On Wednesday the Fed announces its first policy decision of 2023 after a strong rally by stocks in January. But, did the Fed get the market’s memo, or will they pour water on the soft-landing party?

The Federal Reserve (“the Fed” or “FOMC”) is just one of several other central banks meeting this week to raise interest rates, including the European Central Bank and the Bank of England. The Fed, however, has been by far the most aggressive of these, taking rates from effectively 0% to what is expected to be between 4.5% and 4.75% when its policy decision is announced on Wednesday.

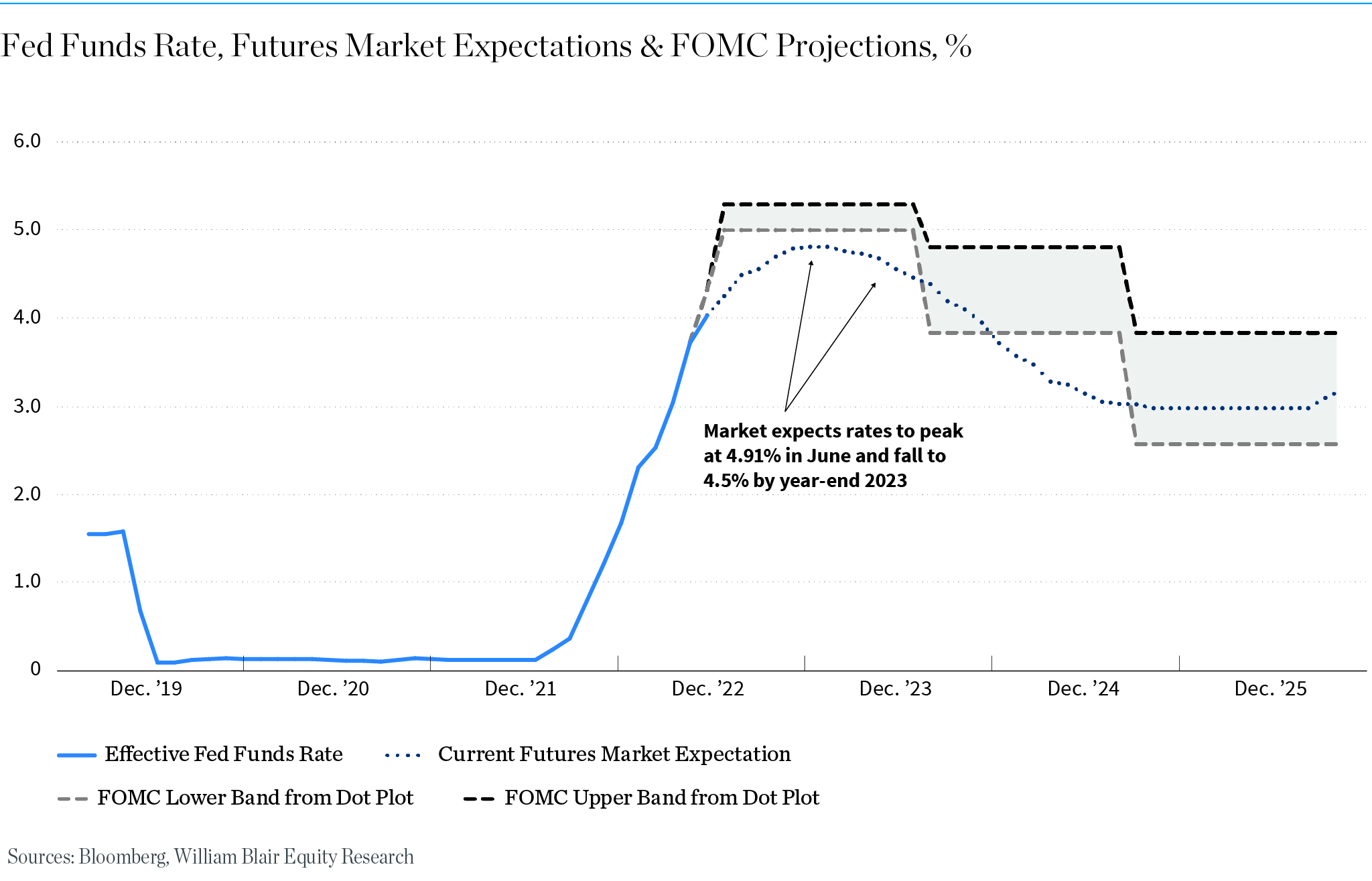

Financial markets have already fully priced in this increase, and indeed are expecting a further rate increase sometime in the second quarter, probably in June, bringing the policy rate to 4.9%, before expecting the Fed to start to cut rates in the second half of 2023 and further in 2024.

Futures market participants now expect the Fed to cut rates by almost 50 basis points by the end of December and close to 200 basis points in 2024.

The problem here is that the Fed didn’t get the market’s memo. In what has been an extremely unified FOMC, all members see the policy rate increasing to between 5.1% and 5.4%, with some intimating that it might even have to be higher.

As far as the Fed sees it, inflation is showing some encouraging signs of rolling over—the CPI peaked at 9.1% in June and was 6.5% at its latest reading in December, while the Fed’s targeted personal consumption expenditure (PCE) price index has fallen from 7.0% to 5.0% in December. However, this is not yet convincing enough to suggest that inflation is on a sustained decline back to the Fed’s mandated 2% target rate.

The Fed is worried that stickier parts of the inflation basket—in particular, the core services less rent services index, which is known to be a favorite gauge of Fed Chair Jerome Powell—are still far too high. This part of the inflation basket is a better gauge of both domestic economic inflation (given that services are often less tradeable) and wages (given that labor costs are the biggest driver of services inflation). Furthermore, with wage growth still close to 5% across most measures of compensation, coupled with very low unemployment and continuing strong jobs gains, this would be inconsistent with a 2% rate of inflation.

The Fed is also deep into risk-management mode. It lost a lot of credibility when inflation proved less transitory than previously supposed, and it can’t afford to lose any more. In our view, it is afraid that should it decide to pause now—but inflation spikes once again on the back of, for example, China reopening, or some other geopolitical event disrupting global supply chains once again—it might result in an even sharper loss in faith in the Fed’s ability to predict and control inflation, inflationary expectations becoming unanchored, and wage-price spirals making inflation that much harder to rein in.

To that effect, it is keen not to see market participants now getting overly excited by a “pivot” and unduly easing financial conditions—the transmission mechanism through which monetary policy impacts the real economy—before it feels the inflation is definitively heading to 2%. It’s in it for the long haul, and the recent inflationary episode is a major test of its credibility, which it feels will have implications for fighting inflation long after today’s inflationary spike has been dealt with.

But the message from financial market participants to the Fed is: we couldn’t care less about your credibility problem, that’s your own issue, and nothing to do with what we’re seeing in the economic data, which is that most measures of inflation, for example three-month annualized rates of change across most inflation gauges, and other inflationary expectations surveys, are already showing a very steep fall in inflation through the end of the year.

Furthermore, market participants know that measures such as rent and services less rent tend to be lagging indicators. Hence, if the Fed is pinning its colors to that mast, it is almost by definition telling us it is planning to overtighten, given the long and variable lags through which rate increases affect the economy.

At this Wednesday’s press conference, we should continue to see Powell acknowledging the softer inflation data but firmly pushing back against the “mission (largely) accomplished” narrative from financial market participants. It wants its credibility restored, which it believes will pay greater dividends in the coming years, even if it might feel there is a relatively small cost of overshooting in the near term.