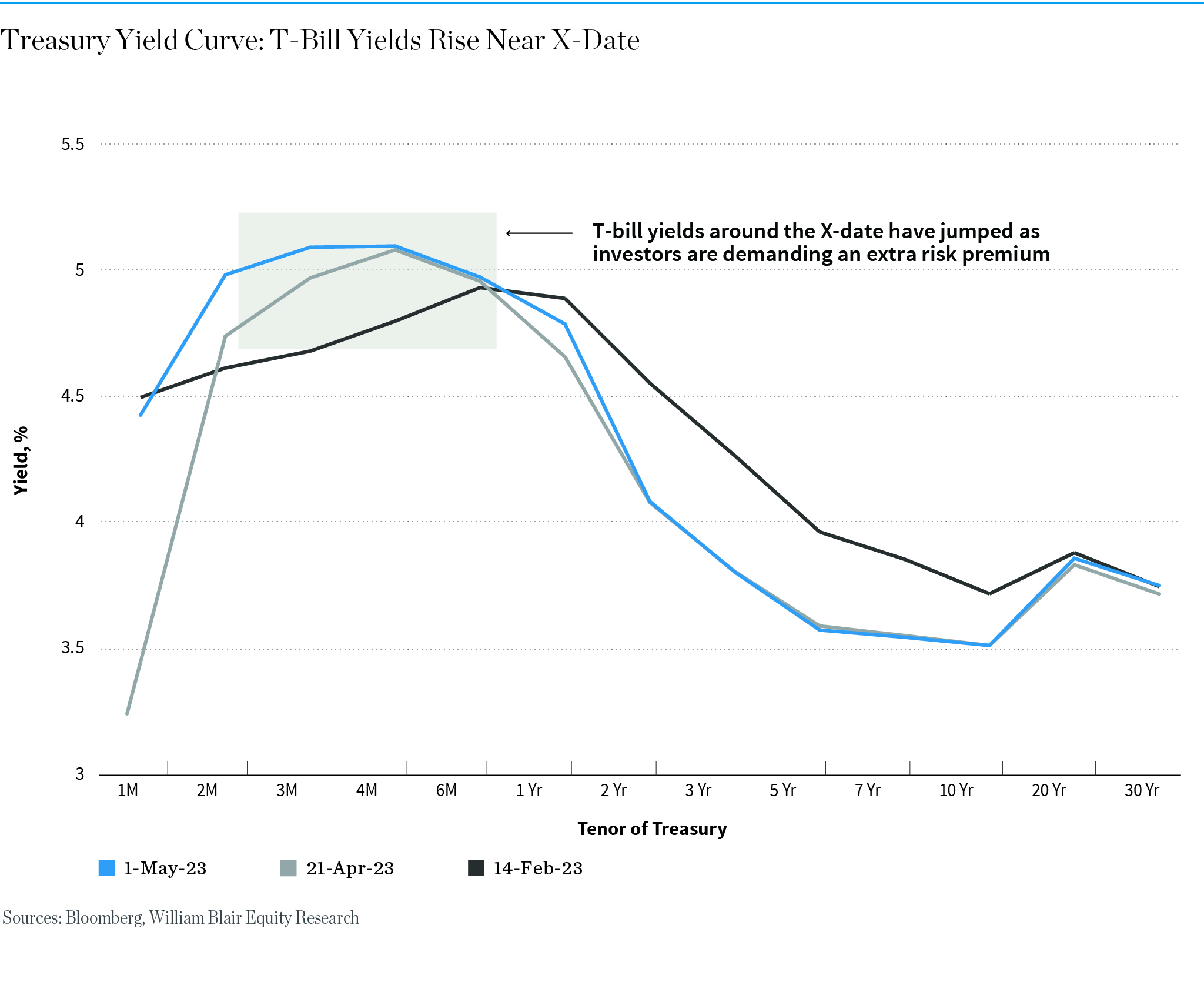

More attention to the approaching X-date came shortly after the April 18 tax day. Yields on Treasury bills—typically seen as among the safest investments—suddenly jumped for those maturing four months out, near the expected X-date in mid-August.

The peak of the yield curve, both in February and in April, has been August. Then, when you get out into the year, the yields are coming down.

“It’s like watching a wave come up on the beach,” said William Blair’s Clancy Burson, a fixed-income trader. “It is exactly what we have seen in the past and what we would expect to see in these situations—the yields on those investments rising as the certainty of repayment on a timely basis becomes more questionable.”

“The wave accelerated to the early June T-bills following Secretary Yellen’s May 1 comment that the Treasury could run out of money in early June,” Burson adds.

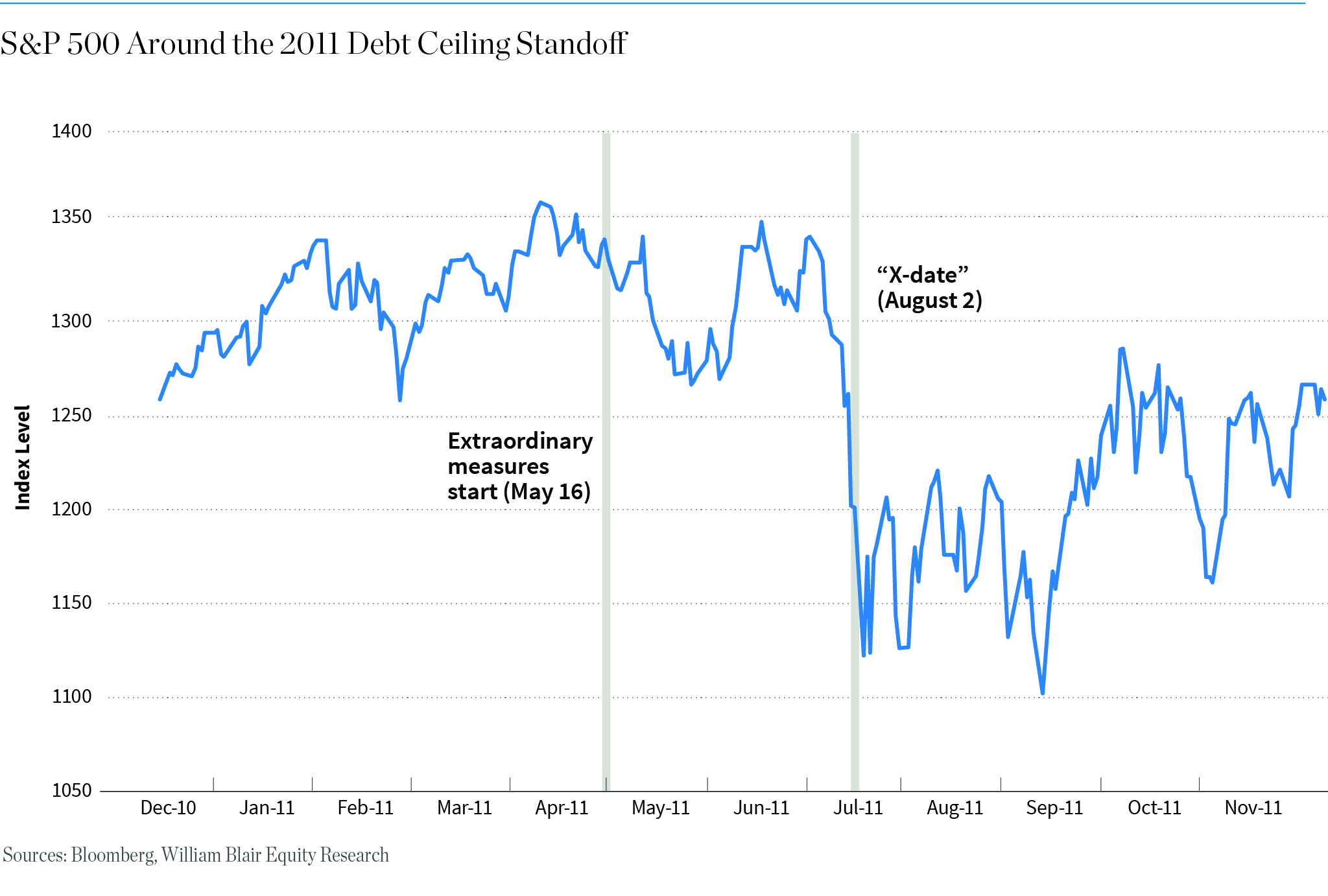

The closest the country came to default was in the summer of 2011. The Republican-controlled House, a Democrat-led Senate, and a Democrat president reached a deal in early August, just days before the country would have defaulted. During those weeks of negotiating, the S&P 500 saw double-digit declines but the biggest drops came in September.

“If you look at 2011, even though we got a deal to raise the debt ceiling, we had $2 trillion of spending cuts attached to it and the Fed was done with quantitative easing, so all of a sudden you went from having fiscal and monetary stimulus to having austerity really quickly and the market needed to reprice for that,” Lowe says.

De Chazal notes that the debt ceiling is already impacting the economy. For instance, there might be companies dependent on government contracts, and those contracts are not being signed by the Treasury because of the debt limit. While the companies know the contracts will eventually be signed, near-term profits don’t get booked and it adds to uncertainty.

“There is also uncertainty over exactly what concessions will have to be made by the Democrats in order to get the GOP on board,” Chazal says. “If they are overly onerous or force the Democrats to retreat on issues that the market was already counting on, the growth impact will have to be taken into account and revised down accordingly.”

About William Blair

At this point, no one knows exactly what politicians will agree upon in raising the debt ceiling and how long it will take, which could add to market uncertainty. William Blair, with 88 years of navigating challenging market conditions, has a long history of evaluating and analyzing the likely effects of events on investments. William Blair is closely monitoring the situation, while staying focused on clients’ needs and goals.

For more information, contact your William Blair advisor or email the firm’s private wealth management team.

Return and/or yield performance shown reflects past performance and does not offer any guarantee of future results. This information has been prepared for informational purposes and is not intended to provide, nor should it be relied on for, accounting, legal, tax, or investment advice. Please consult with your tax and/or legal advisor regarding your individual circumstances. Investment advice and recommendations can be provided only after careful consideration of an investor’s objectives, guidelines, and restrictions. The factual statements herein have been taken from sources we believe to be reliable, but such statements are made without any representation as to accuracy or completeness or otherwise. Opinions expressed are our own unless otherwise stated and are subject to change without notice.