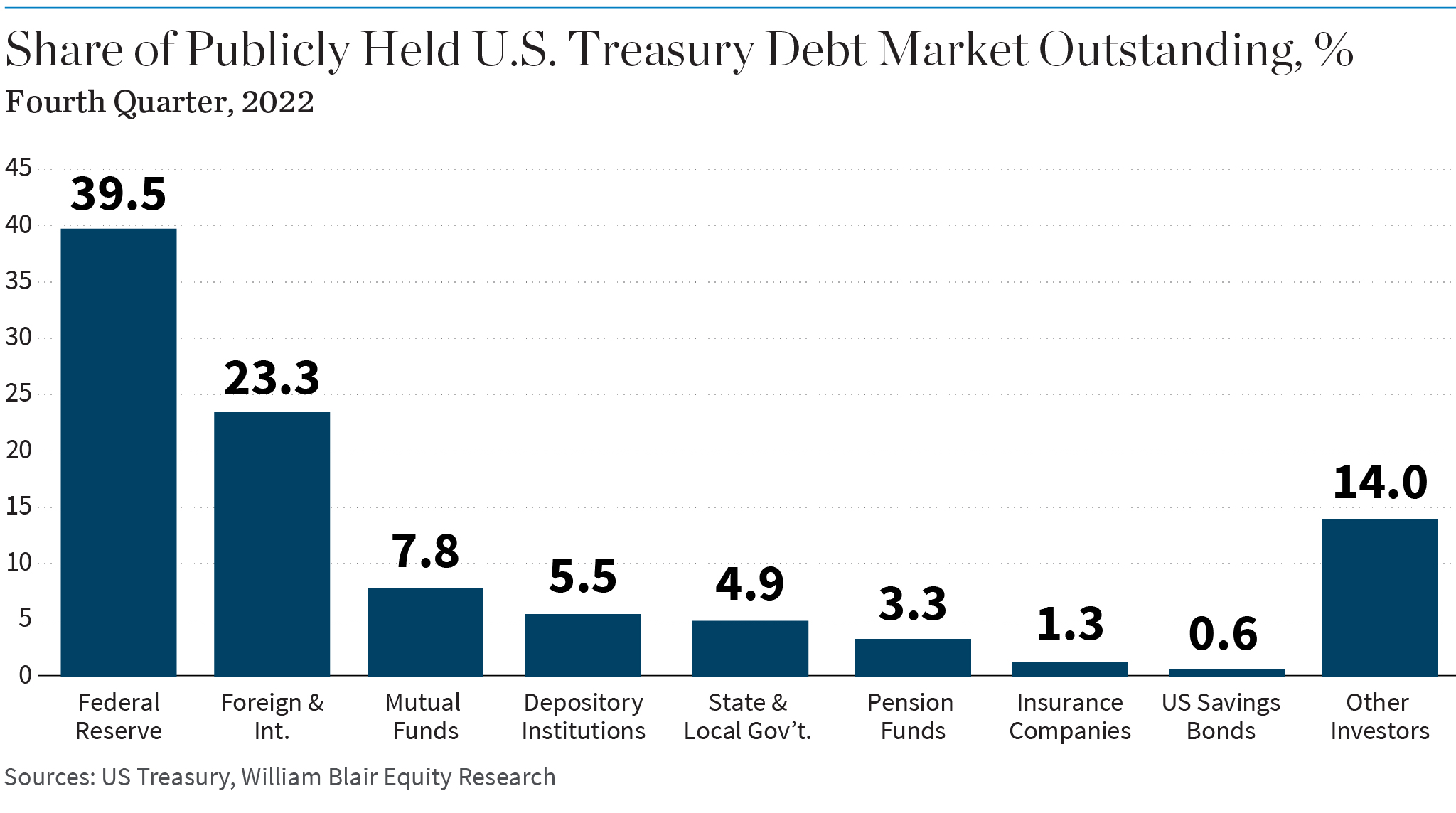

The recent downgrading of U.S. government debt has once again put the question of debt sustainability into the spotlight. While the actual rating change from AAA to AA+ is not overly meaningful for a country such as the United States—which is the world’s reserve currency of choice, has control of its own monetary policy, and also has all of its debt issued in dollars—such a change is unlikely to have resulted in any forced sales of bond holdings (as shown below and in the full report).

Nevertheless, it was a useful reminder that the U.S. capacity to issue debt is not limitless. Debt sustainability is simply a function of the primary deficit, the rate of interest paid on the debt, and the growth rate of the economy. Meaning that, as for anyone in the private sector, the debt is only sustainable as long as income growth is in excess of the cost of servicing the debt—or if the amount of spending adjusts accordingly.

At the moment, it is still the case in the U.S. that the economy’s growth rate is greater than the cost of interest on the debt; however, this is not guaranteed to always be the case. Furthermore, the current trajectory of government debt suggests that the sustainability gap becomes increasingly tight in the coming decade as spending on aging-related social support increases. At the very least, it would make sense not to add to this burden with even more debt being devoted to nonproductive interest payments.