Investment Banking

William Blair’s investment banking group enables corporations, financial sponsors, and owner/entrepreneurs around the world to achieve their growth, liquidity, and financing objectives.

Latest News & Insights

-

-

-

-

-

-

William Blair Deepens Sector Expertise With Strategic Hires Across Chemicals, Energy, and Equity Capital Markets

William Blair today announced another step in its continued growth with the addition of three managing directors, expanding the firm’s Industrial Growth Products team to provide enhanced coverage in the chemicals and specialty materials and in the energy transition, power, and electrification sectors, while also bolstering its comprehensive Equity Capital Markets capabilities.

How We Can Help

Drawing on the collective intellectual capital and deep sector expertise of a global team that spans four continents, William Blair brings a rigorous and innovative approach to mergers and acquisitions, corporate board advisory projects, equity and debt financing, and wealth planning for liquidity events.

We are a trusted partner for your organization’s most important decisions. Truly strategic advice and process execution are the result of knowledge and vision. By combining a deep understanding of your objectives, your industry, and today’s global market, we help you navigate the short- and long-term opportunities and challenges facing your organization.

Capital Markets

Empowered by a holistic approach, our Capital Markets group provides bespoke solutions to public and private clients seeking to fund organic growth and acquisitions, deleverage, and source liquidity. We combine the expertise of our Public Capital Markets, Private Capital Markets, and Leveraged Finance teams to provide comprehensive financing and liquidity capabilities and to meet the need for customized and creative solutions in all market environments. Since January 2021, we have completed over 780 capital markets transactions representing more than $340 billion in value (as of December 31, 2025). More about our Capital Markets group.

William Blair’s investment banking group enables financial sponsors and owner/entrepreneurs around the world to achieve their growth, liquidity, and financing objectives.

As industry specialists, our bankers have extensive knowledge of your sector and the competitive landscape.

-

-

-

Consumer Products & Services

We serve clients across a host of subsectors, including: consumer products, consumer services, consumer technology and e-commerce, food, beverage and agriculture, consumer driven health and wellness, beauty and personal care, pet, automotive aftermarket, multisite retail, and restaurants.

-

-

Healthcare IT

We have extensive experience working with clients across the healthcare continuum, including those in the following subsectors: analytics and machine learning, consumer / patient engagement, hospital and physician solutions, payer and employer solutions, pharma / life sciences IT, pharmacy IT solutions, post-acute care IT, and revenue cycle management.

-

Healthcare Services

We serve clients across the healthcare ecosystem, including leading companies in the following subsectors: behavioral health, distribution, laboratory services, multisite – dental, dermatology, animal health, and optical, outsourced medical manufacturing, pharmaceutical services, post-acute / home health, and specialty provider groups.

-

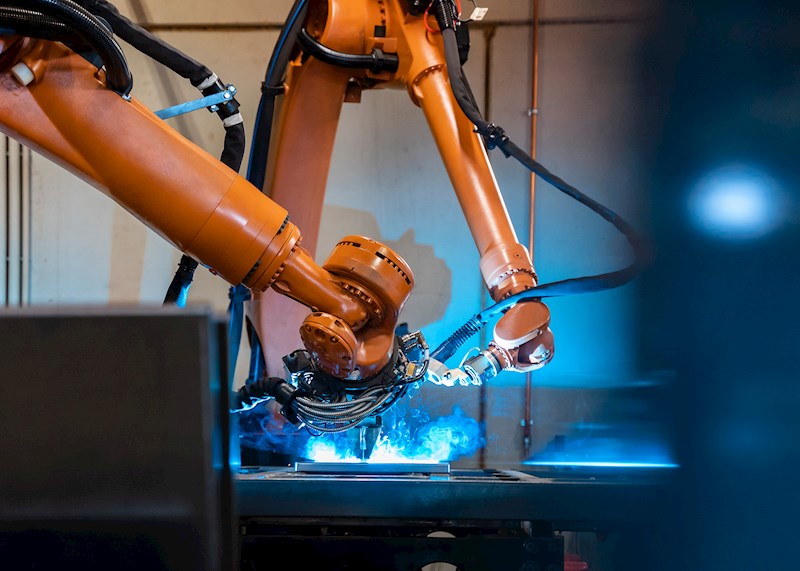

Industrial Growth Products

Our clients represent a broad range of industrial growth subsectors, including: building technologies, chemicals, diversified industrials, engineered components, industrial technology (including robotics and automation, machinery and equipment, motion and flow control, sensors and vision and energy and power), packaging and specialty materials.

-

-

Supply Chain & Commercial Services

We serve clients across the supply chain and commercial services ecosystem, including the following subsectors: environmental services, facility services, industrial services, specialty distribution, transportation and logistics, utility, and infrastructure services.

-

Tech Enabled Services

We work with compelling growth stories across a wide array of subsectors, including: education and training; financial services; governance, risk, and compliance (GRC) and legal services; human capital management; information services; insurance and insurtech; marketing services; outsourced and IT services; professional services; and real estate services.

-

Technology

We serve clients in a broad range of technology subsectors, including: application / vertical software; benefits and HR technology; digital media and marketing technology; e-commerce / e-retail; education technology; enterprise IT; gaming; human capital management; insurance technology; legal technology; managed services; outsourced / IT solutions providers; payments and payments security; security; and systems and semiconductors.

-

$594+

billion in M&A transactions

-

73%

of transactions involve repeat clients

-

30+

countries represented by our clients and counterparties

January 2021 – December 2025

For More Information

Please contact a member of our investment banking team.