Clean Energy Trust CEO Erik Birkerts remains as committed and passionate about bringing new tech solutions to market today as he was more than 25 years ago when he became involved in the clean energy space.

Early in his career, Birkerts was on senior management teams for two IPOs of venture-capital-backed companies, including Orion Energy Systems where he served as chief operating officer. Orion, a manufacturer of energy-efficient lighting systems and renewable technologies, grew quickly and went public in 2007.

“From that role I decided I wanted to do something different—instead of making a single company successful to try and focus on making a sector successful,” says Birkerts, a long-time private wealth client of William Blair.

Around the same time, Birkerts says he was fortunate to be introduced to the Clean Energy Trust, the brainchild of civic leaders and venture entrepreneurs Nick Pritzker and Michael Polsky. Frustrated that the Midwest, with its world-class universities, national laboratories, and Fortune 500 companies, was not attracting the venture financing and start-up creation seen in the San Francisco area or the Northeast corridor, they decided to create an organization to attack the problem.

Today, the Clean Energy Trust has made investments in 36 cleantech and climate-tech companies from Kentucky to Kansas, working on solutions for clean energy, decarbonization, and environmental sustainability—innovations needed to fight climate change and create a zero-carbon future. These companies now employ more than 650 people and the trust has helped them raise more than $31 of follow-on investment for every dollar that it has invested.

Patient Capital From Philanthropic Supporters

Organized as a nonprofit, the Clean Energy Trust operates differently than traditional venture firms. It raises funds through grants, foundations, and philanthropic contributions, investing those dollars in cleantech start-ups working on technologies that take many years to develop. Traditional venture capital firms have shied away from these early-stage cleantech companies, looking for quicker returns.

“We can go in very early and take an enormous amount of risk and be very patient, allowing these technologies to mature. That’s where the nonprofit model makes sense,” Birkerts says, “helping entrepreneurs get their ideas out of the labs, out of the universities, and into the market. And, when we have a successful outcome, we recycle those return proceeds into the next generation of start-ups.”

He describes a phenomenon within VC known as the “valley of death” where promising ideas die on the vine because grant dollars stop and before traditional venture investors feel comfortable stepping in.

“We are bridging that valley of death,” says Birkerts. “We help start-ups get to a point where they are finally de-risked enough for more traditional venture investors.”

Clean Technologies to Fight Climate Change

Birkerts says there has been a huge amount of interest in clean technologies over the past year or so as more businesses realize that cleantech will be a big part of the solution to cut gas emissions and improve the environment. Of course, the broad infrastructure plan proposed by President Biden with its green initiatives is adding fuel to that interest but the trend was already well underway before.

“Take the oil and gas majors, for example. You’re seeing companies like Shell making big investments in EV charging infrastructure because they realize their legacy businesses are eventually going to taper off and they’ll need a presence in electrification.

“From a technology standpoint, what lies ahead are hard challenges,” he adds. “Whether it’s decarbonizing steel or cement or fuels for aircrafts or fuels for shipping—we’re seeing exciting innovations going toward these really hard-to-decarbonize sectors.”

That includes green steel, new ways to produce cement that lowers gas emissions, alternative biofuels coming to market, companies producing renewable fuel from CO2, revolutions in crop farming, novel water purifying systems, and the list goes on.

Clean Energy Trust’s portfolio companies are among the innovators creating the essential technologies these sectors will need, including:

- NanoGraf Corporation has developed an advanced material that makes lithium ion batteries last longer and charge faster—a critical lynchpin for the 21st economy as batteries will enable everything from electric vehicles to allowing more renewable energy be placed on the grid.

- Wright Electric with its “moonshot” idea is building technologies for hybrid electric commercial airplanes with zero emissions. It has partnered with NASA and EasyJet to bring its flagship airplane, a 186-seat airliner with an 800-mile range to service as early as 2025.

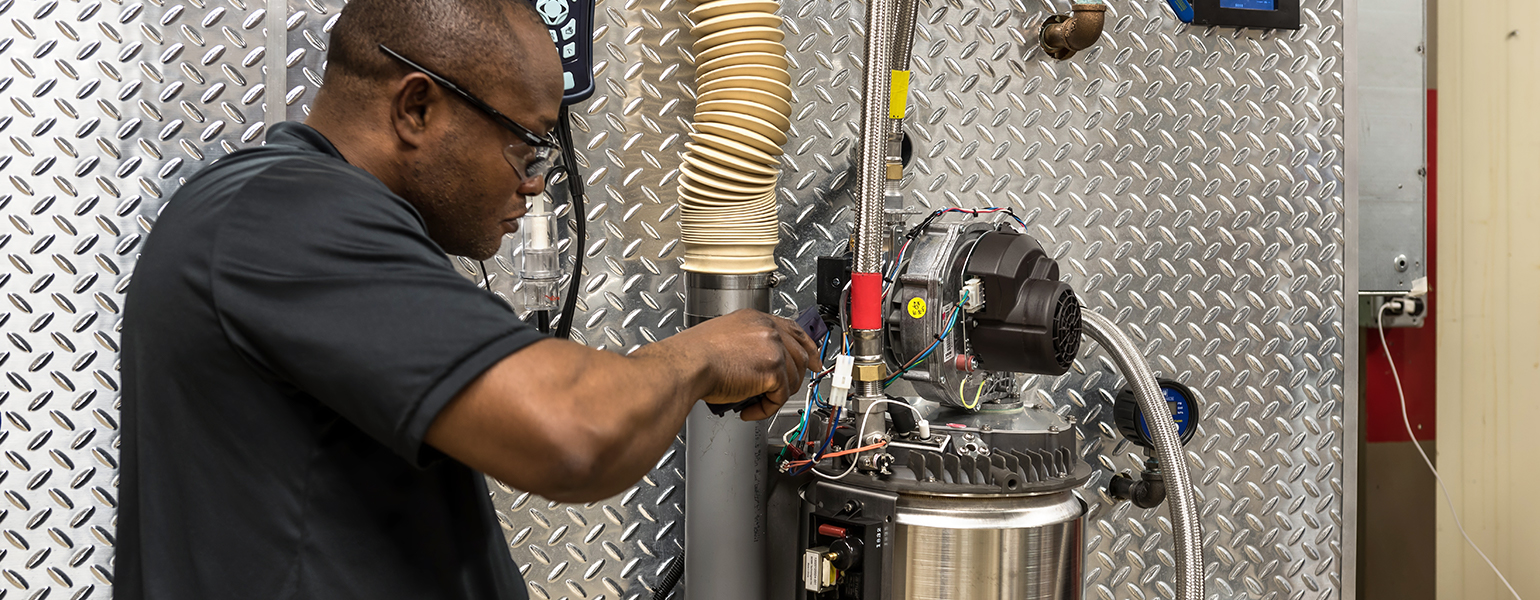

- Intellihot designs and manufactures next-generation tankless water heaters, which provide hot water on demand. The system eliminates the need for huge boilers to store hot water, generating a huge savings for companies in all industries, from hospitality, retail, education, to manufacturing and restaurants. Based in Galesburg, Illinois, Intellihot is creating manufacturing jobs for the local community.

- 75F offers building automation technology for managing heating ventilation/air conditioning that provides up to 50% savings on energy costs. It has been growing rapidly, attracting a lot more capital to scale and penetrate the market. Clean Energy Trust was an early investor, with follow-on investors including Bill Gates and Steve Case of AOL.

Impact Investing

Grant funders and donors are increasingly making investment decisions not only on the financial viability of a company but on its impact potential.

Birkerts says 75F is a great example. Bill Gates invested in 75F through one of his venture funds that will only invest in technologies with the potential, at scale, to reduce greenhouse gases by at least half a gigaton every year, about 1% of global emissions.

Investors are also increasingly focused on questions around diversity, equity, and inclusion.

“They want to see that their investments are going to support capable, high-potential entrepreneurs irrespective of gender, skin color, ethnicities,” says Birkerts, noting that 60% of companies they’ve invested in have female or people of color as founders.

Among family office investors, Birkerts is seeing a transition where younger family members want to not only preserve wealth but also make investments that align with the family’s philosophies and beliefs. Many of those are climate and inclusion initiatives, with an emphasis on climate justice: “that these technologies aren’t just going to accrue for the wealthiest while some of the poorest communities suffer.”

The Future

Since the early days of Clean Energy Trust, it has been exciting to witness the innovation being brought forward to bear on climate and environmental challenges from promising Midwest entrepreneurs and companies, Birkerts says.

“The intellectual horsepower coming into this space out of universities, the people who are making career changes, saying: ‘look, I loved my work at a major investment bank or consultancy firm but now I want to dedicate my career to climate change and working on climate tech or clean tech start-ups’ is exciting and makes me hopeful of what we can achieve.”

Top photo: Marian Singer, CEO and co-founder of Wellntel, a Clean Energy Trust portfolio company, and Erik Birkerts, CEO of the Clean Energy Trust, at the group's 2018 awards event.