Overview: Heading into 2020, the U.S. home services industry was in the midst of a multiyear boom driven by structural factors, including generational shifts and increasing homeownership. This expansion was briefly interrupted during the first few months of the COVID-19 pandemic, but demand for most aspects of home services has since surged as Americans have begun investing more in their homes during the pandemic. As a result, the home services industry—which comprises businesses that provide a range of services for residential properties, including maintenance, repairs, and renovations—is generating significant attention from financial sponsors and strategic buyers.

Key takeaways:

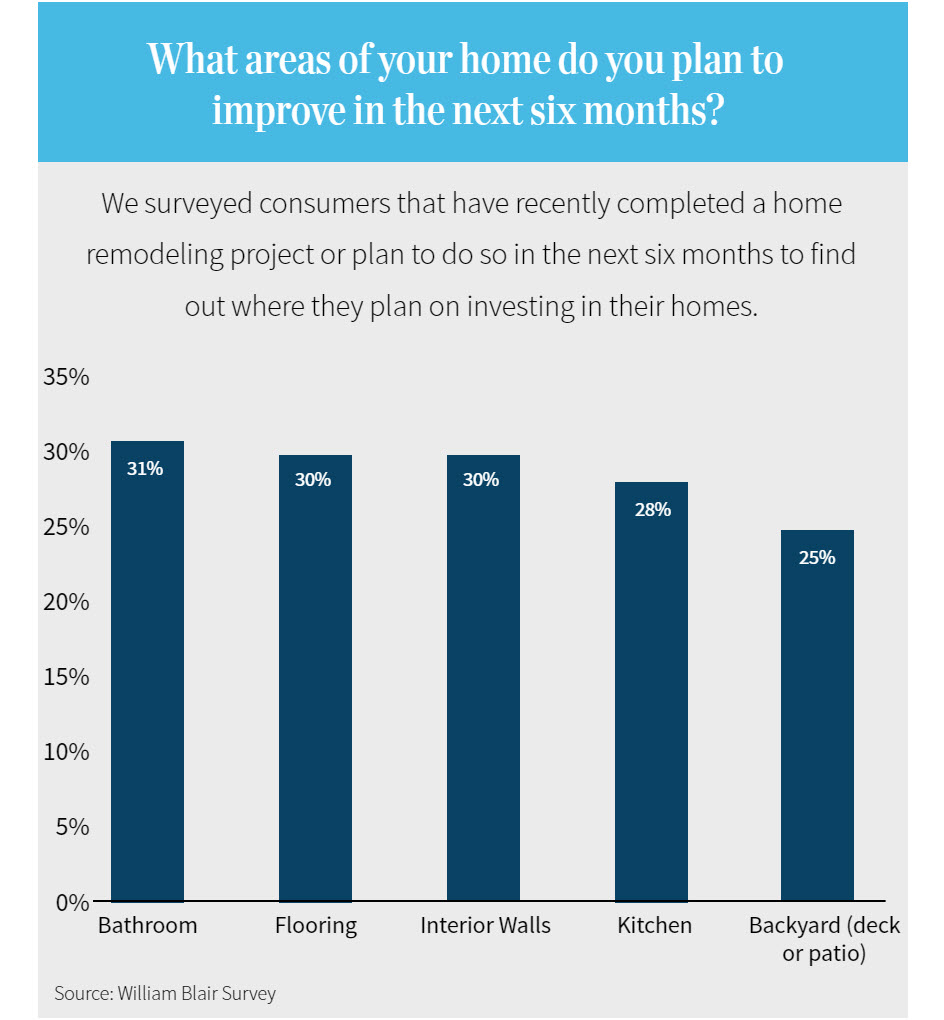

- To help home services business owners and investors better understand the forces shaping the growth of the industry, we examine the main drivers behind the market’s strength and share takeaways from a recent survey we conducted about consumer behavior related to home improvement.

- We also provide recommendations for how business owners and investors can position their companies to capitalize on these trends and maximize the value of their companies. These insights include aligning marketing strategy with digital and demographic trends, leveraging the "aging-in-place" story, and focusing on high-ROI areas of the home.

- Millennials, the oldest of whom turn 40 this year, are quickly outpacing baby boomers as the generation with the greatest discretionary spending power. As a result, home services providers need to expand their customer acquisition strategies to include digitally enabled marketing and engagement to reach this powerful consumer group.

Low mortgage rates, the natural advancement of millennials into the family formation stage of their lives, and other trends have fueled the rebound in homeownership rates over the past several years from their post-Global Financial Crisis lows. This rebound spiked significantly in 2020 amid the COVID-19 pandemic and is likely to continue with increased migration trends to faster-growing, less-urban markets and the suburbs.