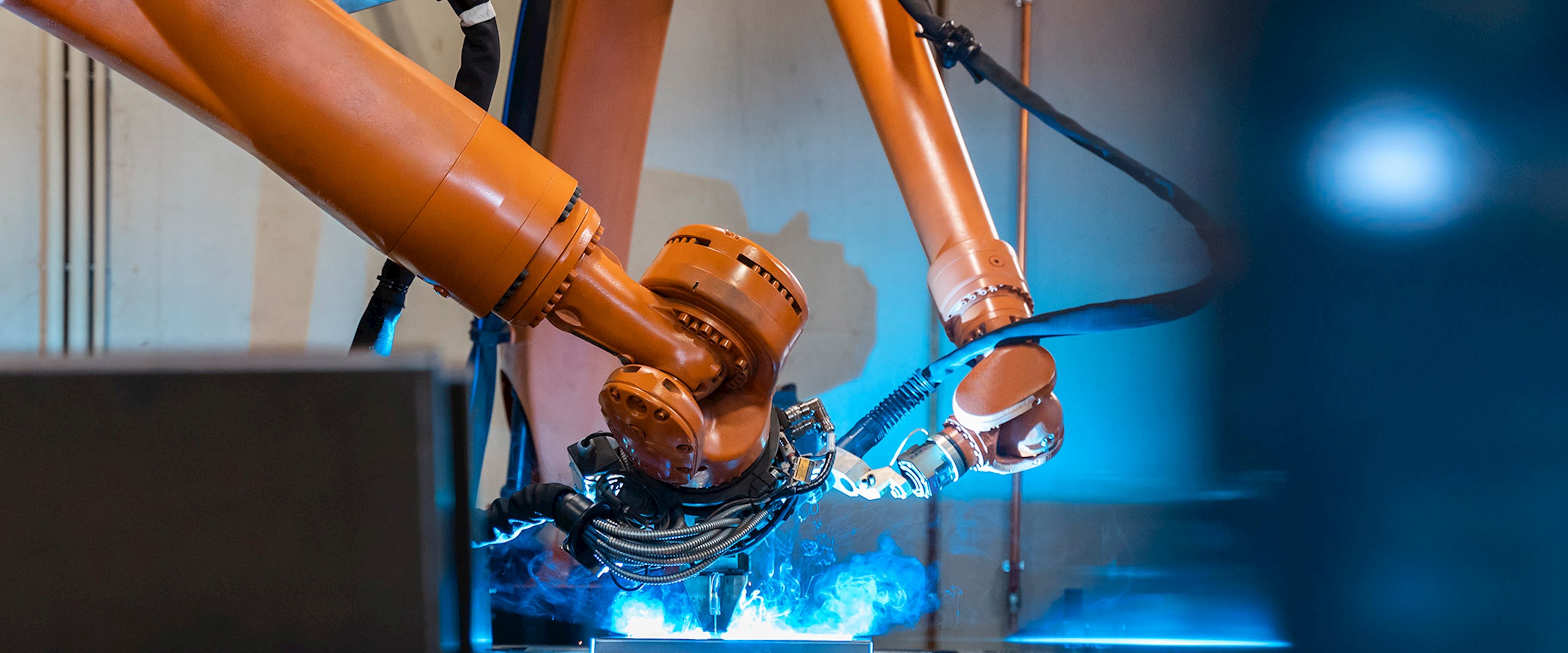

We are a trusted advisor to high-growth companies, market leaders, and technology-enabled businesses across the industrial landscape. Our clients rely on our deep understanding of the global trends that are redefining industrial activity—connected buildings and machines (IoT); the development of innovative, advanced materials; chemistries; manufacturing technologies; and regulatory changes—to help them drive value for their stakeholders. Our knowledge of sector trends and our relationships with leading strategic acquirers and industrial-focused financial sponsors enable us to assist our clients across a range of advisory and financial alternatives.

We serve clients across a broad range of industrial and industrial technology subsectors, including:

- Automated systems

- Building and infrastructure technologies

- Chemicals

- Diversified industrials

- Electronic components

- Energy and sustainability

- Engineered components

- Flow control and filtration

- Packaging

- Power and electrification

- Safety and security

- Sensors and instrumentation

- Specialty materials